Tag: home for sale

-

Rom’s Real Estate Opinion & Stats June 2020

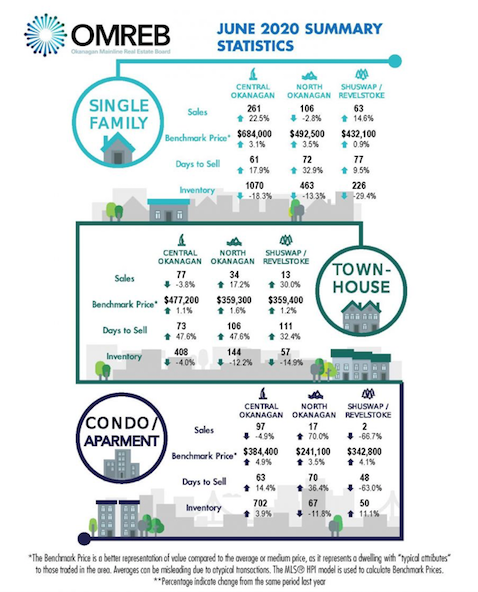

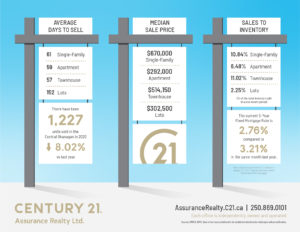

Below you will find the ‘benchmark’ prices for properties. This provides us with a much better idea of the current market rather than using ‘average’ or ‘median’ prices. ALL property prices (Condo’s, Townhomes and Single Family), went UP compared to June 2019.Despite the Pandemic, the real estate market is active and properties are selling. Moreover, the market has bounced back to an astounding level. It is right back to where we thought it would get to before COVID-19 hit. There is no algorithm for the effects of COVID-19 on the Okanagan Real Estate market. World renowned economists really don’t have any idea either.In Kelowna, the absorption rate for June was 24.39%. This means that 24.39% of all residential inventory in the Central Okanagan sold in June! It hasn’t been that high since April 2018. There were 261 residential sales in June in the Central Okanagan. That is the highest number of sales since July 2017.How can the market be flourishing when unemployment has shot up and the GDP has shot down? There are 2 factors creating this.First, banks and governments have stepped up hugely. The pandemic did take eligible buyers out of the market. However, every time the interest rates dropped another fraction of a percentage point, multiple new buyers were now able to buy. Remember, the market is driven by the buyers. There was also a backlog of buyers who were ready to purchase but were waiting out the Pandemic. Since we entered phase 3 here in BC, consumer confidence returned and therefore real estate activity spiked.Second, the market and the economy are not doing well in Alberta. Edmonton seems to be doing slightly better than Calgary but they are both hurting because of COVID-19 effects and the bust of the petro-chemical industry. This is driving some to pull that retirement trigger earlier than previously planned and move to the Okanagan.Please remember this is just the world according to Rom. -

Rom’s Real Estate Opinion April 2020 during COVID-19

The Real Estate Market During the COVID-19 Pandemic

There is no doubt that the COVID-19 pandemic has made a big impact in the lives of everyone around the world. The way we live our day to day lives has changed drastically; from how we get our groceries to being able to see our family and friends. The real estate market is no different. However, people still have the need to buy and sell homes, even during these challenging times.

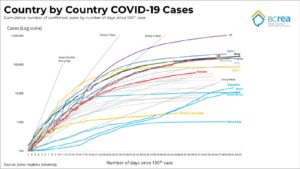

I want to start off by sharing a few visuals. Please click the images to englarge them. The first is Country by Country COVID-19 cases. I want to point out how well BC is doing on flattening the curve, even when comparing to the rest of Canada.

