Okanagan Real Estate Report November 2021

*click images to enlarge

Rom’s Real Estate Opinion

The real estate industry is full of surprises; never a dull moment. That’s why I love this business so much. Very often people quote “history repeats itself”. It’s pretty hard to find historical data that illustrates that history is repeating itself in the Okanagan Real Estate market. This is all new territory.

Winter Real Estate

It is the time of year that, historically speaking, things should slow down. There are other reasons for a slowdown too. Interest rates are rising and consumer confidence is skeptical as to whether this market can sustain itself. People are expecting a slowdown. “The bubble has to burst”, some of my clients are saying.

However, the stats don’t lie and they never will. What’s happening in the statistics in the Real Estate market? They are RISING. If you recall last month I referred to the expected slow down and decrease in absorption simply because of the winter months. However, in November the absorption rate is rising.

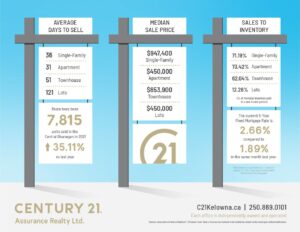

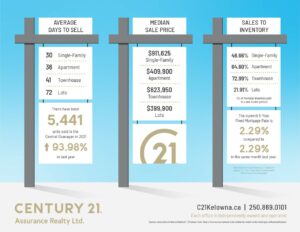

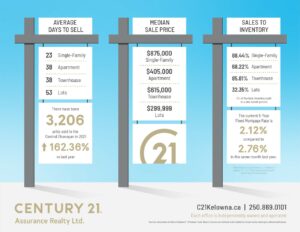

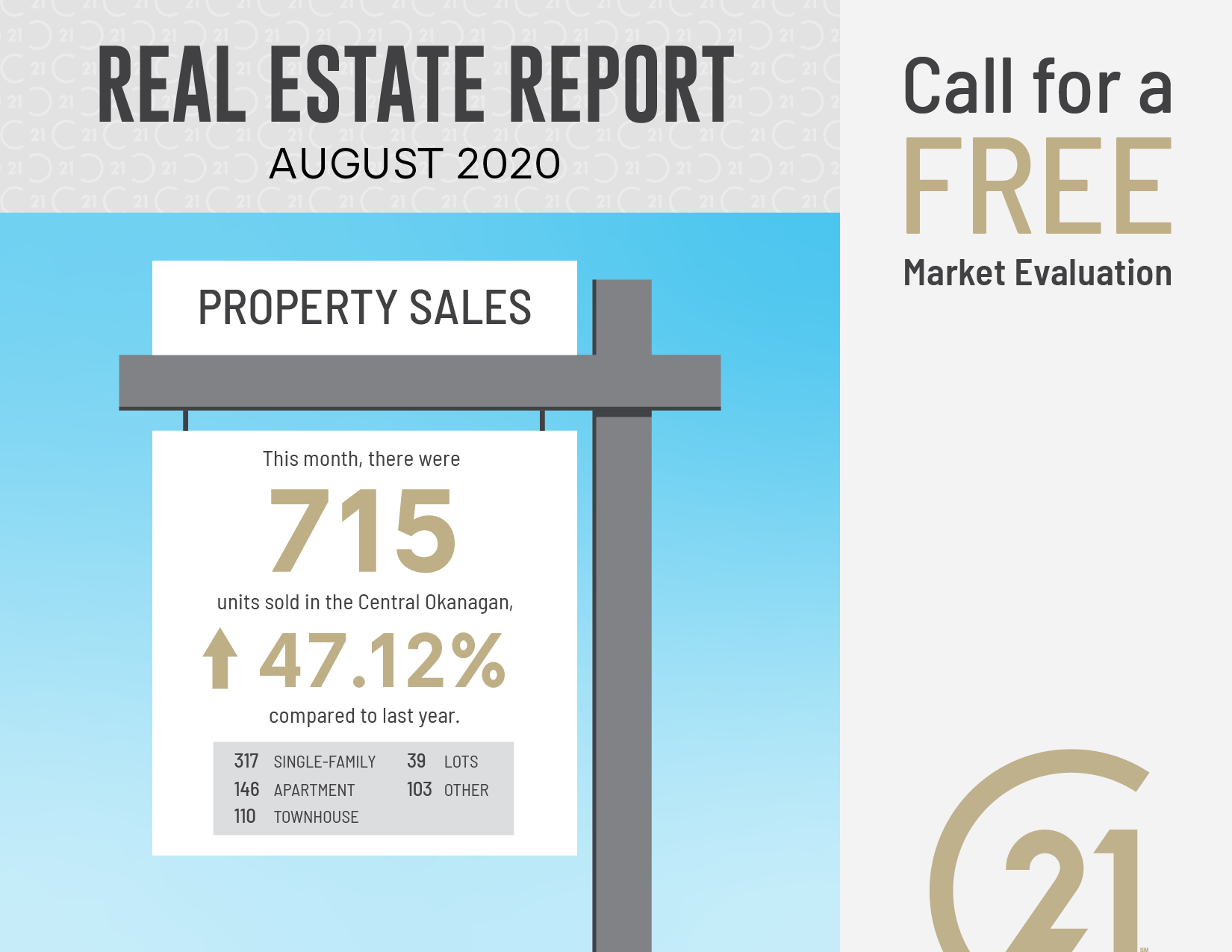

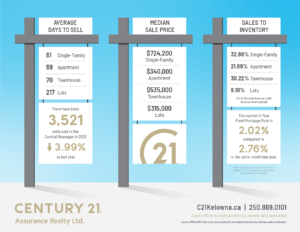

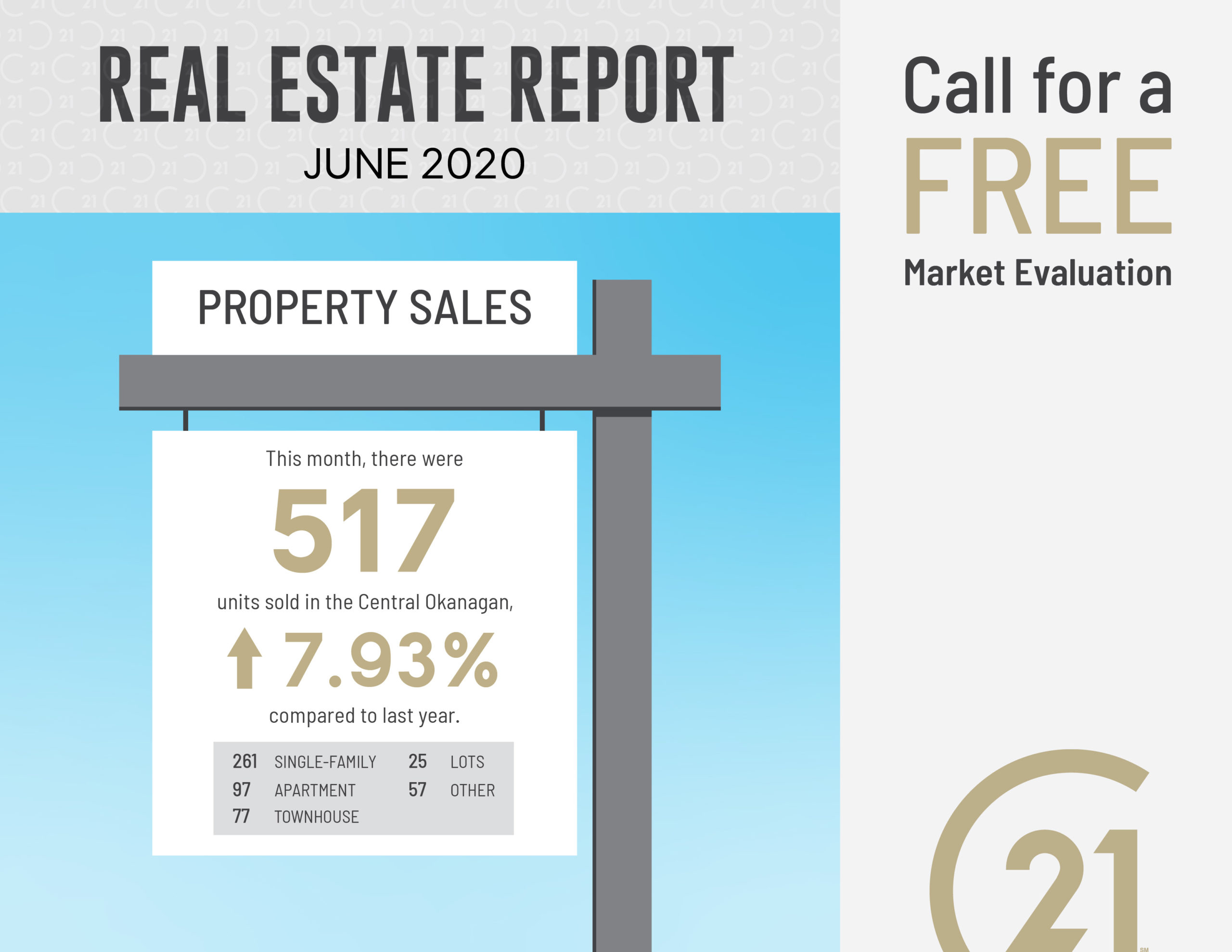

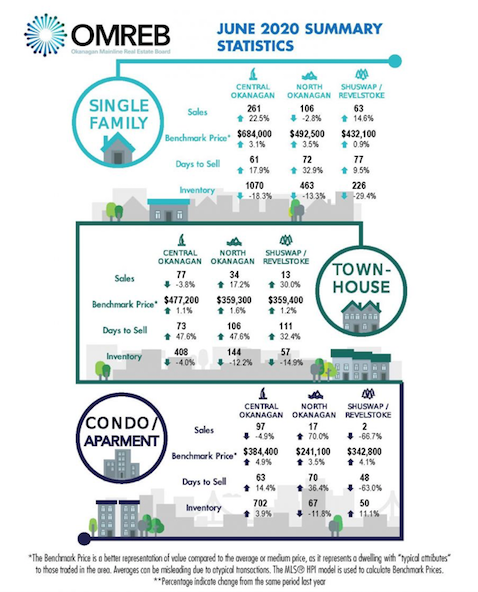

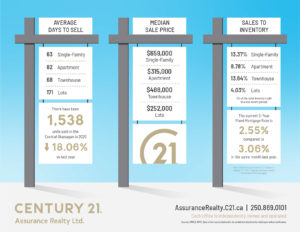

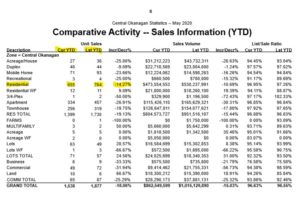

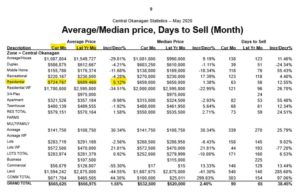

Let’s check out the numbers

In the Central Okanagan, 71% of the residential inventory sold in November, up from 54% in October. Not only that, the inventory actually went down. What does this mean? As bizarre as it may sound, the demand for Real Estate in the Okanagan, which is already higher than ever in recorded history, is now starting to increase again. Prices are going to continue to rise.

The fact that we all live in paradise is no longer a secret. In my opinion over the next few months it has to soften a bit because winter is here. It softens every year at this time. However, as we get closer and closer to 2022 it is setting itself up for a very hot spring in the Okanagan Real Estate Market.

In Conclusion

As always this is just the real estate world according to Rom. Have an amazing Christmas and stay safe and healthy. Wishing you a Happy New Year and an end to this Pandemic in 2022.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.