Okanagan Market Prediction

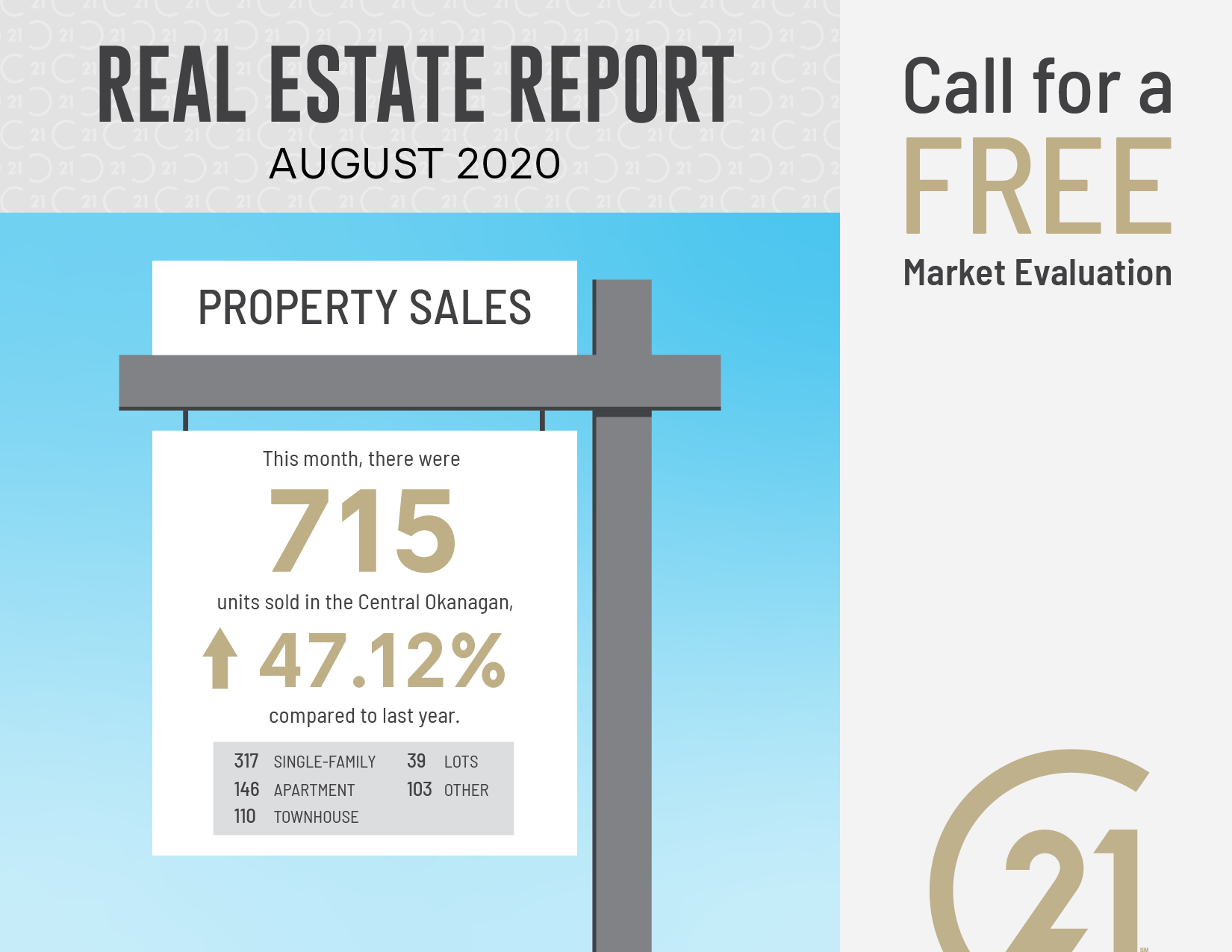

The market in the Okanagan for October is responding pretty much the way we anticipated. It continues to “Stabilize” or flatten out. We are starting to experience the seasonal slowdown that we experience every year at this time. However, sales are down compared to last October.

