As always, this is just the real estate world according to Rom. I hope you are having an amazing Fall!

Tag: real estate market

-

Rom’s September 2023 Market Review for the interior of BC

There are three terminologies that I personally use to describe what is going on in the real estate market in the Interior of British Columbia. They are: “a leveling off”, “a recovery”, and “a correction”. In the last two years we’ve gone from a recovering real estate market (Rising) to a leveling off and we are now in a correcting market. The characteristics of a correcting market are; reducing absorption (less properties sold in a said period of time), reducing sales, reducing prices with rising inventory, and rising days on the market to sell. That is exactly what we are experiencing right now. These five activities are happening all over British Columbia and likely throughout the rest of Canada or at least in most locations in Canada to various different degrees. The reason is that the major driving force pushing the market down is rising interest rates. Interest rates are governed federally.My prediction in the market going forward is that we will likely have 9 or 10 months of a correcting market. In the third and fourth quarters of 2024 the correcting market will likely start to level off. This will be spurred by the Bank of Canada starting to inch the interest rates down as inflation gets more under control. The correction will not be a dramatic drop in prices. We will likely see a moderate drop in prices. Perhaps a further 10%. The reasoning behind this assumption is that immigration is maintaining a relatively high demand and low inventory is maintaining a relatively low supply. This is why we have not seen a huge drop in prices so far.There are quite a few assumptions built into my prediction that may or may not come true. For instance, if the Bank of Canada continues to raise interest rates the correction will pick up speed and will last for an extended period of time. I see this ending in the last two quarters of 2024.We have had quite a few years of robust markets. British Columbia has the highest Real Estate prices of any province or State in North America. We recently passed Hawaii.Some of you may disagree with me or even dislike me for saying it but,”We needed a correction”. -

Should You Buy or Wait?

It is hard to believe January is already over. Is it my age, or is everyone feeling the time is going by faster?

As the market is slower everywhere it is important to reach out to Buyers. Buyers have the impression not to buy or do the wait and see approach… sitting on the fence.

Is this a good time to buy real estate? I often get this asked. The answer is Yes!

Rate-sensitive markets like real estate have fallen over 20% depending on the individual market due interest rates increases and inflation. But this is still an excellent opportunity for investors and new home buyers to take advantage of much lower real estate prices despite the current higher mortgage rates. It’s worth noting that despite much higher rates with lower purchase values, the monthly payments in many cases are very similar. Either you pay top dollars in a high market, 100,000+ more with a lower interest rate, or purchase a property much lower, with higher interest rates.

Example:

Taking the average Canadian sold price, a buyer today would save almost $160,000 on the down payment despite having a higher monthly payment of $257.

With a short-term rate strategy, this buyer can lock in a 1-2 year fixed rate to ride out the current rate cycle and then be in a position to renew/refinance at future lower rates.Whereas waiting until rates come down, we could see real estate values return to growth, which would mean higher down payment requirements and more competition.

-

Tax Fighter Guide for HomeOwners

Tax Fighter Guide for the Homeowner

Here is your guide to appealing your property assessment notice. Pay your fair share of property taxes and not a penny more! Click the TaxFighter link below:

TaxFighterPDF

-

Rom’s Oct 2022 Real Estate Opinion

Okanagan Market Prediction

The market in the Okanagan for October is responding pretty much the way we anticipated. It continues to “Stabilize” or flatten out. We are starting to experience the seasonal slowdown that we experience every year at this time. However, sales are down compared to last October.

Past to Present October

We need to keep in mind last October was not a regular October. It was a boom. The absorption is also down although not substantially. The Central Okanagan absorption is 12.49%. Basically, that number indicates that we are at the very bottom of a balanced market where absorption extends between 12 and 20%. If you look at the prices, they have come down approximately 10 to 14% since the first quarter of 2022. However, they seem to have leveled off.

At the end of October, the Bank of Canada raised the overnight lending rate by 50 basis points (1/2 of a percentage). I believe they will do the same thing (maybe this time .25%), in the beginning of December. Although this is a fairly aggressive rise in interest rates it’s not as aggressive as we’ve seen in the past few months. The overnight lending rate has gone from .25% to 3.75% in just a few months.

Conclusion

Although, the lending rate is having its effect on the market, and it is slowing down inflation and decreasing sales I think you will see the market pick up again as we step into the spring market at the end of February. We see a slow down every year at this time.

As always, this is just the real estate world according to Rom. If you have any real estate questions give me a call or send me an email at any time.

Please remember, I am NEVER too busy for any of your referrals!

