As always, this is just the real estate world according to Rom. I hope you are having an amazing Fall!

Tag: Okanagan Real Estate news

-

Rom’s September 2023 Market Review for the interior of BC

There are three terminologies that I personally use to describe what is going on in the real estate market in the Interior of British Columbia. They are: “a leveling off”, “a recovery”, and “a correction”. In the last two years we’ve gone from a recovering real estate market (Rising) to a leveling off and we are now in a correcting market. The characteristics of a correcting market are; reducing absorption (less properties sold in a said period of time), reducing sales, reducing prices with rising inventory, and rising days on the market to sell. That is exactly what we are experiencing right now. These five activities are happening all over British Columbia and likely throughout the rest of Canada or at least in most locations in Canada to various different degrees. The reason is that the major driving force pushing the market down is rising interest rates. Interest rates are governed federally.My prediction in the market going forward is that we will likely have 9 or 10 months of a correcting market. In the third and fourth quarters of 2024 the correcting market will likely start to level off. This will be spurred by the Bank of Canada starting to inch the interest rates down as inflation gets more under control. The correction will not be a dramatic drop in prices. We will likely see a moderate drop in prices. Perhaps a further 10%. The reasoning behind this assumption is that immigration is maintaining a relatively high demand and low inventory is maintaining a relatively low supply. This is why we have not seen a huge drop in prices so far.There are quite a few assumptions built into my prediction that may or may not come true. For instance, if the Bank of Canada continues to raise interest rates the correction will pick up speed and will last for an extended period of time. I see this ending in the last two quarters of 2024.We have had quite a few years of robust markets. British Columbia has the highest Real Estate prices of any province or State in North America. We recently passed Hawaii.Some of you may disagree with me or even dislike me for saying it but,”We needed a correction”. -

Rom’s Jan 2023 Real Estate Opinion

Okanagan Market Prediction

It’s a new year!

I hope your 2023 has started off on a positive note! The big real estate stories for January 2023 are the absorption rate and the number of sales.

Absorption Rate

The absorption rate is down for the Central Okanagan zone encompassing Kelowna and surrounding areas. It is down to 9.01%. This is 3% below the important limit of 12%. Traditionally below 12% we will see downward pressure on prices.

Number of Sales

The other important statistic to note is the number of sales. Sales are down approximately 50%. What this says is the demand has decreased dramatically. This decrease in demand for housing is a direct result of the rise in interest rates. As interest rates rise fewer and fewer and people can afford to buy a house.

There is a silver lining in this cloud

For the last few years sellers have been dictating to buyers what their house is going to sell for. Now buyers have a choice. The market has shifted to a more balanced market and in some places a buyer’s market. Sellers have had to get aggressive in their pricing in order to compete with other sellers. Sellers who refuse to accept that the price of their house has come down in the last few months, are sitting on the market with no offers. This trend is a good thing for buyers. They have more inventory to look at and can bargain more aggressively.

Interest Rates

On January 25th the Bank of Canada overnight lending rate was increased by 1/4 of a percentage point (25 Basis Points). This sent a message that the bank is softening its aggressive attack on inflation. The next interest rate announcement is on March 8th. I believe we will see a similar 25 basis point increase. The bank desperately wants to slow the economy and bring down the inflation rate. However, if they keep an aggressive direction, it will increase mortgage defaults and foreclosures and that is not good for anyone.

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s April 2022 Real Estate Opinion

What’s happening in the Okanagan Real Estate Market?

The Federal Government has announced 2 ways they are considering to slow down the upward pressure on house prices.

Firstly, a proposed ban on foreign buyers purchasing houses across Canada for the next 2 years. However, the percentage of foreign buyers in Canada has dropped from 9% in 2015 to only 1 % in 2020. I therefore don’t think this will have any real effect on house prices.

