Okanagan Real Estate Report January 2021

Rom’s Real Estate Opinion

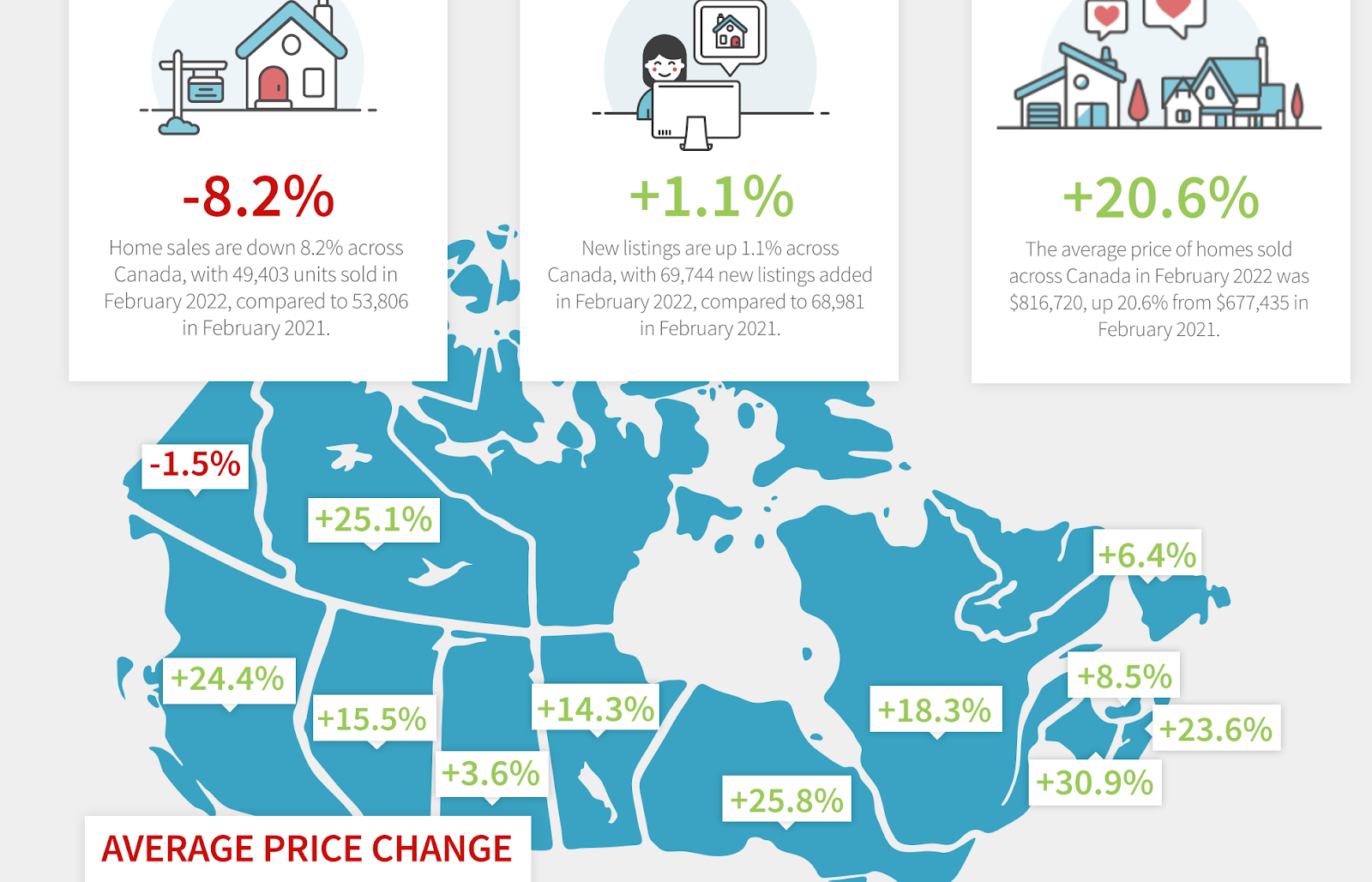

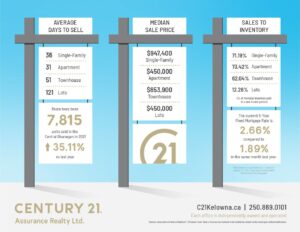

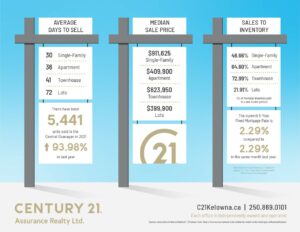

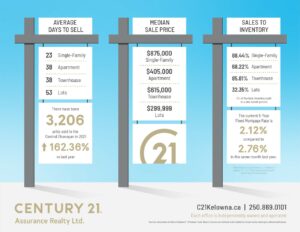

The Okanagan Real Estate Market is continuing its robust, upward direction. Many houses are currently selling for above list price! All signs point toward another robust year.

A question I hear a lot these days is, “Is now a good time to sell”? Absolutely it is! This is one of the few times in my 18 years in this business where sellers do NOT think their homes are worth more than they are. Most sellers are surprised by what they can get for their home.

Recent Scenarios

I just had a new listing that some Realtors commented was ‘overpriced’. However, I received a total of 4 offers in 48 hours and one offer was $30,000 over list price. These stories are not the exception; they are the norm in this market. Just recently, an original condition 1974 home with a lakeview in the Lower Mission, Kelowna area had 15 offers! It was listed for $650,000 and then sold for $110,000(!!) over list price at $760,000.

If you are thinking of making a move in the next 5 years, now is probably the best time you will see to sell your home. However, one has to be a little cautious. You have to remember that the reason prices are rising is the inventory of homes to buy is so low.

Adding in Offer Subjects

There are 2 ways to avoid being homeless when you sell your home. First, you can put in your offer: “Subject to the sale of your home”. This means that you put an offer on a house that will be conditional to you selling your home. The problem with this solution is that this is viewed as a fairly weak offer, especially in this market. The seller has to count on you, the buyer, to price his or her home correctly to sell before they know their home is sold. In this market there are likely offers without this stipulation which puts you in a poor negotiating position.

The second way, in my opinion is the better way to solve this issue. As your Realtor, to protect your best interest, I will put the following clause on the contract: “Subject to the seller finding suitable accommodation on or before (Date). This condition is for the benefit of the seller”. What this means is the sale of your home does not go through unless you find a home to buy or rent and then remove this condition in writing. The reason I think this is a better option is it is an extreme seller’s market. A buyer has much more motivation to allow the seller to find a home than sellers have to allow the buyers to sell their home. You will likely be more successful with the later solution than the former one.

Final Thoughts

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home or it can be done completely remotely if you prefer. It is totally free. As always, this is just the Real Estate World according to Rom.

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.