-

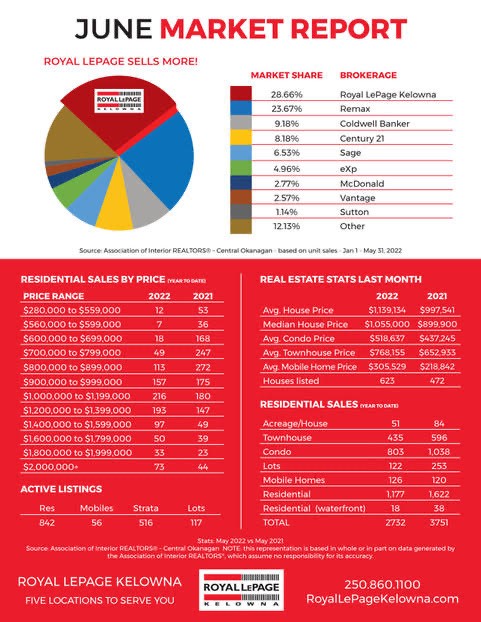

Rom’s June 2022 Real Estate Opinion

What is happening to our house prices?

In the Central Okanagan stats show that the average price has dropped slightly in May 2022 compared to April 2022. BUT! A month does not make a market.

What it does mean is that the crazy frenzy of multiple offers (all over list price!) is over. If we see a continued, gradual increase in interest rates that will be a strong indication of things to come. Year to date our house prices are up 21%.

Interest Rates

On June 1st the government raised the overnight lending rate .5 percent (50 Basis points). That is the third rise since the new year. The talk is that they’re going to do the same thing on July 13th with the next overnight lending rate announcement.

Personally, I think they should wait to see what the true effect is on the rises they have done so far on our housing market and our economy.

My opinion is that the market will shift to a forecast of further declining prices (starting late May). We will likely see a gradual drop in the high end market but a more significant drop in the median market.

It’s still a Sellers Market

The absorption rate (the percentage of properties sold versus inventory at any time) for May 2022 in the Central Okanagan was 28.86%. It is still a seller’s market. The absorption rate will have to go below 20% to show a true shift to reducing prices and a balanced market between sellers and buyers.

I believe we will see a continued softening of the market as we go forward and as the government continues to raise interest rates.

As always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

BUSINESS FOR SALE: Profitable Okanagan Based Wood Panel Manufacturing Company

Okanagan Wood Panelling Business For Sale

One of the cleanest, highly profitable businesses available – this Okanagan wood panelling manufacturing business offers an ease of operation with 8 long term employees. Two key staff can run the manufacturing end of the business. Little competition with export around 70% to the US.

25 plus years of successful operation with well-established repeating markets and customer base. Extremely profitable with 15% projected growth for this year. Cash business with room for additional growth and product diversity. Business is on major route for trucking to the US and Canada.

This is a great opportunity to own a reputable, profitable business AND live in one of the most desirable areas in Canada and the world. The Okanagan is a true 4 season playground offering boating, hiking, skiing, award winning wineries, championship golf courses and more. Don’t miss this special opportunity!

Current owners prefer a buyer who is willing to relocate to the Okanagan and purchase the 2.2 acres of land & buildings. If interested, upon signing the NDA, I will provide you with an information package and video explaining the business and manufacturing process.

