June 2019 Real Estate Report:

*Click the images to enlarge

Market summary for the first half of 2019

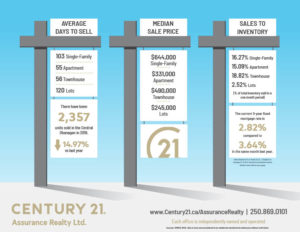

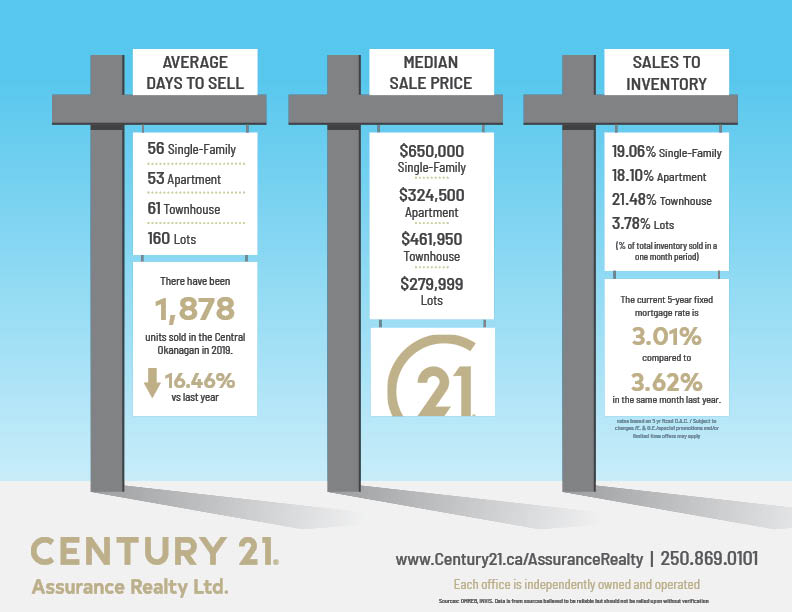

The market is remaining steady to our predictions of a soft correction for this year. Even though most of the stats report a decline, the absorption, (which is the stat that illustrates the balance of supply and demand) is still above normal for a balanced market. Usually, a balanced market will have an absorption of 12 to 14%. Central Okanagan is slightly above that. The other factor is that realtors are still reporting heavy competition in offers below $600,000 in the Central Okanagan area. In general, buyers in this price range are still having trouble finding decent, well-priced listings to buy that do not already have offers on them.

Overall, the market in the Okanagan-Shuswap region are the best they can be. In other words, they are strong yet sustainable. We must be careful not to compare too heavily to markets from years 2007 and 2016. We must look at our present day market as busting. 2007 and 2016 were not normal market years. They were booms. We are now steady and balanced. See below for the first half year comparison from 2018 to 2019 for Central Okanagan. As always, this is just the Real Estate World according to Rom.

Statistical Comparison of Jan-June 2018 and Jan-June 2019

| Jan-Jun | % Change | |

| Avg. Price | $639,792 | -5% |

| Absorption | 14.8% | -30% |

| Sales | 163 | -15% |

| Inventory | 1067 | +18% |