The second proposal is to invest billions into new construction. That is really the only way to slow down the house price increases. The market is driven by supply and demand. We either have to increase the inventory or decrease the demand. The demand for housing in April is still strong in the Okanagan. The absorption rate for March 2022 in the North and Central Okanagan is still above 60%. That means in March 60% of all the houses on the market on the first of the month sold in March. Therefore increasing the inventory should work to slow down the market.

We haven’t yet seen the effect on the market of the rising interest rates and in turn the increasing mortgage rates. Although it is still a great time to sell your home (especially if you own a secondary home!!), the increasing mortgage rates will price more buyers out of the market. Increased mortgage rates and increasing inventory should help shift to a more balanced marketplace.

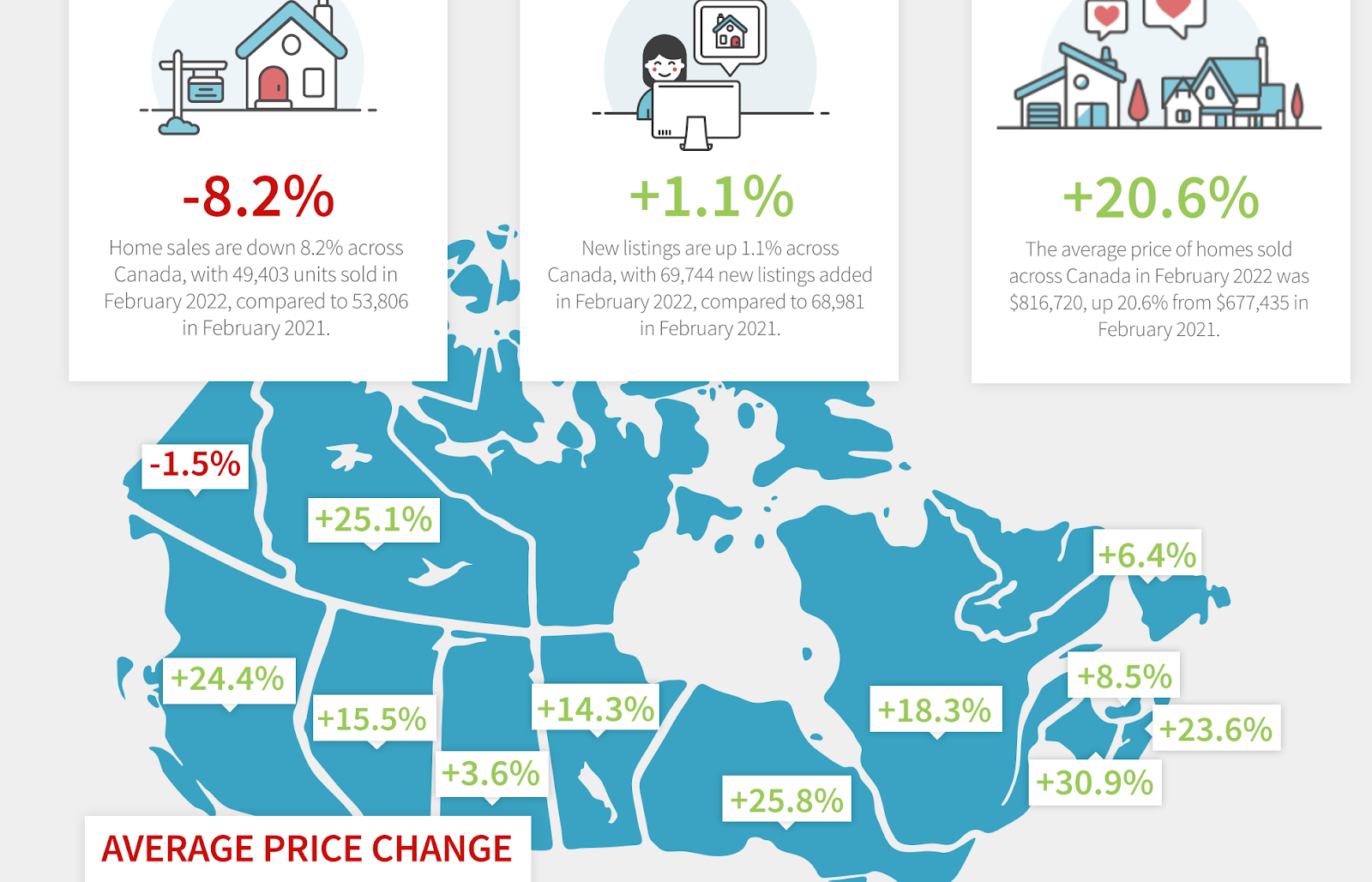

The graphic below shows that the market is similar across Canada. The only place in the entire country where prices dropped was the Yukon and it was only by 1.5%. BC is in the top 3 for price increases.

However, you always have to remember that this is just the Real Estate World according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s November Real Estate Stats & Opinion

Okanagan Real Estate Report November 2021

*click images to enlarge

Rom’s Real Estate Opinion

The real estate industry is full of surprises; never a dull moment. That’s why I love this business so much. Very often people quote “history repeats itself”. It’s pretty hard to find historical data that illustrates that history is repeating itself in the Okanagan Real Estate market. This is all new territory.

Winter Real Estate

It is the time of year that, historically speaking, things should slow down. There are other reasons for a slowdown too. Interest rates are rising and consumer confidence is skeptical as to whether this market can sustain itself. People are expecting a slowdown. “The bubble has to burst”, some of my clients are saying.

However, the stats don’t lie and they never will. What’s happening in the statistics in the Real Estate market? They are RISING. If you recall last month I referred to the expected slow down and decrease in absorption simply because of the winter months. However, in November the absorption rate is rising.

Let’s check out the numbers

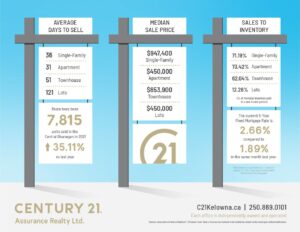

