SEASONS GREETINGS!It is a wonderful time to reflect on this year and I am feeling grateful and blessed for the support I receive from you, my clients and friends. I hope to continue being able to support you with all of your real estate needs. In October I mentioned that the Real Estate market in the Interior of BC was showing the beginning signs of levelling off. That levelling has continued into November which gives us one more month towards any kind of certainty that this correction is over. The Bank of Canada has maintained its overnight lending at 5% for the 4th consecutive time. The main reason for this is the inflation rate has come down to 3.12%. That is in contrast to 3.8% last month and 6.9% last year at this time. Therefore, it is getting close to their target rate of 2%. As far as corrections go, this was a pretty mild one. In 2008 the correction lasted 4 years. Here’s an interesting point: people talk of prices going down. Even in a correction, prices rarely go down substantially. When the year ends, prices in 2023 will have been stabilized and we didn’t see much of a decline at the end. I expect in 2024, a rise in house prices around 5-6%. In 2024 I expect the Bank of Canada rate to go down by 1-1.5%. |

| Looking forward to a happy and positive 2024 for all, and as always, this is just the real estate world according to Rom. Wishing you, your family and friends a fun and relaxing Christmas and holiday break! |

Tag: Kelowna real estate development

-

Rom’s April 2022 Real Estate Opinion

What’s happening in the Okanagan Real Estate Market?

