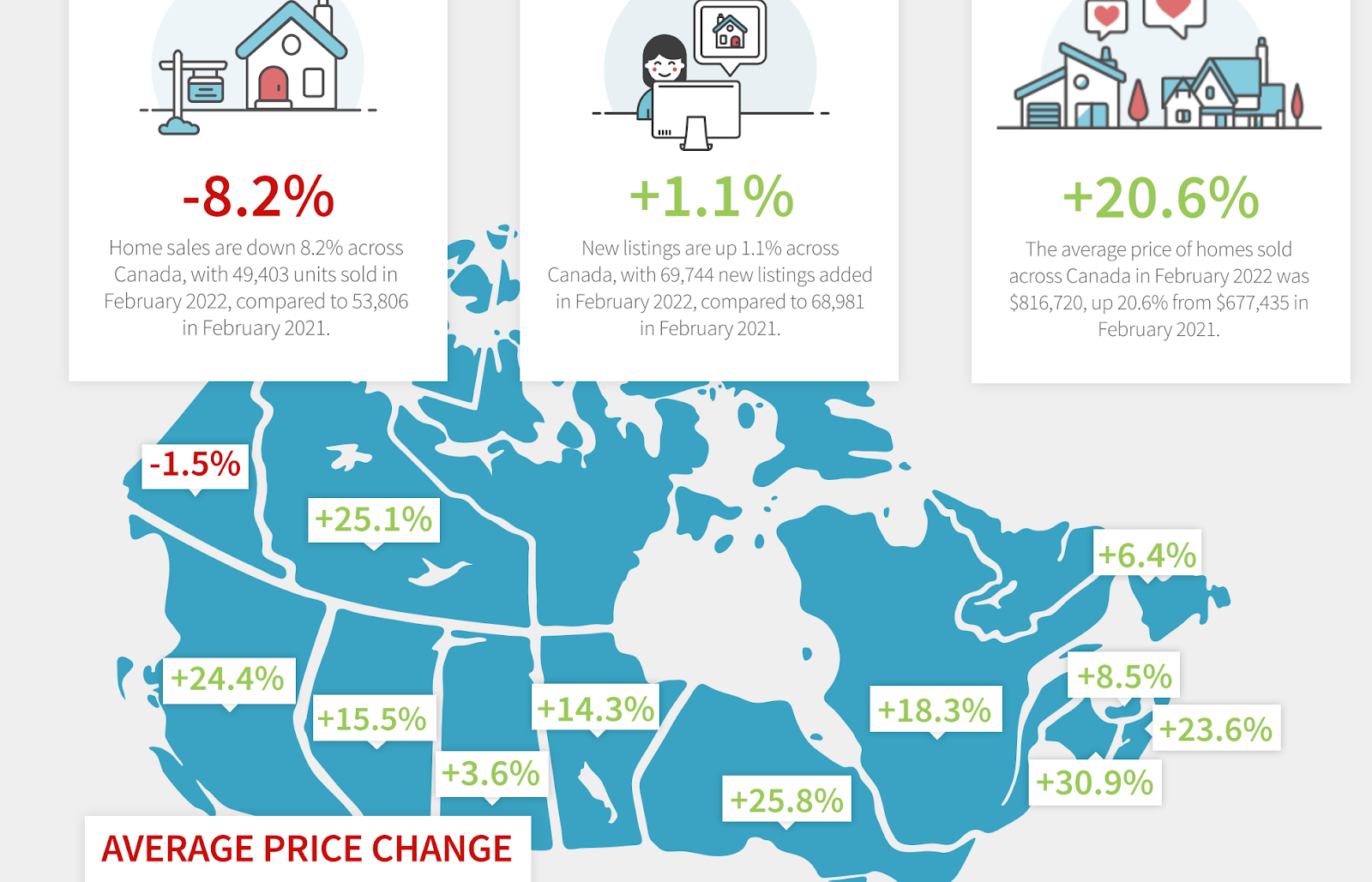

The Real estate market in January of 2024 is sending us mixed messages.

The stats for January indicate that the market is actually down in the Central Okanagan. The absorption in the Central Okanagan is below 10% for the second month in a row. If you look at these statistics you would say that the market is still correcting.

However, I know that is not true from what other Realtor colleagues have been telling me. Every Realtor I know has been saying that the year started out strong or at least increasing from 2023.

We have to remember that our stats are always 2 weeks to a month behind reality. When a Realtor writes a deal, the deal is not recorded as sold until the conditions are removed – which means the statistics could be outdated by up to a month. You will likely see the absorption rise in February.

We expect prices to rise in 2024 and we expect a fairly strong year. You can see, when we take a closer look at the MLS system, that even though the absorption is down for the month, sales increased in the last half of the month.

In summary, in the next few months you will see an increase in sales, prices and absorption and a decrease in days on market to sell. This is called a recovering market. The spring market will create some of that upward pressure but as we compare month over month you will see that is increasing as well.

As always, this is just the real estate world according to Rom. Contact me today for all of your real estate needs!