In the Central Okanagan, 71% of the residential inventory sold in November, up from 54% in October. Not only that, the inventory actually went down. What does this mean? As bizarre as it may sound, the demand for Real Estate in the Okanagan, which is already higher than ever in recorded history, is now starting to increase again. Prices are going to continue to rise.

The fact that we all live in paradise is no longer a secret. In my opinion over the next few months it has to soften a bit because winter is here. It softens every year at this time. However, as we get closer and closer to 2022 it is setting itself up for a very hot spring in the Okanagan Real Estate Market.

In Conclusion

As always this is just the real estate world according to Rom. Have an amazing Christmas and stay safe and healthy. Wishing you a Happy New Year and an end to this Pandemic in 2022.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s October Real Estate Stats & Opinion

Okanagan Real Estate Report October 2021

*click images to enlarge

Rom’s Real Estate Opinion

This month the overall message for our real estate market is positive, (with a little bit of caution). The market is cruising along just as we predicted. Perhaps a little better than we predicted.

Let’s talk Absorption

The absorption (percentage of total residential inventory that sells on a monthly basis) in the Central Okanagan is staying strong at slightly above 50%. Usually there is downward pressure on absorption this time of year as the market slows for the winter. If you look back on previous years the absorption tends to start dropping in September and continues until spring. That has not happened yet.

Again, to be redundant, the absorption has to get below 20% before the upward pressure on prices levels off. Statistically, absorption has to get below 12% before you see prices trending downward. Year to date prices for residential properties are up 20+% in the Central Okanagan compared to the same time frame last year. Keep in mind this is residential properties only.

The Commercial Side

The commercial/industrial market, although not as robust as the residential market, is also showing strong gains. Most of the excess inventory we saw 3 to 5 years ago has been eaten up and prices per acre of industrial land are rising. Commercial lease rates are also rising and demand for development land is increasing. We are seeing more and more developers coming to the interior as they realize the lack of inventory is like a carrot in front of the donkey they are riding on.

