As always, this is just the real estate world according to Rom. I hope you are having an amazing Fall!

Tag: kelowna lifestyle

-

Rom’s September 2023 Market Review for the interior of BC

There are three terminologies that I personally use to describe what is going on in the real estate market in the Interior of British Columbia. They are: “a leveling off”, “a recovery”, and “a correction”. In the last two years we’ve gone from a recovering real estate market (Rising) to a leveling off and we are now in a correcting market. The characteristics of a correcting market are; reducing absorption (less properties sold in a said period of time), reducing sales, reducing prices with rising inventory, and rising days on the market to sell. That is exactly what we are experiencing right now. These five activities are happening all over British Columbia and likely throughout the rest of Canada or at least in most locations in Canada to various different degrees. The reason is that the major driving force pushing the market down is rising interest rates. Interest rates are governed federally.My prediction in the market going forward is that we will likely have 9 or 10 months of a correcting market. In the third and fourth quarters of 2024 the correcting market will likely start to level off. This will be spurred by the Bank of Canada starting to inch the interest rates down as inflation gets more under control. The correction will not be a dramatic drop in prices. We will likely see a moderate drop in prices. Perhaps a further 10%. The reasoning behind this assumption is that immigration is maintaining a relatively high demand and low inventory is maintaining a relatively low supply. This is why we have not seen a huge drop in prices so far.There are quite a few assumptions built into my prediction that may or may not come true. For instance, if the Bank of Canada continues to raise interest rates the correction will pick up speed and will last for an extended period of time. I see this ending in the last two quarters of 2024.We have had quite a few years of robust markets. British Columbia has the highest Real Estate prices of any province or State in North America. We recently passed Hawaii.Some of you may disagree with me or even dislike me for saying it but,”We needed a correction”. -

BUSINESS FOR SALE: Profitable Okanagan Based Wood Panel Manufacturing Company

Okanagan Wood Panelling Business For Sale

One of the cleanest, highly profitable businesses available – this Okanagan wood panelling manufacturing business offers an ease of operation with 8 long term employees. Two key staff can run the manufacturing end of the business. Little competition with export around 70% to the US.

25 plus years of successful operation with well-established repeating markets and customer base. Extremely profitable with 15% projected growth for this year. Cash business with room for additional growth and product diversity. Business is on major route for trucking to the US and Canada.

This is a great opportunity to own a reputable, profitable business AND live in one of the most desirable areas in Canada and the world. The Okanagan is a true 4 season playground offering boating, hiking, skiing, award winning wineries, championship golf courses and more. Don’t miss this special opportunity!

Current owners prefer a buyer who is willing to relocate to the Okanagan and purchase the 2.2 acres of land & buildings. If interested, upon signing the NDA, I will provide you with an information package and video explaining the business and manufacturing process.

-

Rom’s July Real Estate Stats & Opinion

Okanagan Real Estate Report July 2021

Rom’s Real Estate Opinion

The market is progressing exactly in the direction that we anticipated. Things are settling down but definitely not crashing.

Think of the market in the last year as something like a Chicken Little scenario from the 1943 Disney Movie. For the last 6 months the market has been running around with his hands waving in the air screaming and yelling that the sky is falling. In other words, the absorption was ridiculously high, the inventory was ridiculously low, monthly sales we’re breaking all historical records and price increases we’re breaking all historical records.

What’s happening now is Chicken Little is settling down. The absorption in the Central Okanagan (Peachland to Lake Country) has now dropped to between 40 and 50%. The inventory is still very low and sales have dropped to a reasonable level. However, let’s keep this in perspective. Absorption between 40 and 50% is still off the charts for our area. A balanced Market is considered to be 12 to 18% depending on which expert you listen to. Below 12% indicates that you can expect price decreases and it is also considered a strong buyer’s market. Above 18% is considered a seller’s market and you can expect price increases with this level of absorption. 40% is a long way above 18%…

Where is the market going to go from here and why?