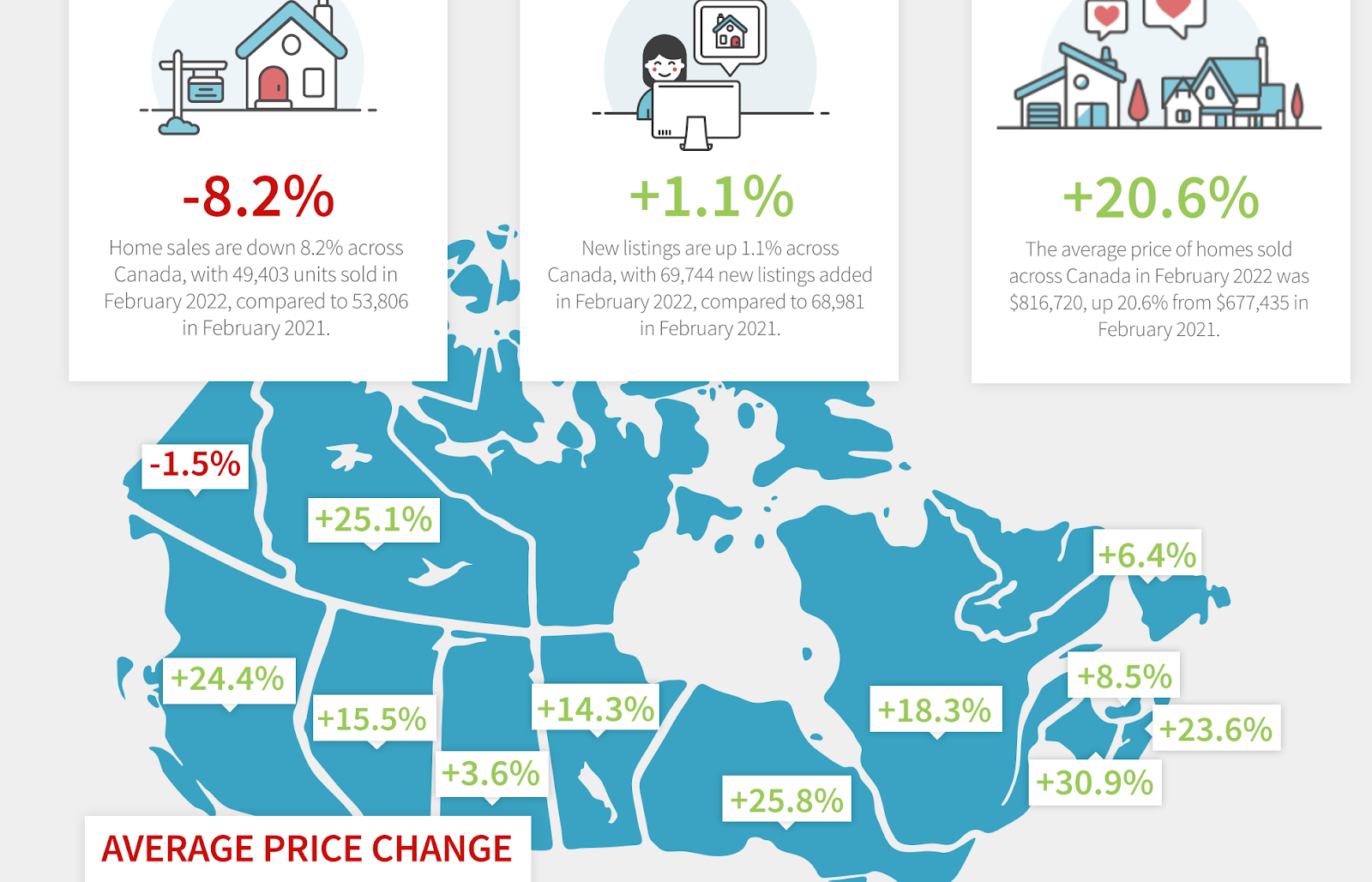

The Federal Government has announced 2 ways they are considering to slow down the upward pressure on house prices.

Firstly, a proposed ban on foreign buyers purchasing houses across Canada for the next 2 years. However, the percentage of foreign buyers in Canada has dropped from 9% in 2015 to only 1 % in 2020. I therefore don’t think this will have any real effect on house prices.

The second proposal is to invest billions into new construction. That is really the only way to slow down the house price increases. The market is driven by supply and demand. We either have to increase the inventory or decrease the demand. The demand for housing in April is still strong in the Okanagan. The absorption rate for March 2022 in the North and Central Okanagan is still above 60%. That means in March 60% of all the houses on the market on the first of the month sold in March. Therefore increasing the inventory should work to slow down the market.

We haven’t yet seen the effect on the market of the rising interest rates and in turn the increasing mortgage rates. Although it is still a great time to sell your home (especially if you own a secondary home!!), the increasing mortgage rates will price more buyers out of the market. Increased mortgage rates and increasing inventory should help shift to a more balanced marketplace.

The graphic below shows that the market is similar across Canada. The only place in the entire country where prices dropped was the Yukon and it was only by 1.5%. BC is in the top 3 for price increases.

However, you always have to remember that this is just the Real Estate World according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

