Okanagan Real Estate Report October 2021

*click images to enlarge

Rom’s Real Estate Opinion

This month the overall message for our real estate market is positive, (with a little bit of caution). The market is cruising along just as we predicted. Perhaps a little better than we predicted.

Let’s talk Absorption

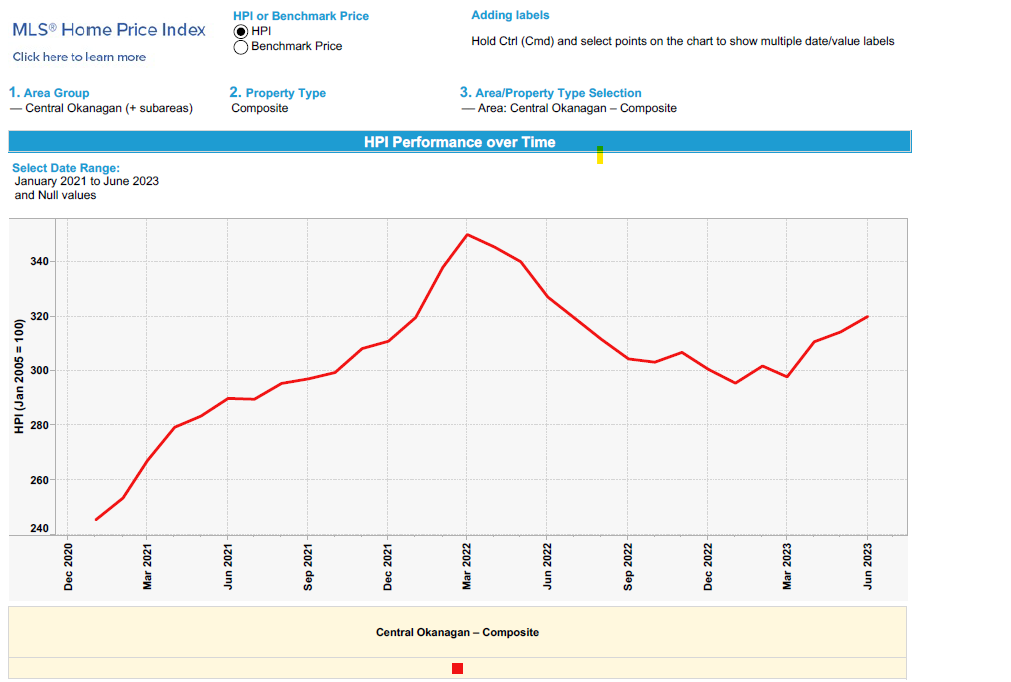

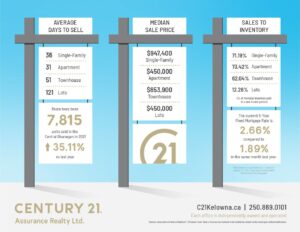

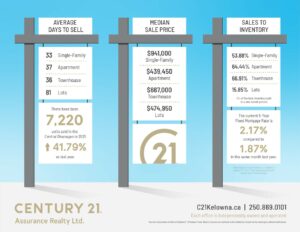

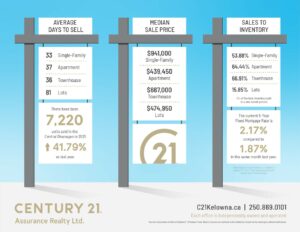

The absorption (percentage of total residential inventory that sells on a monthly basis) in the Central Okanagan is staying strong at slightly above 50%. Usually there is downward pressure on absorption this time of year as the market slows for the winter. If you look back on previous years the absorption tends to start dropping in September and continues until spring. That has not happened yet.