-

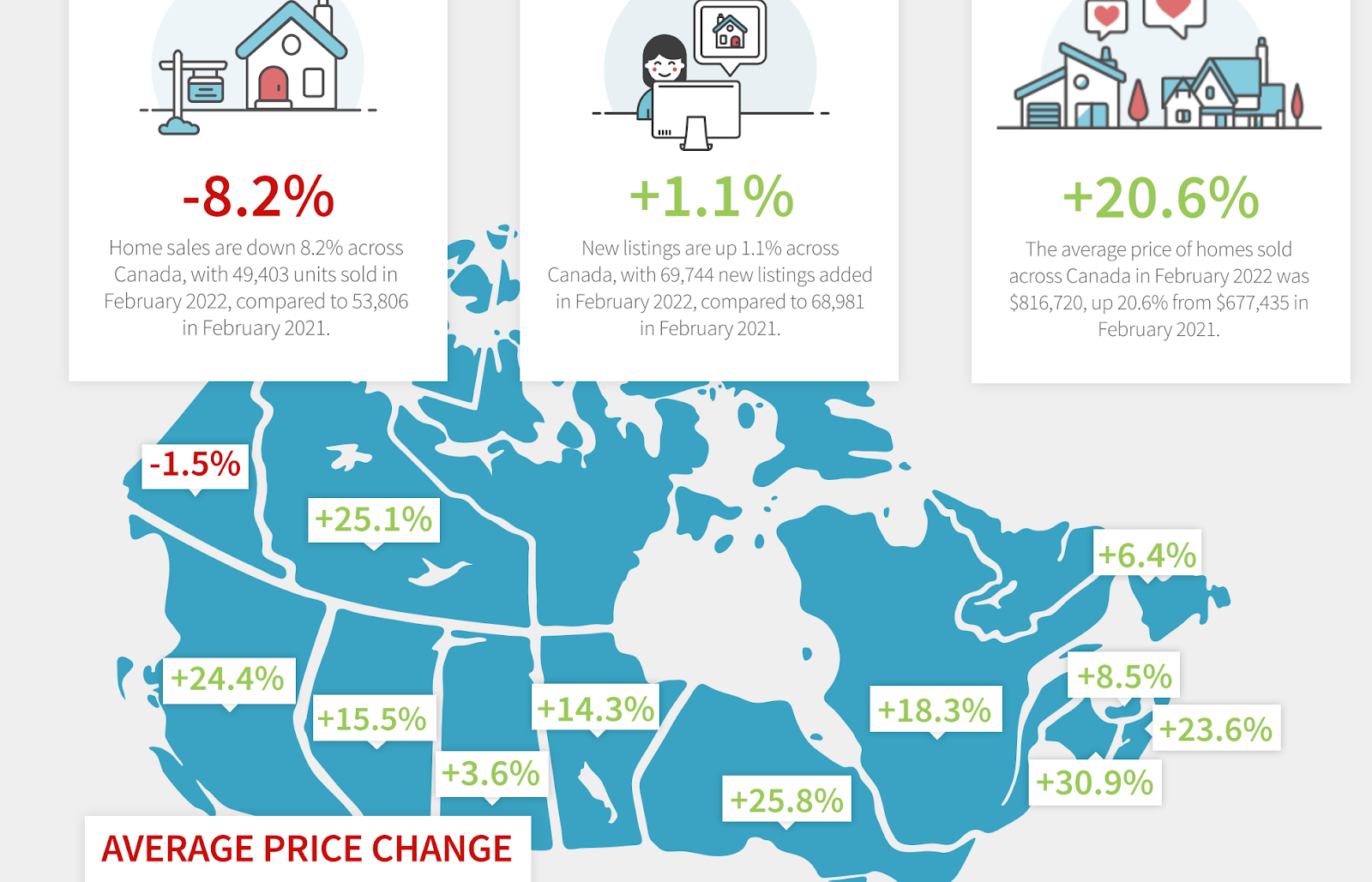

Rom’s April 2022 Real Estate Opinion

What’s happening in the Okanagan Real Estate Market?

The Federal Government has announced 2 ways they are considering to slow down the upward pressure on house prices.

Firstly, a proposed ban on foreign buyers purchasing houses across Canada for the next 2 years. However, the percentage of foreign buyers in Canada has dropped from 9% in 2015 to only 1 % in 2020. I therefore don’t think this will have any real effect on house prices.

The second proposal is to invest billions into new construction. That is really the only way to slow down the house price increases. The market is driven by supply and demand. We either have to increase the inventory or decrease the demand. The demand for housing in April is still strong in the Okanagan. The absorption rate for March 2022 in the North and Central Okanagan is still above 60%. That means in March 60% of all the houses on the market on the first of the month sold in March. Therefore increasing the inventory should work to slow down the market.

We haven’t yet seen the effect on the market of the rising interest rates and in turn the increasing mortgage rates. Although it is still a great time to sell your home (especially if you own a secondary home!!), the increasing mortgage rates will price more buyers out of the market. Increased mortgage rates and increasing inventory should help shift to a more balanced marketplace.

The graphic below shows that the market is similar across Canada. The only place in the entire country where prices dropped was the Yukon and it was only by 1.5%. BC is in the top 3 for price increases.

However, you always have to remember that this is just the Real Estate World according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

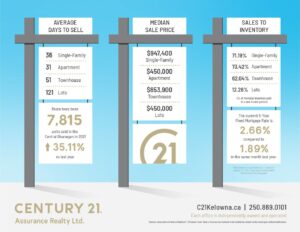

Rom’s November Real Estate Stats & Opinion

Okanagan Real Estate Report November 2021

*click images to enlarge

Rom’s Real Estate Opinion

The real estate industry is full of surprises; never a dull moment. That’s why I love this business so much. Very often people quote “history repeats itself”. It’s pretty hard to find historical data that illustrates that history is repeating itself in the Okanagan Real Estate market. This is all new territory.