What has to change in order for prices and sales to drop dramatically? If we look at the inventory for July 2021 and compare this with inventory levels in July 2020 and 2019 then this July inventory level is less than half the other 2 year averages. Although over time inventory levels will typically gradually increase as more houses will be built, more construction and development. However, in order for the market to change dramatically to even approach a balanced Market the inventory has to increase dramatically; likely more than double. Is this going to happen? This is the big question. We will not get rid of multiple offers on the same property until that inventory increases. That is just basic logic.

Conclusion

I think we will see this present direction of the inventory, absorption and sales start to level off at these relatively higher levels. The market has settled down from its Chicken Little level to its “normal” place in the regular cycle.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free. As always have to remember that’s just the Real Estate World according to Rom.

-

Rom’s May Real Estate Stats & Opinion

Okanagan Real Estate Report May 2021

Rom’s Real Estate Opinion

There is a very tiny crack in the foundation of the Real Estate market in the Okanagan right now. Sales are actually down in the Kelowna area. If you look back over the years there is almost always an increase in sales from April to May. The tiny crack continues into the absorption rate (the amount of sales versus the amount of listings at any time). There is almost always an increase in absorption from April to May; this year it is actually down.

One of the phrases that I use in real estate is “A month does not make a market”. In other words this may just be a slight downward blip. If this is a real trend, it will continue for at least the next few months. I do believe this is what we will see. There will be a slight flattening of the market in the next few months but it will hardly be noticeable.

There are 2 possibilities to explain this change. First, the market is starting a minor (or major!) correction. We have peaked and will start to see things settle down. Second, the market is “too good”. We saw this happen in 2007. The demand is so high and the supply is so low that sales are decreasing because people have nothing to buy. In my ever so humble opinion it is a combination of the two.

The market was so ridiculously hot that it could not sustain itself. It was inevitable that it was going to slow down at least to light speed. Many Realtors are saying that their buyers are saying “I give up”. They have been disappointed so many times making offers on houses and losing out to other buyers. Some buyers have decided not to make their move until the market slows a bit and there is more inventory to choose from.

Conclusion

Personally, I am glad to see this crack in the foundation. The market was super hyper. It was no fun telling my buyers to go into a multiple offer battle, $50,000 over list and still have no chance of getting the property they want. It needed a bit of a time out.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free. As always have to remember that’s just the Real Estate World according to Rom.

-

Rom’s October Okanagan Real Estate Stats and Update

Kelowna Real Estate Report October 2020

Rom’s Monthly Real Estate Opinion

Brrr… we got our first glimpse of winter this past month here in the beautiful Okanagan. Even with our first snow fall, the real estate market has not gone into hibernation.

If we didn’t know better we would have to conclude that the best thing to happen to the Real Estate market across this country is a global pandemic. In October the absorption rate for Central Okanagan was at 53%. What that means is that in the Central Okanagan 53% of the entire residential inventory was sold in October. These are figures usually reserved for Toronto and Vancouver when they are booming. To give you another perspective, a balanced market is considered somewhere around 12 to 18%. This gives you an idea of how much of a seller’s market this is.This market will start to slow down as we get into November and December because of the winter weather and the holidays. It slows down every year at this time. It’s in extreme markets like this that REALTORS show their value. It takes a well trained REALTOR to figure out what a house is worth in a market like this but also how to write an offer in a market like this and actually get the house for their buyer.Where are buyers coming from?

Where our buyers are coming from is changing. We are seeing an increase in buyers from Alberta, from the Coast and from other areas of the world. The Okanagan is no longer a secret. I believe we will see a dramatic increase in buyers from major cities like Vancouver, Edmonton, Calgary and Toronto into the Okanagan region. Right now that is just a prediction but soon we will have the data to reveal the reality.As always, please remember this is just the Real Estate World according to Rom. Get out and enjoy the beauty of late Fall in Kelowna! -