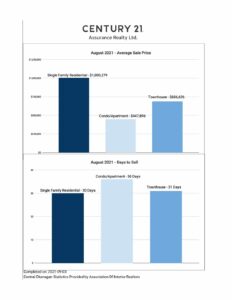

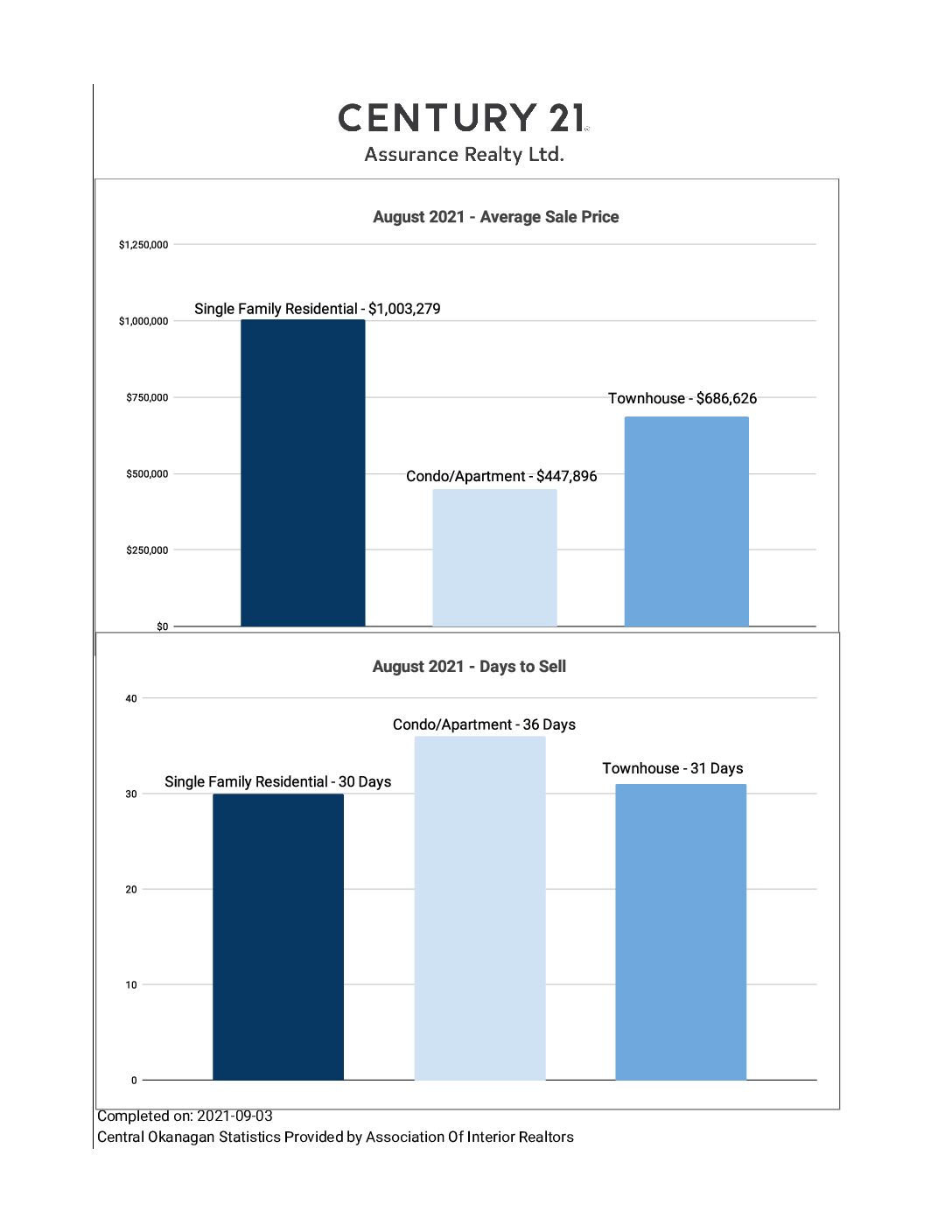

Rom’s August Real Estate Stats & Opinion

Okanagan Real Estate Report August 2021

*click images to enlarge

Rom’s Real Estate Opinion

The phrase of the month for August 2021 for the Okanagan Real Estate market is “Levelling Off”. I hate to be a broken record but this is what was expected. The insane market of the last 2 quarters of 2020 and the first 2 quarters of 2021 could not sustain itself. The market had to correct either by a crash or a levelling off; and levelling off is what it has done.

For the moment, it has stopped its minor correction and leveled off at a very strong market.

Why did it not crash?

That can be answered in 1 word: Inventory. (There isn’t any!) Low inventory will keep multiple offers coming and keep the prices rising. For the second month in a row the average price for the Central Okanagan is above $1,000,000. The demand from outside of the Okanagan continues to be strong which keeps the inventory low. Because the rental market is just as tight as the sales market, buyers have no alternative but to continue to push to buy in this market. I get a few calls per month from people who are desperately trying to find a place to live – buy or rent. For some reason they think I might have an “in” that other REALTORS don’t have. Of course the contrary is true.