Interest Rates

Now, here is the caution I spoke of. The Bank of Canada has decided to ease off a program called “Quantitative Ease” (QE). I am not an economist nor would I propose to understand the intricacies of this but here is what I know so far. The QE program is designed to push inflation and avoid deflation. The Federal Government buys billions in bonds weekly; which somehow keeps interest rates down, pushing people to buy more “stuff”: cars, houses, etc.

As of October 27, the Feds have decided to diminish these purchases to slow down inflation. This will put upward pressure on interest rates. We have already seen borrowing rates rise slightly in the last few weeks. At this stage I am not sure what will happen to interest rates or the effect on our demand for Real Estate in the Okanagan. I don’t think you will see huge jumps in interest rates. It would shut down the economy. Rather they will “creep” them up.

It does not take a rocket scientist to figure out that as interest rates went down, more people qualified and were able to buy. So guess what? As interest rates go up, less and less people will qualify to buy.

In Conclusion

I doubt we are going to see anything but a continued minor slow down as we end the year and walk into 2022. However, as always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s August Real Estate Stats & Opinion

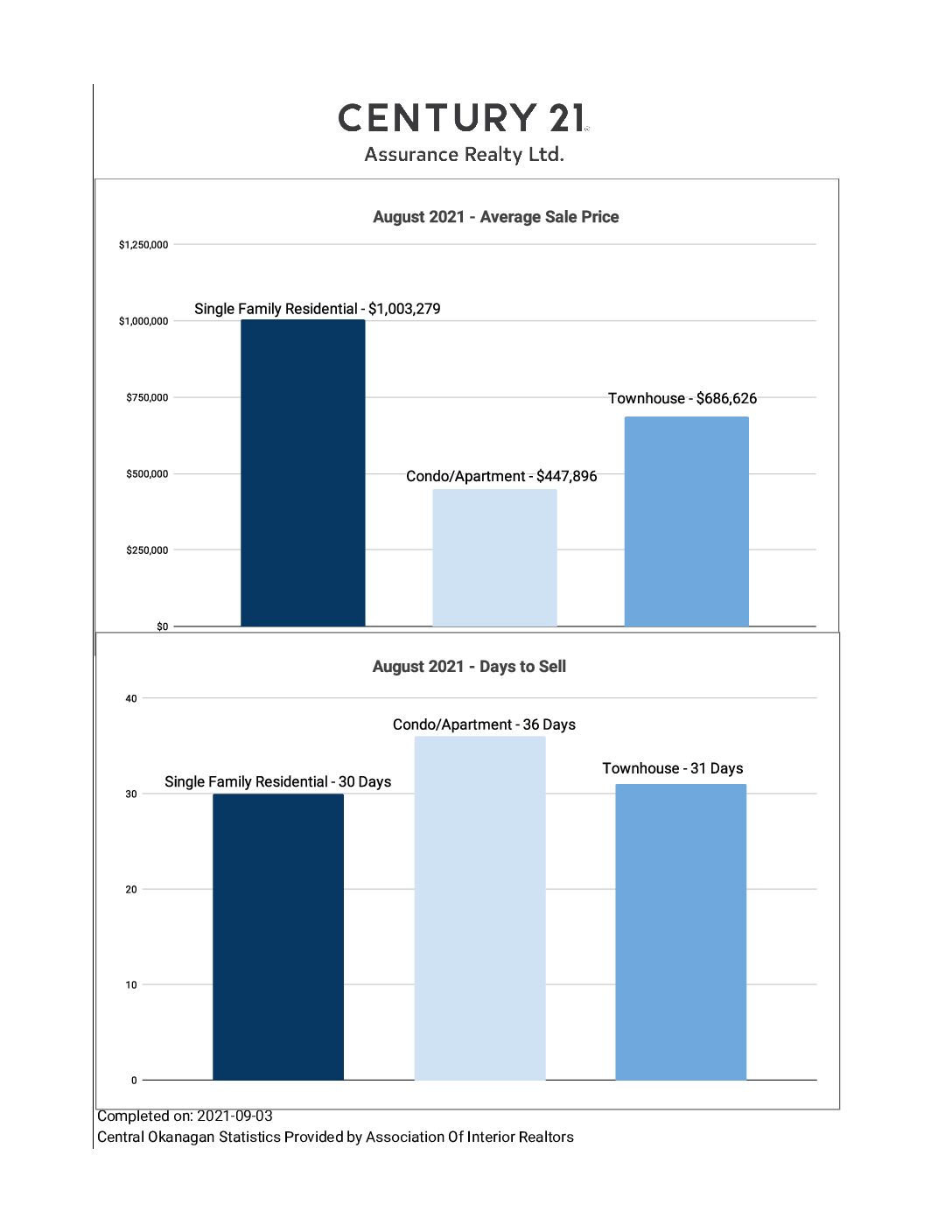

Okanagan Real Estate Report August 2021

*click images to enlarge

Rom’s Real Estate Opinion

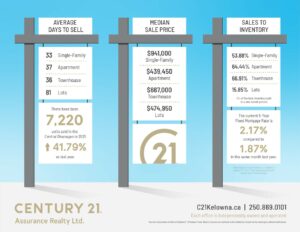

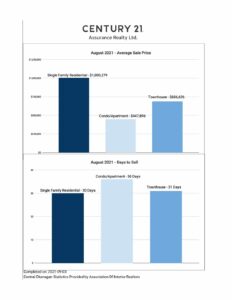

The phrase of the month for August 2021 for the Okanagan Real Estate market is “Levelling Off”. I hate to be a broken record but this is what was expected. The insane market of the last 2 quarters of 2020 and the first 2 quarters of 2021 could not sustain itself. The market had to correct either by a crash or a levelling off; and levelling off is what it has done.

For the moment, it has stopped its minor correction and leveled off at a very strong market.

Why did it not crash?