Rom’s September Okanagan Real Estate Stats and Update

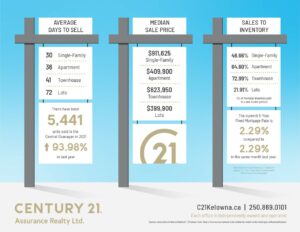

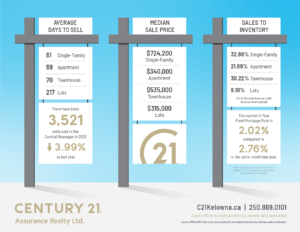

Central Okanagan

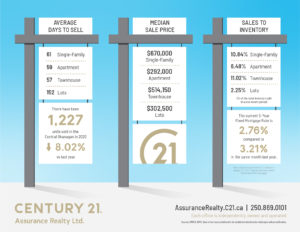

“Unusual market activity seems to be the theme this year, although not surprising considering there is nothing normal about 2020. The pandemic has definitely made people look at things differently. We are seeing higher demand likely due to post-quarantine lifestyle changes.The Pandemic lifestyle changes (who doesn’t want to live in the Okanagan), still record low mortgage rates, very low listing inventory and a continuing migration of buyers from the Lower Mainland are driving up prices from in particular single family homes to record highs. The Albertan buyers were only making up 7% last month, likely due to the effects of the Pandemic to the oil and gas industry. The Benchmark home price (better representation than average or median house prices) was $710,700, up 6.3% from September 2019! It is also remarkable that the sales activity in the one million and up range tripled this year.It is interesting to note that the largest type of Buyers are couples without children (29%) last month, followed by couples with children (24%), see graphic. This led me to believe that more semi-retired and retired couples aremoving and purchasing in the Kelowna area. Overall, 41% of all the buyers were out of town buyers! Also noticeable is the large amount of first time home buyers last month, 24% of all the buyers.The average number of days to sell a home, always a good barometer to watch, barely nudged over August’s 89 days, coming in at 90 days.

BC Overall market

The British Columbia Real Estate Association (BCREA) reports that a total of 11,368 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in September 2020, an increase of 63.3 percent from September 2019. The average MLS® residential price in BC set a monthly record of $803,210, a 15.3 percent increase from $696,647 recorded the previous year. Total sales dollar volume in August was $9.1 billion, an 88.3 per cent increase over 2019.“The provincial housing market had a record-setting September,” said BCREA Chief Economist Brendon Ogmundson. “Both total sales and average prices were the highest ever for the month of September as pent-up demand from the spring pushes into the fall.”

“Average prices are skewing higher as demand for space during the pandemic drives sales of single-detached homes,” added Ogmundson. Total provincial active listings are still down about 12 per cent year-over-year, with some markets even more under-supplied as the pandemic continues to keep listings low. Year-to-date, BC residential sales dollar volume was up 25.1 per cent to $49.7 billion, compared with the same period in 2019. Residential unit sales were up 12.5 per cent to 65,023 units, while the average MLS® residential price was up 11.2 per cent to $764,298.