The average inventory in August 2021 is 267. The average inventory in August 2020 was 536. That is slightly less than half the inventory of 2020, which was already low. That says it all about what is going on.

Conclusion

If anyone ever asks you what is going to happen to the Real Estate Market in the Okanagan you can most definitely state that it is going to stay strong for the next year at least. That inventory has to go up dramatically before the market direction will change. That can’t happen overnight. This winter we will have our seasonal slow down which will make a better time to buy for BUYERS! As always, that is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s March Okanagan Real Estate Stats & Opinion

Okanagan Real Estate Report March 2021

Rom’s Real Estate Opinion

Imagine in any given market, statistics were so off the charts that an experienced analyst says, “It must be a typo”. In March the absorption in the Central Okanagan was 99.76%! What does that mean? In March, virtually all houses that were on the market at the beginning of the month, were sold by the end of the month. That is truly unbelievable.The average DOM (Days on Market to sell) in the Central Okanagan was 33 days. That is less than half of the 10 year average. The average sale price in March in Kelowna was $160,000 higher than the average sale price of the last 12 months. That does not mean prices have gone up that much. I had one Realtor tell me that he believes the market is rising $10,000 per month. There is no question, the Okanagan paradise we live in is no longer a secret.What does this all really mean to consumers and Realtors?

People think we as Realtors must be having a heyday. In fact, I don’t think I have ever seen Realtors so frustrated. Almost all Realtors care deeply about their clients. They work hard to write offers that are legal and enforceable and with clauses to protect their clients, only to lose out to a higher bid over and over. Naturally, that is very frustrating for buyers and Realtors.One way to get an advantage for a buyer is to write an offer with no conditions on it. When the seller signs the offer the house is sold which gives that particular buyer an advantage over one with conditions. The problem is there are risks involved. A good Realtor will explain those risks in detail but at the end of the day buyers are looking for any way to create an advantage for their offer. If you are a buyer in this crazy market be sure you understand the possible worst case scenarios if you make this type of offer. It does not mean that you should or should not make an offer like this. I personally have done it many times. It simply means you have to be informed, prepared and comfortable with the risks. Real Estate environments like this have been historically common in cities like Vancouver and Toronto but it is new here.Final Thoughts

People are moving here in droves and there is no indication that this is going to let up any time soon. Our job is not to tell buyers what to do. It is to make sure they understand all their options, all the risks involved in those options and then take instructions from our clients. As a buyer you must move fast in this market to get the house you want. Pay attention to your Realtor, listen to their advice, make an informed decision and then act and act fast if you want to get a step up on all the other numerous buyers that are likely looking at the same property.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home or it can be done completely remotely if you prefer. It is totally free. As always, this is just the Real Estate World according to Rom.

-

Rom’s October Okanagan Real Estate Stats and Update

Kelowna Real Estate Report October 2020

Rom’s Monthly Real Estate Opinion

Brrr… we got our first glimpse of winter this past month here in the beautiful Okanagan. Even with our first snow fall, the real estate market has not gone into hibernation.

If we didn’t know better we would have to conclude that the best thing to happen to the Real Estate market across this country is a global pandemic. In October the absorption rate for Central Okanagan was at 53%. What that means is that in the Central Okanagan 53% of the entire residential inventory was sold in October. These are figures usually reserved for Toronto and Vancouver when they are booming. To give you another perspective, a balanced market is considered somewhere around 12 to 18%. This gives you an idea of how much of a seller’s market this is.This market will start to slow down as we get into November and December because of the winter weather and the holidays. It slows down every year at this time. It’s in extreme markets like this that REALTORS show their value. It takes a well trained REALTOR to figure out what a house is worth in a market like this but also how to write an offer in a market like this and actually get the house for their buyer.Where are buyers coming from?

