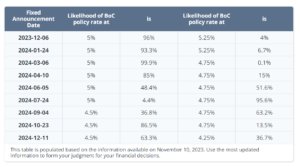

The real estate market in the interior of British Columbia is starting to show signs that things may be leveling off some. Below is a graph of the Bank of Canada overnight lending interest rate announcements since it was .25% in April of 2022. The last two interest rate announcements from the Bank of Canada have been holding steady at 5% for their overnight lending rate. Inflation dropped on October 17 from 4% to 3.8%. This is what the bank wants to see. The Canadian Real Estate, and Mortgage Market are watching this closely. It seems that the rate hikes are starting to level off. Please see the rate predictions below

The Bank of Canada, along with the government need to put pressure on inflation by raising the interest rate to push consumers from purchasing, but if they are aggressive for too long of a period it’s going to create a much bigger problem for us in the future.The next Bank of Canada announcement is December 6th. If they hold steady at 5%,which In my opinion I believe they will, that will bring us a balanced market in 2024.

I am estimating that we can call the market “back to the norm.” What we experienced in the years prior to Covid. A reasonably active Spring 2024, with a slight downturn in the summer months, and then a moderate increase in the fall.

Things are looking up for 2024, and as always, this is just the real estate world according to Rom. I hope you enjoy the rest of your November.