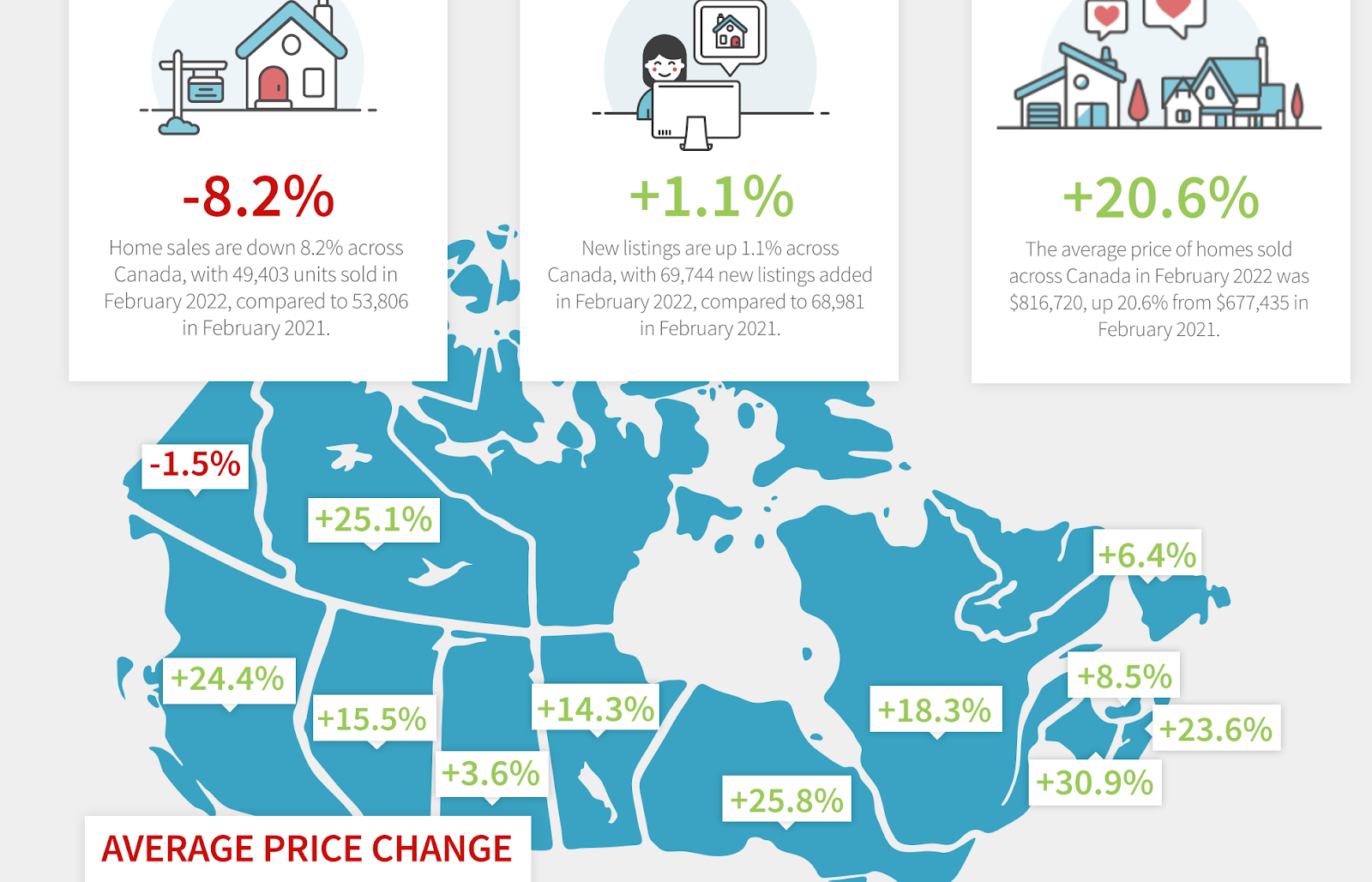

Again, to be redundant, the absorption has to get below 20% before the upward pressure on prices levels off. Statistically, absorption has to get below 12% before you see prices trending downward. Year to date prices for residential properties are up 20+% in the Central Okanagan compared to the same time frame last year. Keep in mind this is residential properties only.

The Commercial Side

The commercial/industrial market, although not as robust as the residential market, is also showing strong gains. Most of the excess inventory we saw 3 to 5 years ago has been eaten up and prices per acre of industrial land are rising. Commercial lease rates are also rising and demand for development land is increasing. We are seeing more and more developers coming to the interior as they realize the lack of inventory is like a carrot in front of the donkey they are riding on.

Interest Rates

Now, here is the caution I spoke of. The Bank of Canada has decided to ease off a program called “Quantitative Ease” (QE). I am not an economist nor would I propose to understand the intricacies of this but here is what I know so far. The QE program is designed to push inflation and avoid deflation. The Federal Government buys billions in bonds weekly; which somehow keeps interest rates down, pushing people to buy more “stuff”: cars, houses, etc.

As of October 27, the Feds have decided to diminish these purchases to slow down inflation. This will put upward pressure on interest rates. We have already seen borrowing rates rise slightly in the last few weeks. At this stage I am not sure what will happen to interest rates or the effect on our demand for Real Estate in the Okanagan. I don’t think you will see huge jumps in interest rates. It would shut down the economy. Rather they will “creep” them up.

It does not take a rocket scientist to figure out that as interest rates went down, more people qualified and were able to buy. So guess what? As interest rates go up, less and less people will qualify to buy.

In Conclusion

I doubt we are going to see anything but a continued minor slow down as we end the year and walk into 2022. However, as always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.