Where our buyers are coming from is changing. We are seeing an increase in buyers from Alberta, from the Coast and from other areas of the world. The Okanagan is no longer a secret. I believe we will see a dramatic increase in buyers from major cities like Vancouver, Edmonton, Calgary and Toronto into the Okanagan region. Right now that is just a prediction but soon we will have the data to reveal the reality.As always, please remember this is just the Real Estate World according to Rom. Get out and enjoy the beauty of late Fall in Kelowna! -

Emigration Expo 2020

Emigration Expo 2020 in The Netherlands!

I am excited to share that I will once again have at booth at the Emigration Expo in Europe! This is a great opportunity to go overseas and promote the amazing lifestyle we live here in Kelowna. Do you have a home or business for sale and want to promote it internationally? Contact me today and we can set up a meeting to discuss.

What is the Emigration Expo?

The Emigration Expo is held on February 8 and 9, 2020. With about 11,000 visitors, the Emigration Expo is Europe’s largest event for emigrants, expats, job seekers, entrepreneurs and anyone else looking to live abroad. The Emigration Expo is about information, orientation and doing business. There are 3 halls with an area of 12,000m² and about 200 exhibitors and free lectures and presentations. The Emigration Expo is a must for everyone planning to move abroad, temporarily or permanently.

My sister, Pauline and I, in front of my booth at the Emigration Expo in 2019.

Do you want a FREE ticket to the Emigration Expo?

The first 50 people to click here can get a free ticket to the Expo! Let me know if you will be attending, I would love to see you there! My booth number is #230 in Hall 2.

Do you want more information for immigration, live and work in Canada? Please fill out the form here and I will contact you shortly.

-

Purchase Plus Improvements Mortgage

Considering buying a home that could use an update? A purchase plus improvements mortgage might be the right choice for you.

The purchase plus improvements mortgage is a customizable mortgage that will allow you to make home improvements as soon as you move into your new home by rolling the renovation cost into your mortgage. Improvements such as replacing the floors, updating a bathroom or replacing old wiring are some of the many ways to enhance the value of your new home.

Affordability

Even though there are some limits on what you can do, a purchase-plus-improvements mortgage is the most affordable way to finance a renovation. This is because of today’s low mortgage rates. A mortgage is the cheapest way to borrow. If you put an additional $40,000 on your mortgage, it will cost you far less than if you borrow $40,000 on a line of credit for renovations down the road.

Timeline

There are 90 to 180 day timeline on these mortgages, meaning you and your contractor must be prepared to finish any renovations promptly. The timeline is part of what makes this mortgage so great – you improve the value of your home and you get to live in it right away. The exact timeline will depend on your lender and your mortgage broker can help you navigate your options.

How It Works

The first thing you will do is work with your mortgage broker to be pre-approved for your maximum amount.

Then the fun part – find a home you love! Once you have found a home and your purchase offer is accepted, you will get estimates for the improvements you want to make. Your broker can then pass along the estimates to your lender for approval.

If your lender agrees that the renovations will improve the value of your home, they will send your broker an approval for the revised amount of your mortgage – the purchase price PLUS the cost of renovations.

On your closing date, the amount approved for your renovation will go to your lawyer, to be held until you’ve completed the proposed renovations. You will receive the funds once your renovation is complete. This means you must pay the renovation costs up-front from your pocket. Some choose to use a credit card or line of credit to get through the renovation period.

An appraisal will confirm that your renovations were completed within the agreed upon amount of time and then your lawyer can release the funds to you.

It’s important to note that your minimum down payment will be calculated based on the total amount of your home’s assessed value – the purchase price plus the price of the approved renovations.

Purchase-plus-improvements mortgages are the most affordable way to finance home improvements! Contact me today for more information – or if you have any other real estate question! I’d love to help!

