The Real Estate Market During the COVID-19 Pandemic

There is no doubt that the COVID-19 pandemic has made a big impact in the lives of everyone around the world. The way we live our day to day lives has changed drastically; from how we get our groceries to being able to see our family and friends. The real estate market is no different. However, people still have the need to buy and sell homes, even during these challenging times.

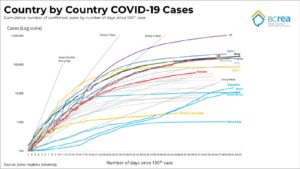

I want to start off by sharing a few visuals. Please click the images to englarge them. The first is Country by Country COVID-19 cases. I want to point out how well BC is doing on flattening the curve, even when comparing to the rest of Canada.

Next I want to share some graphics on home sales and home prices in past recessions. In April, single family homes were actually still up by 4% compared to April 2019. Factor in low rates that we likely wont see again, it is actually a great time to purchase a home.

Jean-Francois Perrault, SVP & Chief Economist of Scotiabank stated the following, “We view the housing market to be on a COVID-related pause. Following a dramatic slowing in Canadian housing markets in 2020Q2, we anticipate a quick rebound in home sales and housing starts through 2021 if population growth remains strong, and the economy improves in the second half of the year”.

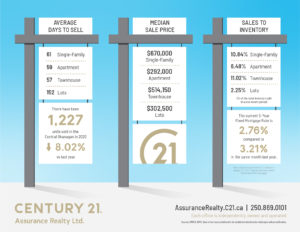

April 2020 Okanagan Real Estate Report

In real estate, we track 5 stats that are the best indicators of what’s going on in the residential market. Those stats are sales, DOM (days on market to sell), inventory, absorption (% of inventory that sells each month), and prices.

Sales and absorption are the first stats to change. They are both down 50-60% compared to April 2019. This is normally the time the market would be ramping up for spring.

The stats also illustrate a significant factor that we discovered years ago about how a market goes through its changes. This is that the prices are always the last stat to change. April’s statistics show exactly this. Prices have essentially not changed.

If we look back to the recession of 2008, sales and absorption began to drop right in the first quarter. However, prices remained stable and/or continued to rise. We are seeing the same right now with house prices actually up 4%, yet condo prices are down 4%. I expect the prices of condos to lower further this year. House prices may lower as well but not as much as condos will.

Conclusion

Although the last stat to be typically affected by a recession/pandemic is the price, it may have a short term effect on lower house prices. Although, we haven’t see this happen yet.

We will soon come to know our new ‘normal’. Businesses will reopen, consumers will regain their confidence and the real estate market will rebound. This could be as early as this Fall.

However, I do believe that condo prices in the Kelowna area will continue to dip due to ample new construction.

As always, this is just the Real Estate World According to Rom.