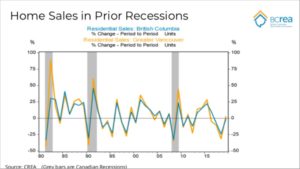

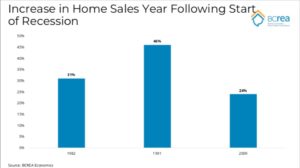

Next I want to share some graphics on home sales and home prices in past recessions. In April, single family homes were actually still up by 4% compared to April 2019. Factor in low rates that we likely wont see again, it is actually a great time to purchase a home.Jean-Francois Perrault, SVP & Chief Economist of Scotiabank stated the following, “We view the housing market to be on a COVID-related pause. Following a dramatic slowing in Canadian housing markets in 2020Q2, we anticipate a quick rebound in home sales and housing starts through 2021 if population growth remains strong, and the economy improves in the second half of the year”.April 2020 Okanagan Real Estate Report

In real estate, we track 5 stats that are the best indicators of what’s going on in the residential market. Those stats are sales, DOM (days on market to sell), inventory, absorption (% of inventory that sells each month), and prices.

Sales and absorption are the first stats to change. They are both down 50-60% compared to April 2019. This is normally the time the market would be ramping up for spring.

The stats also illustrate a significant factor that we discovered years ago about how a market goes through its changes. This is that the prices are always the last stat to change. April’s statistics show exactly this. Prices have essentially not changed.

If we look back to the recession of 2008, sales and absorption began to drop right in the first quarter. However, prices remained stable and/or continued to rise. We are seeing the same right now with house prices actually up 4%, yet condo prices are down 4%. I expect the prices of condos to lower further this year. House prices may lower as well but not as much as condos will.

Conclusion

Although the last stat to be typically affected by a recession/pandemic is the price, it may have a short term effect on lower house prices. Although, we haven’t see this happen yet.

We will soon come to know our new ‘normal’. Businesses will reopen, consumers will regain their confidence and the real estate market will rebound. This could be as early as this Fall.

However, I do believe that condo prices in the Kelowna area will continue to dip due to ample new construction.

As always, this is just the Real Estate World According to Rom.

-

Buying and Selling Real Estate During the Coronavirus Pandemic

Buying and Selling Homes during the Coronavirus Pandemic

Even during this difficult time, I want to let you know that my obligation to help you sell or buy a home is still in force.

The Government of British Columbia has released it’s list of Essential Services. Real Estate services have been listed as essential.

While following the guidelines set out by the government, I will continue to support my clients who are in the need to sell or purchase a home. Homes are still selling, albeit there is less activity.

So, how do you buy and sell real estate in the coronavirus era?

There are many factors to consider while trying to buy or sell while also maintaining social distancing. Open houses are unfortunately not advisable during this time.

