Kelowna Real Estate Report August 2020

Rom’s Monthly Real Estate Opinion

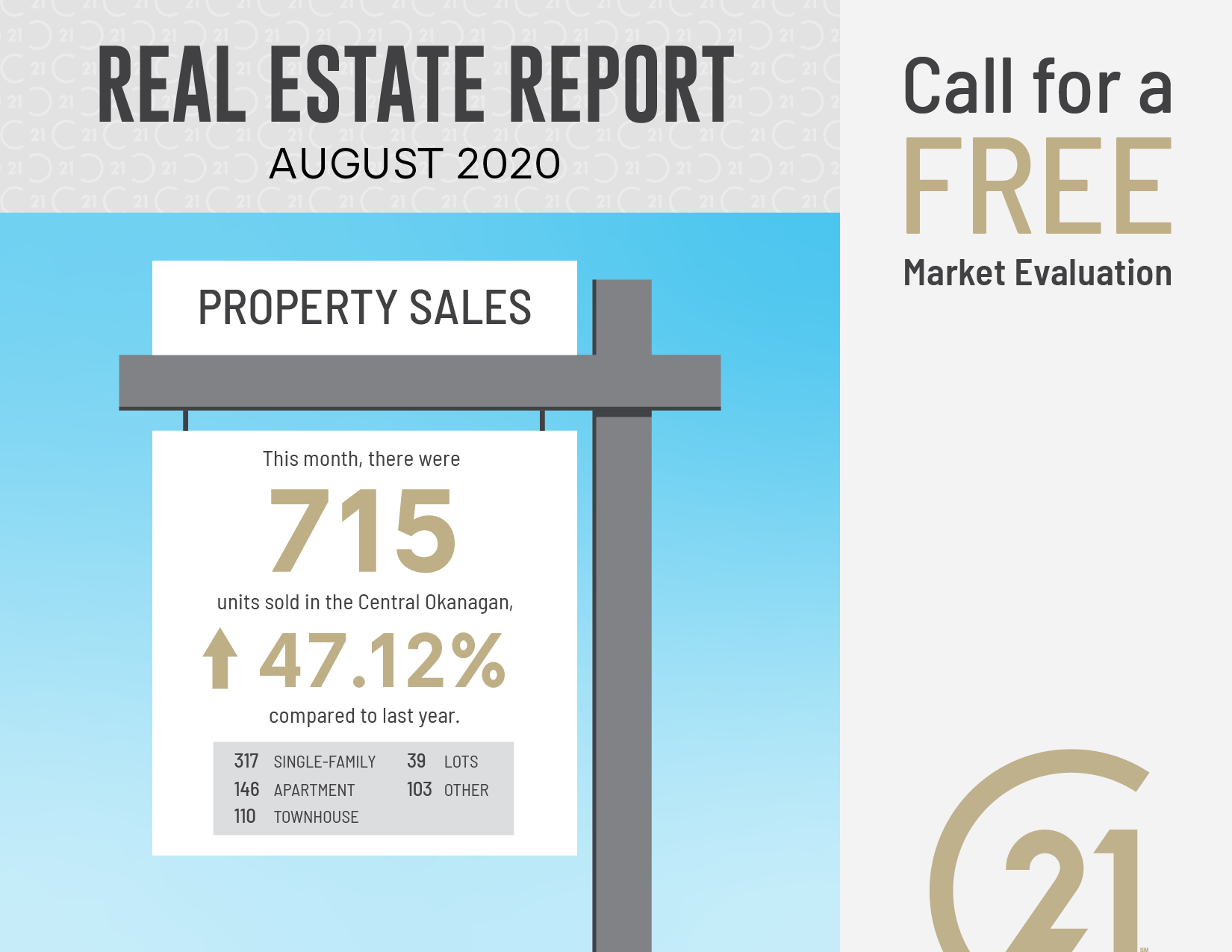

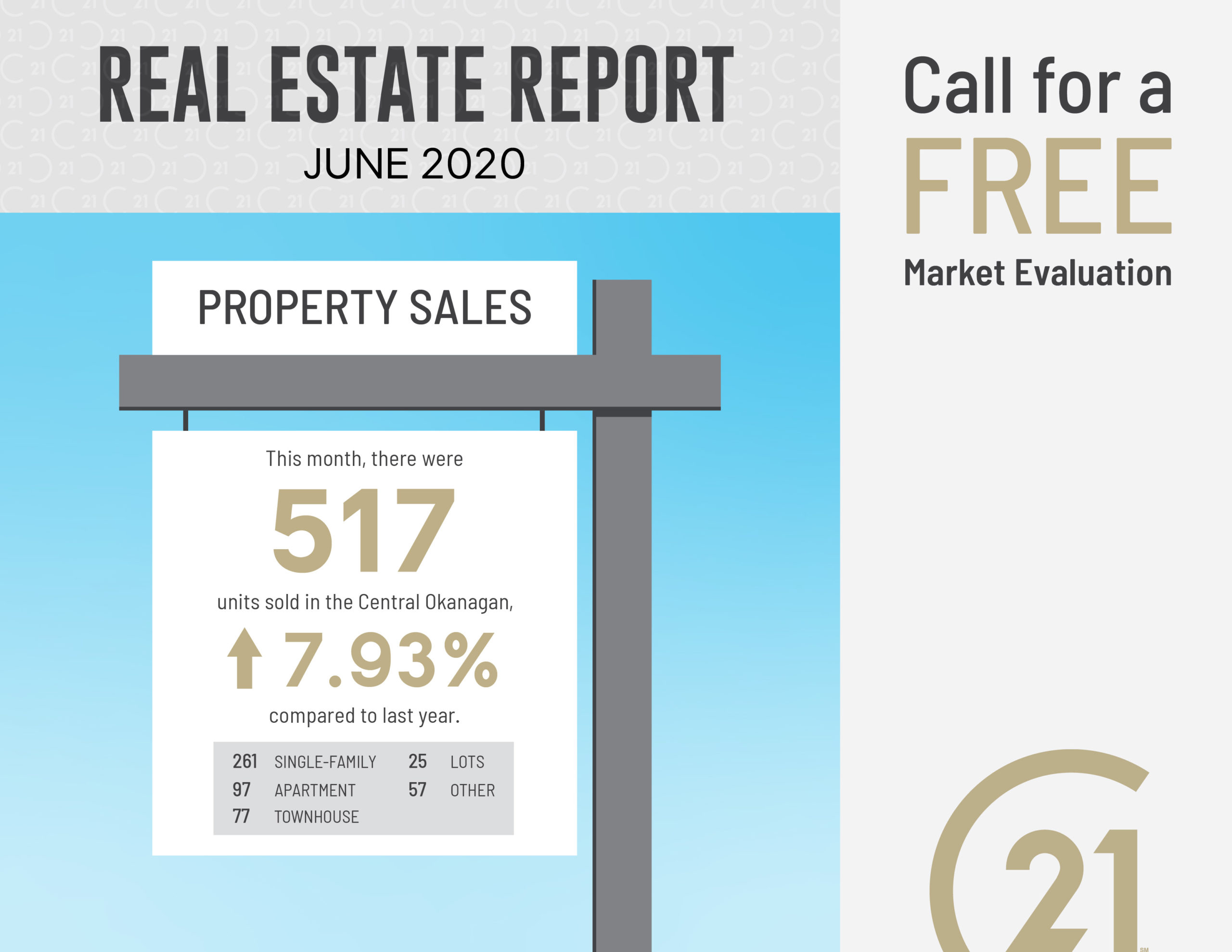

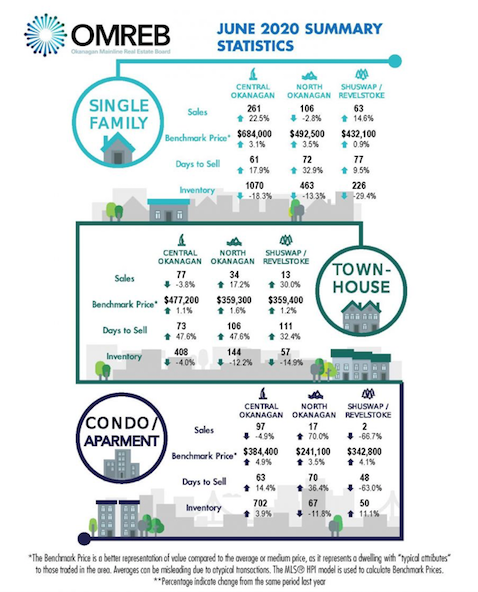

What a whirlwind summer it has been for Okanagan Real Estate! The market continues at a record-breaking pace.

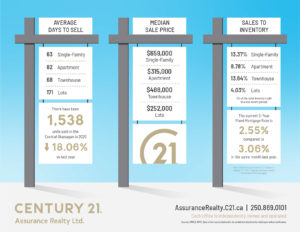

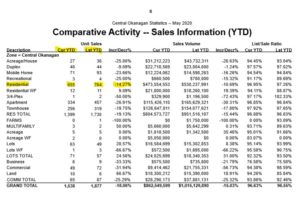

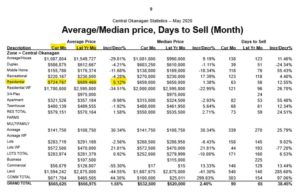

Looking at the stats for this month, remember that low inventory is the sign of a robust real estate market, not the opposite! Some of the stats we look at have never been this robust and some we would have to go back years to find a comparable level.

There is a lot of speculation from realtors, investors, buyers and sellers as to what is going to happen in the near future. Most people think that when the government subsidies go away, the real estate market is going to soften or collapse. However, a market never responds to one force.

Multiple positive forces also pushing on the marketplace in the Okanagan! We have dramatically increased migration from Alberta and the Lower Mainland, there are some of the lowest interest rates in history, very low inventory (which pushes up price!), and the back-log demand created from the drop in sales from COVID-19 in April/May.

Stats to consider

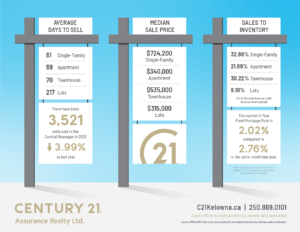

Each year the market softens in the fall, so some may anticipate the market turning down. However, when we compare August 2020 to August 2019 stats, it tells a positive, robust story. Residential sales for August decreased slightly to 1,034 compared to July’s 1,094 total units sold across the region yet remained up compared to this time last year by 43%, reports the Okanagan Mainline Real Estate Board (OMREB).

I believe that we are in a fairly robust market for a while to come still. The one change we cannot predict, is if COVID-19 cases were to dramatically increase that shuts our market down again. However, I don’t think this is going to happen again.