Winter Real Estate

It is the time of year that, historically speaking, things should slow down. There are other reasons for a slowdown too. Interest rates are rising and consumer confidence is skeptical as to whether this market can sustain itself. People are expecting a slowdown. “The bubble has to burst”, some of my clients are saying.

However, the stats don’t lie and they never will. What’s happening in the statistics in the Real Estate market? They are RISING. If you recall last month I referred to the expected slow down and decrease in absorption simply because of the winter months. However, in November the absorption rate is rising.

Let’s check out the numbers

In the Central Okanagan, 71% of the residential inventory sold in November, up from 54% in October. Not only that, the inventory actually went down. What does this mean? As bizarre as it may sound, the demand for Real Estate in the Okanagan, which is already higher than ever in recorded history, is now starting to increase again. Prices are going to continue to rise.

The fact that we all live in paradise is no longer a secret. In my opinion over the next few months it has to soften a bit because winter is here. It softens every year at this time. However, as we get closer and closer to 2022 it is setting itself up for a very hot spring in the Okanagan Real Estate Market.

In Conclusion

As always this is just the real estate world according to Rom. Have an amazing Christmas and stay safe and healthy. Wishing you a Happy New Year and an end to this Pandemic in 2022.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

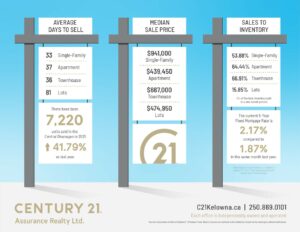

Rom’s October Real Estate Stats & Opinion

Okanagan Real Estate Report October 2021

*click images to enlarge

Rom’s Real Estate Opinion

This month the overall message for our real estate market is positive, (with a little bit of caution). The market is cruising along just as we predicted. Perhaps a little better than we predicted.

Let’s talk Absorption

The absorption (percentage of total residential inventory that sells on a monthly basis) in the Central Okanagan is staying strong at slightly above 50%. Usually there is downward pressure on absorption this time of year as the market slows for the winter. If you look back on previous years the absorption tends to start dropping in September and continues until spring. That has not happened yet.

Again, to be redundant, the absorption has to get below 20% before the upward pressure on prices levels off. Statistically, absorption has to get below 12% before you see prices trending downward. Year to date prices for residential properties are up 20+% in the Central Okanagan compared to the same time frame last year. Keep in mind this is residential properties only.

The Commercial Side

The commercial/industrial market, although not as robust as the residential market, is also showing strong gains. Most of the excess inventory we saw 3 to 5 years ago has been eaten up and prices per acre of industrial land are rising. Commercial lease rates are also rising and demand for development land is increasing. We are seeing more and more developers coming to the interior as they realize the lack of inventory is like a carrot in front of the donkey they are riding on.

Interest Rates

Now, here is the caution I spoke of. The Bank of Canada has decided to ease off a program called “Quantitative Ease” (QE). I am not an economist nor would I propose to understand the intricacies of this but here is what I know so far. The QE program is designed to push inflation and avoid deflation. The Federal Government buys billions in bonds weekly; which somehow keeps interest rates down, pushing people to buy more “stuff”: cars, houses, etc.

As of October 27, the Feds have decided to diminish these purchases to slow down inflation. This will put upward pressure on interest rates. We have already seen borrowing rates rise slightly in the last few weeks. At this stage I am not sure what will happen to interest rates or the effect on our demand for Real Estate in the Okanagan. I don’t think you will see huge jumps in interest rates. It would shut down the economy. Rather they will “creep” them up.

It does not take a rocket scientist to figure out that as interest rates went down, more people qualified and were able to buy. So guess what? As interest rates go up, less and less people will qualify to buy.

In Conclusion

I doubt we are going to see anything but a continued minor slow down as we end the year and walk into 2022. However, as always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