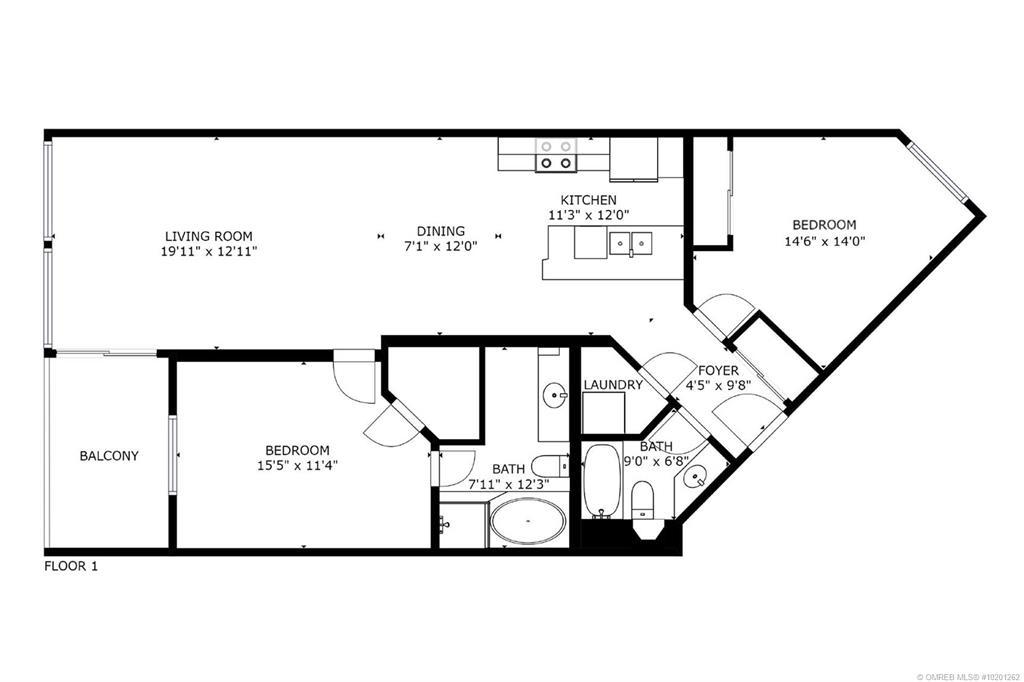

Virtual tours offer an in depth look inside a home and its floorplan. Touring a home virtually allows clients to see if a home makes sense to them.

Another option available is if the home for sale is vacant. In fact, I have two vacant properties on the market currently (click the addresses listed below for more information on these listings)!

205-1125 Bernard Ave, Kelowna, BC

While showing vacant properties, I ensure that inside is sanitized, touch nothing and maintain distance from clients as they walk through.

Upon making or accepting an offer, handshakes may not be feasible but teleconferencing and e-signing programs allow things to flow digitally.

Realtors have checklists for buyers and sellers to ensure that properties are able to be viewed safely. If you have any questions, please feel free to contact me to discuss further.

Stay safe and healthy – Rom.

-

FOR SALE: Condo in Kelowna’s Cultural District!

FOR SALE: 315-1331 ELLIS STREET, KELOWNA, BC

$418,800

$418,800NEW LISTING!

Beautiful and spacious two bedroom, two full bath condo in the heart of Kelowna’s downtown cultural district! Abundant natural light from large windows and 10’ ceilings fills the condo. The loft windows of sunrise views over Black Mountain and Knox Mountain. The split floorplan places both large bedrooms on either side of the main living area to create more privacy and great rental potential.

The condo has been freshly painted and there is new vinyl plank flooring installed in the main living areas and both bathrooms. Other upgrades include a “silent” Bosch dishwasher and new hot water tank. The large patio with gas hookup provides for a relaxing outdoor living space.

Perfect location in the downtown core only steps away from coffee shops, restaurants, shopping and events. Only one block away from the beautiful lakeshore and all the water sports and beach amenities that Kelowna has to offer!

For more details, please contact Rom Houtstra at 250-317-6405 or email him at rom@romrealty.com.

-

KELOWNA CONDO CLOSE TO DOWNTOWN!

FOR SALE: 205-1125 BERNARD AVE, KELOWNA, BC

$289,800

$289,800PRICE REDUCED!

Spacious and inviting one bedroom, two bathroom condo close to downtown Kelowna. This large condo features 9’ ceilings and an open floor plan kitchen, dining and living space complete with nice laminate flooring and a cozy fireplace. Just off the living room is a large outdoor deck with excellent privacy. The master bedroom features brand new carpet and its own ensuite bathroom.

Along with another full bathroom, this condo comes with a laundry room that is spacious enough to use as storage. Also included is a separate locker room for storage and secured underground parking with security cameras. There are no rental restrictions and one pet (under 20lbs) is allowed. Excellent location with shopping and a bus stop only steps away.

For more details, please contact Rom Houtstra at 250-317-6405 or email him at rom@romrealty.com.