That can be answered in 1 word: Inventory. (There isn’t any!) Low inventory will keep multiple offers coming and keep the prices rising. For the second month in a row the average price for the Central Okanagan is above $1,000,000. The demand from outside of the Okanagan continues to be strong which keeps the inventory low. Because the rental market is just as tight as the sales market, buyers have no alternative but to continue to push to buy in this market. I get a few calls per month from people who are desperately trying to find a place to live – buy or rent. For some reason they think I might have an “in” that other REALTORS don’t have. Of course the contrary is true.

The average inventory in August 2021 is 267. The average inventory in August 2020 was 536. That is slightly less than half the inventory of 2020, which was already low. That says it all about what is going on.

Conclusion

If anyone ever asks you what is going to happen to the Real Estate Market in the Okanagan you can most definitely state that it is going to stay strong for the next year at least. That inventory has to go up dramatically before the market direction will change. That can’t happen overnight. This winter we will have our seasonal slow down which will make a better time to buy for BUYERS! As always, that is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s May Real Estate Stats & Opinion

Okanagan Real Estate Report May 2021

Rom’s Real Estate Opinion

There is a very tiny crack in the foundation of the Real Estate market in the Okanagan right now. Sales are actually down in the Kelowna area. If you look back over the years there is almost always an increase in sales from April to May. The tiny crack continues into the absorption rate (the amount of sales versus the amount of listings at any time). There is almost always an increase in absorption from April to May; this year it is actually down.

One of the phrases that I use in real estate is “A month does not make a market”. In other words this may just be a slight downward blip. If this is a real trend, it will continue for at least the next few months. I do believe this is what we will see. There will be a slight flattening of the market in the next few months but it will hardly be noticeable.