Past to Present October

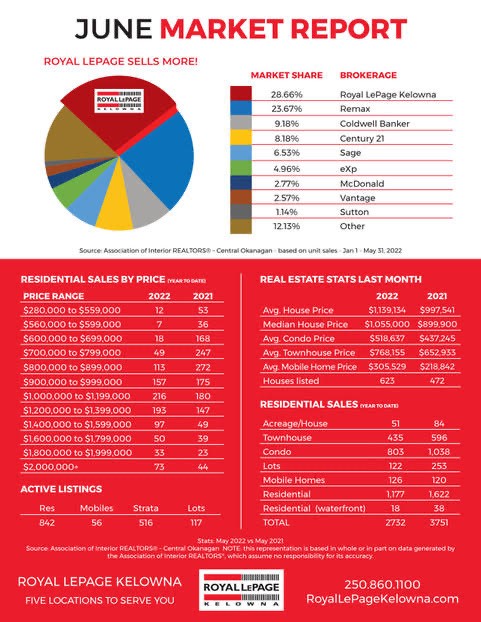

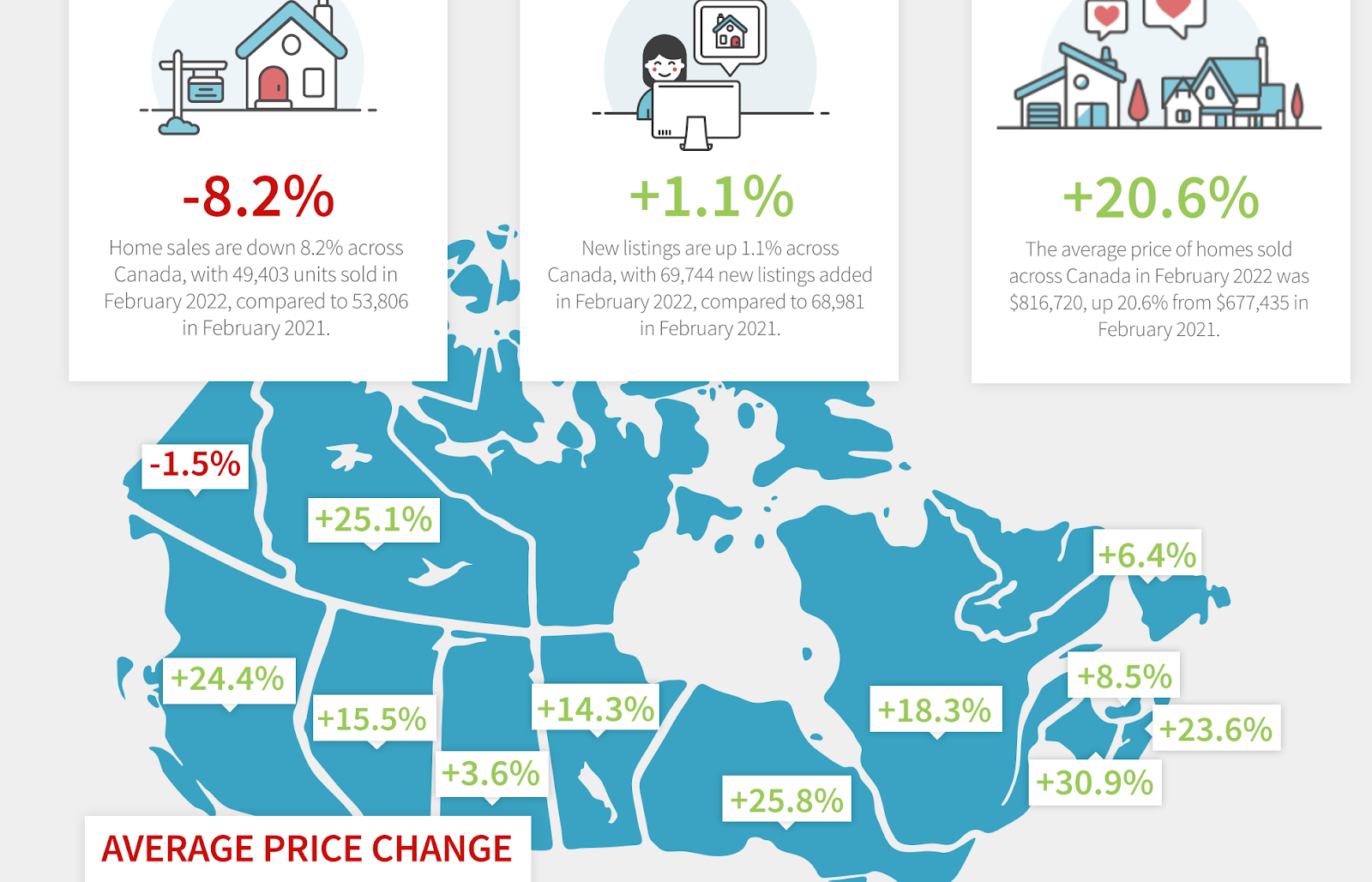

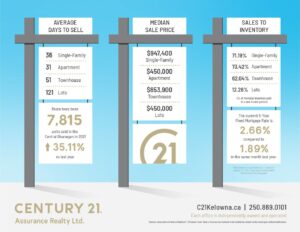

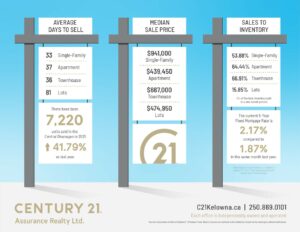

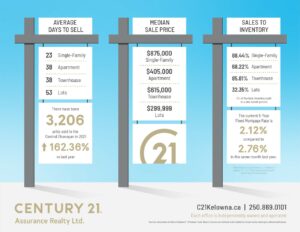

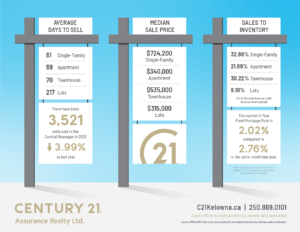

We need to keep in mind last October was not a regular October. It was a boom. The absorption is also down although not substantially. The Central Okanagan absorption is 12.49%. Basically, that number indicates that we are at the very bottom of a balanced market where absorption extends between 12 and 20%. If you look at the prices, they have come down approximately 10 to 14% since the first quarter of 2022. However, they seem to have leveled off.

At the end of October, the Bank of Canada raised the overnight lending rate by 50 basis points (1/2 of a percentage). I believe they will do the same thing (maybe this time .25%), in the beginning of December. Although this is a fairly aggressive rise in interest rates it’s not as aggressive as we’ve seen in the past few months. The overnight lending rate has gone from .25% to 3.75% in just a few months.

Conclusion

Although, the lending rate is having its effect on the market, and it is slowing down inflation and decreasing sales I think you will see the market pick up again as we step into the spring market at the end of February. We see a slow down every year at this time.

As always, this is just the real estate world according to Rom. If you have any real estate questions give me a call or send me an email at any time.

Please remember, I am NEVER too busy for any of your referrals!