-

Rom’s Kelowna Real Estate Opinion January 2020

Kelowna Real Estate Opinion for Jan 2020

We are well into the swing of things for 2020. I hope you are continuing on with any resolutions and visions you set for yourself for 2020! It’s never too late to get back on track. For this months opinion, I will start off with a couple of real estate definitions:

- Market Correction: A downward trend with prices, absorption and sales reducing, and inventory and DOM (days on market to sell) increasing

- Market Recovery: An upward trend with prices, absorption and sales increasing, and inventory and DOM (days on market to sell) decreasing

One of the important differences when comparing the Real Estate Market to the Stock Market is that the Stock Market is global and the Real Estate Market is local. The old phrase, “location, location, location” is not only important in real estate. It causes a lot of misunderstandings with ‘experts’ who try to predict the Real Estate Market (including a lot of realtors). The press will grab onto anything that looks radical in the market. Then they report without a lot of reference to the relevance of the information or the differences in the various locations. The problem is that the public gobbles up whatever the press feeds them. This problem is relevant in the Real Estate statistics in the Okanagan right now.

Current Okanagan Situation

Currently, when we look at the statistics, the Okanagan is in recovery mode. Around the third quarter of 2019, it started to shift from a slight correction to a slight recovery. Here in the Central Okanagan, there was a bit of a lag for the last couple of years. We have a larger economy than some surrounding markets. Therefore, it was building up rebound pressure. We are now seeing a positive market bounce back! It will be interesting to watch as we proceed through 2020 if this trend continues. I expect big markets like Vancouver and Toronto will continue to recover. This means for the Okanagan that we will be in a very gradual recovery trend for the next couple years.

As always, this is just the Real Estate World according to Rom.

-

Kelowna Happenings February 2020

Looking for something fun to do in Kelowna for February 2020? Here’s a few events happening in our great city!

February 2-6 – The Village Walk, Dine & Wine Tour @ Big White Ski Resort

February 7-9 – BC Snow Sculpture Competition @ SilverStar Mountain Resort

February 8 – Snowed In Comedy Tour @ Kelowna Community Theatre

February 8-9 – Scenic Sip Trail – Sweetheart Pairings Wine Tour

February 12 – Kelowna Rockets vs Tri City Americans @ Prospera Place

February 14-15 – Ballet Kelowna: Twilight @ Kelowna Community Theatre

February 15-17 – Family Day Weekend @ Big White Ski Resort

February 17 – Family Day @ H2O Adventure and Fitness Centre

February 22 – Lake Country Indoor Children’s Festival

Have an event you want to share? Please let me know and I would be happy to add it to my blog!

As always, if you have any real estate questions, feel free to contact me! – Rom

-

Rom’s Kelowna Real Estate Opinion December 2019

December 2019 Kelowna Real Estate Report:

*Click the images to enlarge

Kelowna Real Estate Opinion for Dec 2019

Welcome to a new decade! Last month, I did a year in review for 2019 and made some predictions for the new year. Now, lets get into the full swing of 2020!

There is something interesting going on in the market right now! We weren’t sure about it until we had a full year of stats to compare. If we compare the averages and totals of all of 2019 to all of 2018, it shows what I saying last year. The market is in a soft correction. Inventory is up in the Okanagan area. Absorption, prices and sales are down slightly, compared to 2018. However, here is the cool part. When we compare the second half of 2019 to the second half of 2018, the trend is upwards.

What does that mean?

It means that about half way through 2019, the market started to shift from a very slight correction (Down Market) to a very slight recovery (Up Market). If you remember, half way through 2019 I said there are some positive forces coming into the market that should make a difference in 2020. These positive forces reflect the introduction of the first time buyer program from CMHC, interest rates at record lows again and Vancouver and Toronto – our 2 biggest economies – are in recovery again. Home sales in Vancouver rose 5.2%. This makes it a great time to sell your home in Kelowna as many Vancouverites are making the move to the Okanagan.

As expected, these forces are making a difference and we are starting to see that in the stats. 2019 was a relatively balanced year in the Okanagan, with a slight downturn. 2020 will be a relatively balanced year with a slight upturn. As always, this is just the Real Estate World according to Rom.