There are 2 possibilities to explain this change. First, the market is starting a minor (or major!) correction. We have peaked and will start to see things settle down. Second, the market is “too good”. We saw this happen in 2007. The demand is so high and the supply is so low that sales are decreasing because people have nothing to buy. In my ever so humble opinion it is a combination of the two.

The market was so ridiculously hot that it could not sustain itself. It was inevitable that it was going to slow down at least to light speed. Many Realtors are saying that their buyers are saying “I give up”. They have been disappointed so many times making offers on houses and losing out to other buyers. Some buyers have decided not to make their move until the market slows a bit and there is more inventory to choose from.

Conclusion

Personally, I am glad to see this crack in the foundation. The market was super hyper. It was no fun telling my buyers to go into a multiple offer battle, $50,000 over list and still have no chance of getting the property they want. It needed a bit of a time out.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free. As always have to remember that’s just the Real Estate World according to Rom.

-

Rom’s April Real Estate Stats & Opinion

Okanagan Real Estate Report April 2021

Rom’s Real Estate Opinion

In the current whirlwind real estate market, we are hearing many stories emerging of how fast-paced and wild the home buying process has become. I wanted to share a story with you all today.

Home Buyers Debacle

A local realtor detailed an experience she had trying to find a home for her clients to purchase. Her buyer clients had lost out a few deals by being out bid. They finally found a home they were not going to be outdone on and they offered $100,000 over list price. They considered not putting in any conditions because their financing was a slam dunk at only 20% loan to value and they trusted what they saw in the house when they viewed it. However , they were advised by their mortgage broker to put a condition of financing in anyways.

They did not get the deal. The were told the winning offer was $50,000 less than their offer but had no conditions. The sellers put more value on getting a firm decision than getting another $50,000. My Realtor said the buyers were angry and blaming the other side. However, this is like no fault insurance. The sellers are just taking the best offer for them in their minds. The seller’s Realtor is just looking after their client. The buyer’s Realtor was careful not to push them to go into a risky situation. The mortgage broker was being cautious and protecting the buyers. If anyone is to blame it would be the buyers because they did not choose to take the risk. How can anyone truly blame them for that? This is one crazy market when we are actually discussing that putting a single condition on an offer and offering $100,000 over list price was too conservative. At the end of the day people have to calculate and be comfortable with their risks. Then they have to accept the consequences and move on.

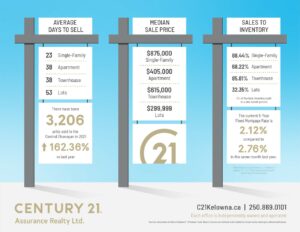

Kelowna Stats

The Stats this month are off the charts, in the stratosphere, or any other similar metaphor I can come up with. This month Kelowna’s absorption is 88%. That means that 88% of all the houses on the market on April 1 sold in April. The average days on market to sell (DOM) was 23 days in Kelowna. What that means is that the listing was activated, an offer was negotiated and all conditions were removed in less than 23 days.

Conclusion

On top of all that there is not a shred of hard evidence indicating that this market is going away anytime soon. Those who believe the bubble is going to burst are simply speculating and guessing at this point. However, even a broken clock is right twice a day. Sooner or later things will change.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home or it can be done completely remotely if you prefer. It is totally free. As always, this is just the Real Estate World according to Rom.

-

Rom’s March Okanagan Real Estate Stats & Opinion

Okanagan Real Estate Report March 2021

Rom’s Real Estate Opinion

Imagine in any given market, statistics were so off the charts that an experienced analyst says, “It must be a typo”. In March the absorption in the Central Okanagan was 99.76%! What does that mean? In March, virtually all houses that were on the market at the beginning of the month, were sold by the end of the month. That is truly unbelievable.The average DOM (Days on Market to sell) in the Central Okanagan was 33 days. That is less than half of the 10 year average. The average sale price in March in Kelowna was $160,000 higher than the average sale price of the last 12 months. That does not mean prices have gone up that much. I had one Realtor tell me that he believes the market is rising $10,000 per month. There is no question, the Okanagan paradise we live in is no longer a secret.What does this all really mean to consumers and Realtors?