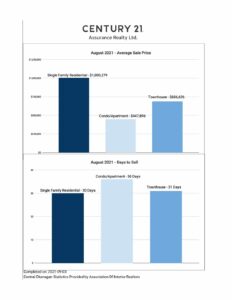

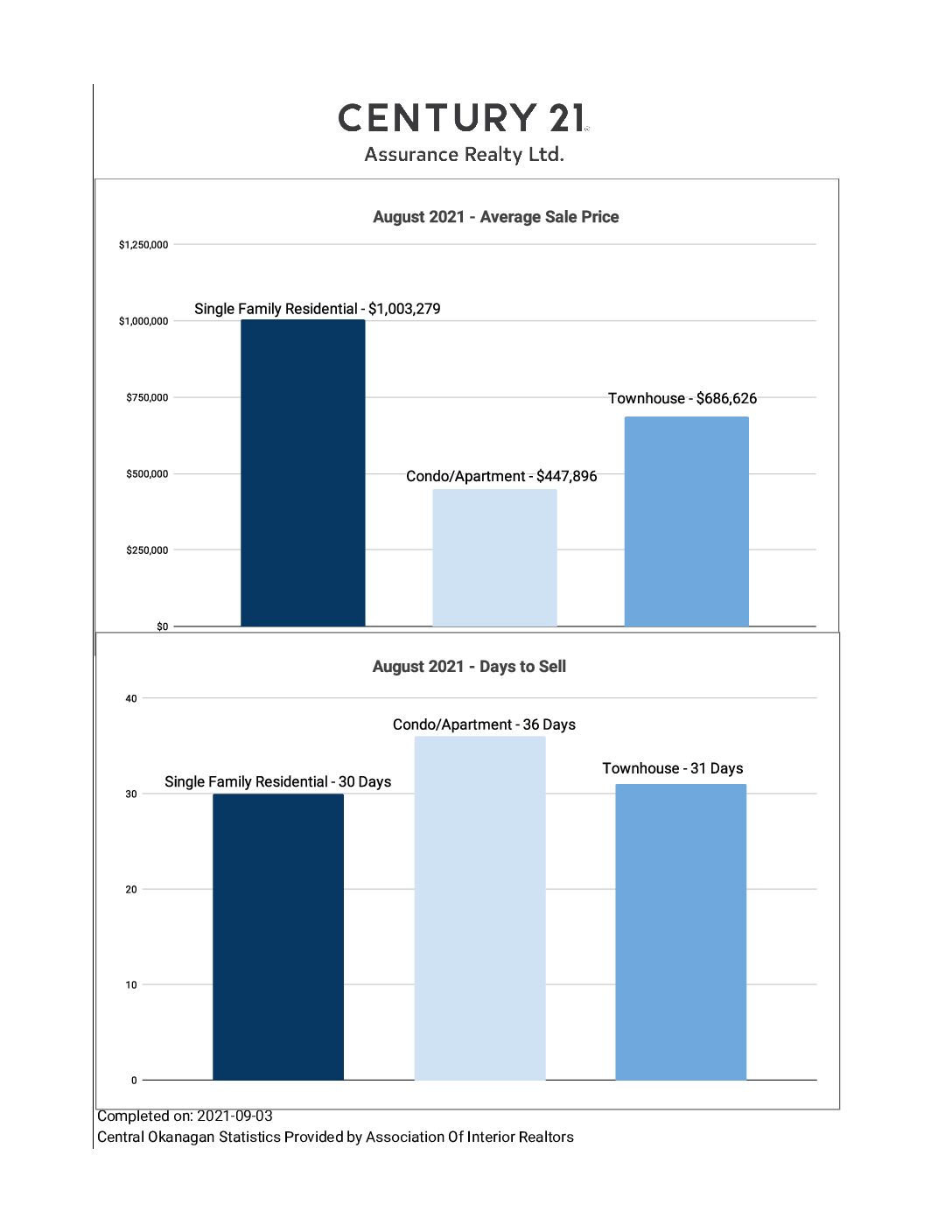

Rom’s August Real Estate Stats & Opinion

Okanagan Real Estate Report August 2021

*click images to enlarge

Rom’s Real Estate Opinion

The phrase of the month for August 2021 for the Okanagan Real Estate market is “Levelling Off”. I hate to be a broken record but this is what was expected. The insane market of the last 2 quarters of 2020 and the first 2 quarters of 2021 could not sustain itself. The market had to correct either by a crash or a levelling off; and levelling off is what it has done.

For the moment, it has stopped its minor correction and leveled off at a very strong market.

Why did it not crash?

That can be answered in 1 word: Inventory. (There isn’t any!) Low inventory will keep multiple offers coming and keep the prices rising. For the second month in a row the average price for the Central Okanagan is above $1,000,000. The demand from outside of the Okanagan continues to be strong which keeps the inventory low. Because the rental market is just as tight as the sales market, buyers have no alternative but to continue to push to buy in this market. I get a few calls per month from people who are desperately trying to find a place to live – buy or rent. For some reason they think I might have an “in” that other REALTORS don’t have. Of course the contrary is true.

The average inventory in August 2021 is 267. The average inventory in August 2020 was 536. That is slightly less than half the inventory of 2020, which was already low. That says it all about what is going on.

Conclusion

If anyone ever asks you what is going to happen to the Real Estate Market in the Okanagan you can most definitely state that it is going to stay strong for the next year at least. That inventory has to go up dramatically before the market direction will change. That can’t happen overnight. This winter we will have our seasonal slow down which will make a better time to buy for BUYERS! As always, that is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.