-

Rom’s Kelowna Real Estate Opinion November 2019

November 2019 Kelowna Real Estate Report:

*Click the images to enlarge

Kelowna Real Estate Opinion for Nov 2019

We are well into December now and I love to take the time at the end of the year to reflect on the past 12 months. Each year I make predictions about the market for the coming year and I will do that here today for 2020.

Last December, I predicted a flat market, relatively ‘boring’ with no dramatic rise or fall in any statistic. I called it a soft correction which means it’s a little on the downside but mostly flat. This is exactly what we got in 2019.

Overall, prices inched down a bit here in the Central Okanagan. I also predicted that inventory would rise slightly, which it did (about 5-10%). Sales were predicted to be flat as well. The absorption rate (% of total residential inventory that sells on a monthly basis), decreased slightly.

As you can see, for 2019 overall it has been a very flat market. You can view the 12 month comparison of Nov 2018 to Nov 2019 by clicking here: 12 Month Comparison November 2019 (1).

So, what will happen in 2020?

Basically, we will see more of the same with one slight change. The forces driving the market are charging slightly. There is some uncertainty in the US government, Canadian government and the BC government that is keeping consumer confidence down.

However, banks are counteracting that negativity. Interest rates are historically low again. The new first time home buyer program (see my blog post here), that rolled out in September is being used aggressively. Big cities like Toronto and Vancouver have gone into the recovery leg of their cycle. We are still influenced by the increased buyer activity from the failing Alberta market and people cashing in from the West Coast.

In summary, we will see a relatively flat market for 2020. Instead of calling it a soft correction, I will say it will be a soft recovery. Prices, absorption and sales will rise slightly and inventory will remain constant. It will be a good market but nothing spectacular. That is the Real Estate World according to Rom.

Wishing you and your family a safe and happy holiday season!

-

Purchase Plus Improvements Mortgage

Considering buying a home that could use an update? A purchase plus improvements mortgage might be the right choice for you.

The purchase plus improvements mortgage is a customizable mortgage that will allow you to make home improvements as soon as you move into your new home by rolling the renovation cost into your mortgage. Improvements such as replacing the floors, updating a bathroom or replacing old wiring are some of the many ways to enhance the value of your new home.

Affordability

Even though there are some limits on what you can do, a purchase-plus-improvements mortgage is the most affordable way to finance a renovation. This is because of today’s low mortgage rates. A mortgage is the cheapest way to borrow. If you put an additional $40,000 on your mortgage, it will cost you far less than if you borrow $40,000 on a line of credit for renovations down the road.

Timeline

There are 90 to 180 day timeline on these mortgages, meaning you and your contractor must be prepared to finish any renovations promptly. The timeline is part of what makes this mortgage so great – you improve the value of your home and you get to live in it right away. The exact timeline will depend on your lender and your mortgage broker can help you navigate your options.

How It Works

The first thing you will do is work with your mortgage broker to be pre-approved for your maximum amount.

Then the fun part – find a home you love! Once you have found a home and your purchase offer is accepted, you will get estimates for the improvements you want to make. Your broker can then pass along the estimates to your lender for approval.

If your lender agrees that the renovations will improve the value of your home, they will send your broker an approval for the revised amount of your mortgage – the purchase price PLUS the cost of renovations.

On your closing date, the amount approved for your renovation will go to your lawyer, to be held until you’ve completed the proposed renovations. You will receive the funds once your renovation is complete. This means you must pay the renovation costs up-front from your pocket. Some choose to use a credit card or line of credit to get through the renovation period.

An appraisal will confirm that your renovations were completed within the agreed upon amount of time and then your lawyer can release the funds to you.

It’s important to note that your minimum down payment will be calculated based on the total amount of your home’s assessed value – the purchase price plus the price of the approved renovations.

Purchase-plus-improvements mortgages are the most affordable way to finance home improvements! Contact me today for more information – or if you have any other real estate question! I’d love to help!