-

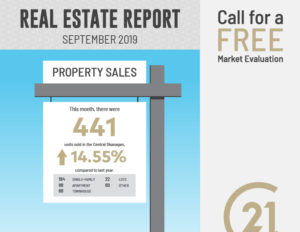

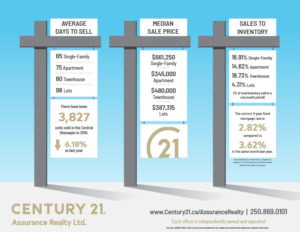

Rom’s Kelowna Real Estate Opinion for Sept 2019

September 2019 Real Estate Report:

*Click the images to enlarge

Kelowna Real Estate Opinion for Sept 2019

Fall is here and with that brings the falling of leaves, cooler temperatures and a new season of the real estate world. Like I have stated in the last few months, the current market is flat. No exciting rises or bubble bursts and there will be none in the immediate future. Bubbles burst when the market has shot up like a rocket like 2004 to 2007. Markets rise dramatically when the market previously fell off a cliff like in 2009 to 2013. We have nothing like that going on. The market is good; not great, not terrible but good.

A new report shows disparity in home price trajectories across Canada, including some large decreases. The CENTURY 21 analysis of home prices reveals that some communities have seen some steep decreases in price per square foot in the past year, most notably in British Columbia. Brian Rushton, Executive Vice-President of CENTURY 21 Canada said, “It is not surprising to see Vancouver prices drop so much, but the drop is actually more significant in some Metro Vancouver suburbs like West Vancouver and secondary B.C. markets such as Vernon and Kelowna”.

While the report is showing prices drop, sales activity is steady. The townhome market under $500,000 continues to be very active. The single family house market is all over the place. The market for homes over $1 million is very slow right now, with only 3 sold last month. Condo sales are still strong too but I suspect this market to stabilize within the next 2 years.

The only insight we can give you is that so far it looks like 2020 will be very similar. There may be a slight increase in the markets in 2020 caused by some of the positive lending changes; lower interest rates, lower qualifying stress test rates and the new first-time buyer incentive program. These programs and changes will allow a small percentage of the population the ability to buy when they could not before the program. Also, the five year bond yields and mortgage rates (yes, there is a correlation there), are back at or have broken levels compared to five years ago.

As always, this is the Real Estate World according to Rom.

-

‘Dull’ development moved forward

Dull – run of the mill – disappointing.’

That’s how one Kelowna City Councillor described a proposed development at the northeast corner of the intersection of Highway 97 and 33.

Photo: Contributed – City of KelownaConceptual Drawing

Photo: Contributed – City of KelownaConceptual DrawingNew Town Architectural Services brought forth an application to have the property, formerly the Vineyard Inn Motel, rezoned from C9 Tourist Commercial to C4 Urban Centre Zone to allow for office retail and service uses.

“I have to say this is a pretty dull, run of the mill project. I would hope we have a much better quality project in this very important location,” says Councillor Robert Hobson.

“It is a very important location and it requires a signature development. The issue is the visual quality of it and to just see a couple of building and parking at Highway 33 and 97 is disappointing.”

The developer took the unusual step of asking for the rezoning prior to submitting a Development Permit application, however, Urban Land Use Manager, Danielle Noble assured council that would be a requirement before a zoning amendment bylaw gets final approval.

The envisioned development includes a four storey commercial building at the rear, a lower profile multi-tenant building parallel to Powick Road, two free-standing single tenant commercial buildings and parking.

The proposal also includes the possibility of a drive-thru business at the corner of Highway 33 and 97 that further irked council.

While the drawings outlining the project are completely conceptual, Councillor Gail Given led the opposition to the drive-thru concept.

“For me that was a little bit of a red flag. It would be similar to the Rexall Drug Store drive-thru (Hollywood Road and Rutland Road),” says Given.

“I just want it to be of note that a drive-thru at the front corner of a main intersection is not something I would find supportable and would encourage any future development that comes forward to address that in a different manner to make sure it looks more like a gateway project and not a drive-thru.”

As for the rezoning itself, council agreed the C4 Zone is a proper application for the property, however, they did agree that, as a city gateway, any development should be a showpiece.

The application did get initial approval and will go forward to a future public hearing.