Okanagan Real Estate Report November 2020

Rom’s Real Estate Opinion

Canadian Real Estate Trends

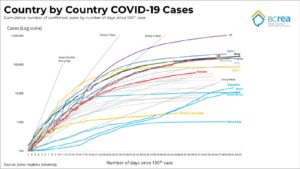

Let’s look at one of the trends that is arising from the global pandemic and allow me to make a prediction. There is no question that people are trending away from big cities in this country. Major Real Estate organizations are beginning to predict a slow down in Canada because of this trend. One of the things that is significantly different between the stock market and the Real Estate Market is that the Real Estate market is incredibly local. Very often 2 markets separated by a relatively short distance can be experiencing completely different markets. To look at “Canadian Real Estate” stats and make decisions locally based on them is not an effective methodology.

The 2 largest economies in Canada are Vancouver and Toronto. To give you an idea of how large the Real Estate markets are in these cities consider this. There are approximately 110,000 Realtors in Canada. 62% of them work in Toronto and Vancouver. That means that when a report talks of Canadian Real Estate they are primarily talking about Real Estate in Toronto and Vancouver.

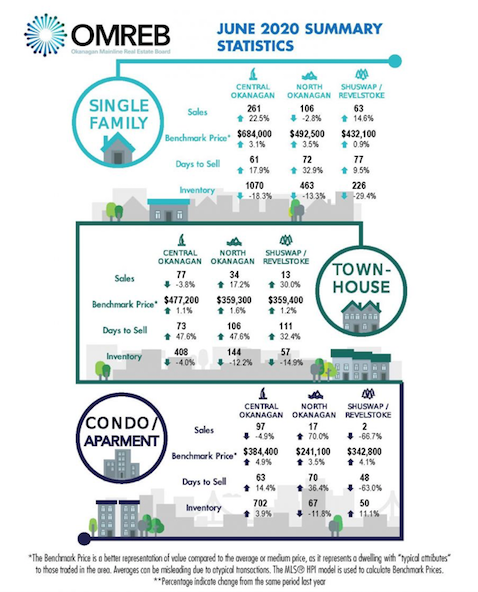

So let’s get back to our trends. If consumers are moving from the cores of the 2 major cities in this country the reports on Canadian Real Estate will be that sales in Canada are dropping. However, the fringe communities will likely benefit from that trend. The outlying suburbs of Toronto, Vancouver, Montreal and Ottawa are already reporting an increase in sales. Here is the kicker: the Okanagan is an outlying area of Vancouver. That may seem strange being it is 4 hours from Vancouver. However, an increased number of people in Vancouver are opting out of city life and coming to the Okanagan.

Final Thoughts

My prediction is that as long as the government does not shut down the country, in 2021 you will see news reports that the Canadian Real Estate market is beginning to soften. However, our stats in the Okanagan will remain strong as migration from Lower Mainland and Alberta continues. As always, this is just the Real Estate World according to Rom.