Okanagan Real Estate Report July 2021

Rom’s Real Estate Opinion

The market is progressing exactly in the direction that we anticipated. Things are settling down but definitely not crashing.

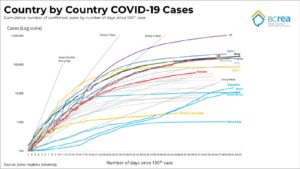

Think of the market in the last year as something like a Chicken Little scenario from the 1943 Disney Movie. For the last 6 months the market has been running around with his hands waving in the air screaming and yelling that the sky is falling. In other words, the absorption was ridiculously high, the inventory was ridiculously low, monthly sales we’re breaking all historical records and price increases we’re breaking all historical records.

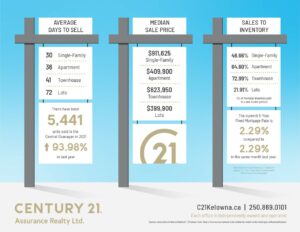

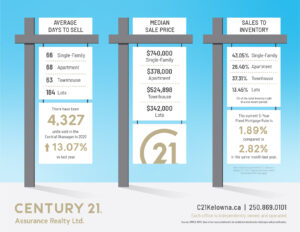

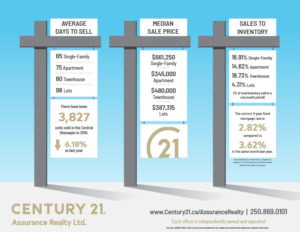

What’s happening now is Chicken Little is settling down. The absorption in the Central Okanagan (Peachland to Lake Country) has now dropped to between 40 and 50%. The inventory is still very low and sales have dropped to a reasonable level. However, let’s keep this in perspective. Absorption between 40 and 50% is still off the charts for our area. A balanced Market is considered to be 12 to 18% depending on which expert you listen to. Below 12% indicates that you can expect price decreases and it is also considered a strong buyer’s market. Above 18% is considered a seller’s market and you can expect price increases with this level of absorption. 40% is a long way above 18%…

Where is the market going to go from here and why?

What has to change in order for prices and sales to drop dramatically? If we look at the inventory for July 2021 and compare this with inventory levels in July 2020 and 2019 then this July inventory level is less than half the other 2 year averages. Although over time inventory levels will typically gradually increase as more houses will be built, more construction and development. However, in order for the market to change dramatically to even approach a balanced Market the inventory has to increase dramatically; likely more than double. Is this going to happen? This is the big question. We will not get rid of multiple offers on the same property until that inventory increases. That is just basic logic.

Conclusion

I think we will see this present direction of the inventory, absorption and sales start to level off at these relatively higher levels. The market has settled down from its Chicken Little level to its “normal” place in the regular cycle.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free. As always have to remember that’s just the Real Estate World according to Rom.