People think we as Realtors must be having a heyday. In fact, I don’t think I have ever seen Realtors so frustrated. Almost all Realtors care deeply about their clients. They work hard to write offers that are legal and enforceable and with clauses to protect their clients, only to lose out to a higher bid over and over. Naturally, that is very frustrating for buyers and Realtors.One way to get an advantage for a buyer is to write an offer with no conditions on it. When the seller signs the offer the house is sold which gives that particular buyer an advantage over one with conditions. The problem is there are risks involved. A good Realtor will explain those risks in detail but at the end of the day buyers are looking for any way to create an advantage for their offer. If you are a buyer in this crazy market be sure you understand the possible worst case scenarios if you make this type of offer. It does not mean that you should or should not make an offer like this. I personally have done it many times. It simply means you have to be informed, prepared and comfortable with the risks. Real Estate environments like this have been historically common in cities like Vancouver and Toronto but it is new here.Final Thoughts

People are moving here in droves and there is no indication that this is going to let up any time soon. Our job is not to tell buyers what to do. It is to make sure they understand all their options, all the risks involved in those options and then take instructions from our clients. As a buyer you must move fast in this market to get the house you want. Pay attention to your Realtor, listen to their advice, make an informed decision and then act and act fast if you want to get a step up on all the other numerous buyers that are likely looking at the same property.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home or it can be done completely remotely if you prefer. It is totally free. As always, this is just the Real Estate World according to Rom.

-

Rom’s January Okanagan Real Estate Stats & Opinion

Okanagan Real Estate Report January 2021

Rom’s Real Estate Opinion

The Okanagan Real Estate Market is continuing its robust, upward direction. Many houses are currently selling for above list price! All signs point toward another robust year.

A question I hear a lot these days is, “Is now a good time to sell”? Absolutely it is! This is one of the few times in my 18 years in this business where sellers do NOT think their homes are worth more than they are. Most sellers are surprised by what they can get for their home.

Recent Scenarios

I just had a new listing that some Realtors commented was ‘overpriced’. However, I received a total of 4 offers in 48 hours and one offer was $30,000 over list price. These stories are not the exception; they are the norm in this market. Just recently, an original condition 1974 home with a lakeview in the Lower Mission, Kelowna area had 15 offers! It was listed for $650,000 and then sold for $110,000(!!) over list price at $760,000.

If you are thinking of making a move in the next 5 years, now is probably the best time you will see to sell your home. However, one has to be a little cautious. You have to remember that the reason prices are rising is the inventory of homes to buy is so low.

Adding in Offer Subjects

There are 2 ways to avoid being homeless when you sell your home. First, you can put in your offer: “Subject to the sale of your home”. This means that you put an offer on a house that will be conditional to you selling your home. The problem with this solution is that this is viewed as a fairly weak offer, especially in this market. The seller has to count on you, the buyer, to price his or her home correctly to sell before they know their home is sold. In this market there are likely offers without this stipulation which puts you in a poor negotiating position.

The second way, in my opinion is the better way to solve this issue. As your Realtor, to protect your best interest, I will put the following clause on the contract: “Subject to the seller finding suitable accommodation on or before (Date). This condition is for the benefit of the seller”. What this means is the sale of your home does not go through unless you find a home to buy or rent and then remove this condition in writing. The reason I think this is a better option is it is an extreme seller’s market. A buyer has much more motivation to allow the seller to find a home than sellers have to allow the buyers to sell their home. You will likely be more successful with the later solution than the former one.

Final Thoughts

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home or it can be done completely remotely if you prefer. It is totally free. As always, this is just the Real Estate World according to Rom.