As always, this is just the Real Estate World according to Rom. -

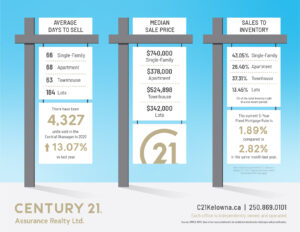

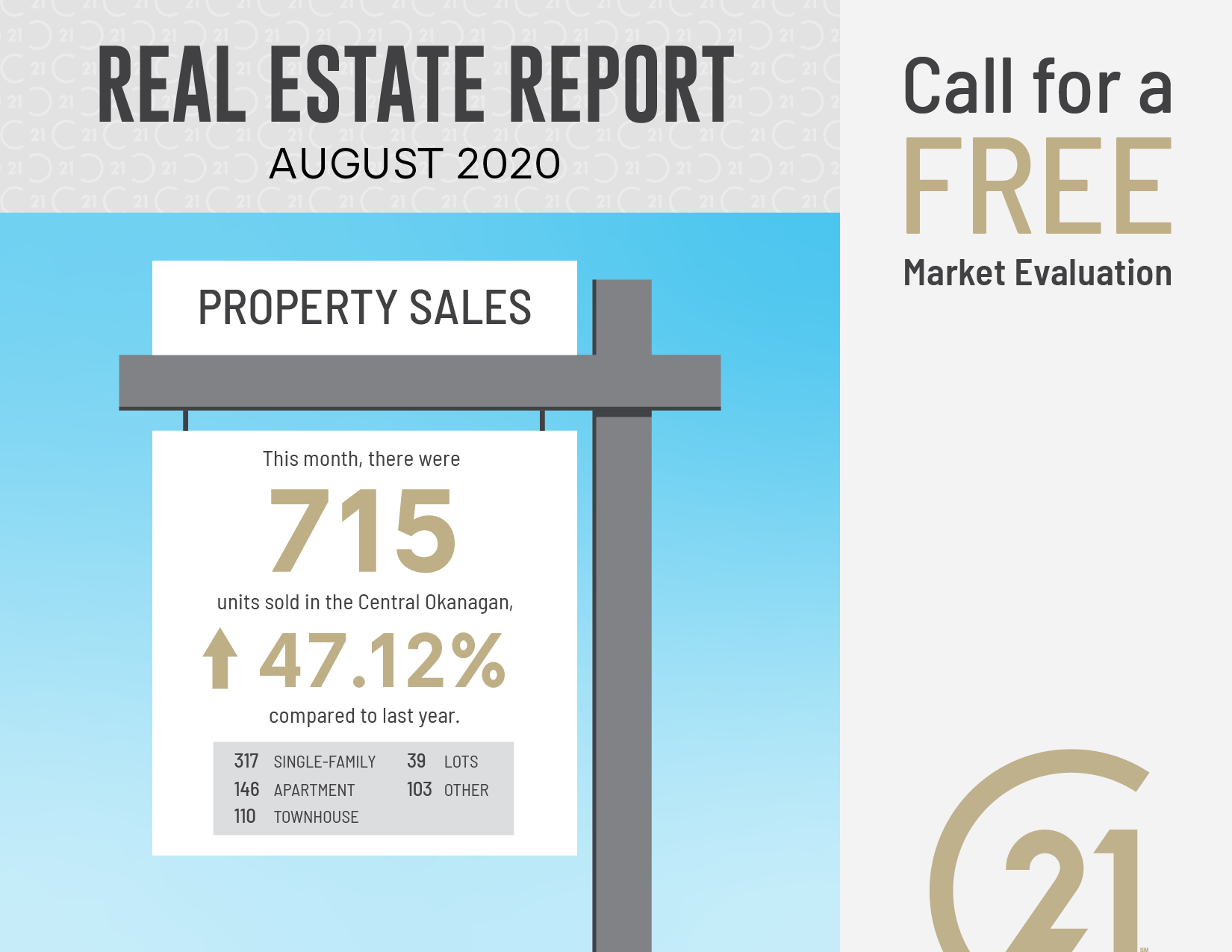

Rom’s Real Estate Opinion & Stats August 2020

Kelowna Real Estate Report August 2020

Rom’s Monthly Real Estate Opinion

What a whirlwind summer it has been for Okanagan Real Estate! The market continues at a record-breaking pace.

Looking at the stats for this month, remember that low inventory is the sign of a robust real estate market, not the opposite! Some of the stats we look at have never been this robust and some we would have to go back years to find a comparable level.

There is a lot of speculation from realtors, investors, buyers and sellers as to what is going to happen in the near future. Most people think that when the government subsidies go away, the real estate market is going to soften or collapse. However, a market never responds to one force.

Multiple positive forces also pushing on the marketplace in the Okanagan! We have dramatically increased migration from Alberta and the Lower Mainland, there are some of the lowest interest rates in history, very low inventory (which pushes up price!), and the back-log demand created from the drop in sales from COVID-19 in April/May.

Stats to consider

Each year the market softens in the fall, so some may anticipate the market turning down. However, when we compare August 2020 to August 2019 stats, it tells a positive, robust story. Residential sales for August decreased slightly to 1,034 compared to July’s 1,094 total units sold across the region yet remained up compared to this time last year by 43%, reports the Okanagan Mainline Real Estate Board (OMREB).

I believe that we are in a fairly robust market for a while to come still. The one change we cannot predict, is if COVID-19 cases were to dramatically increase that shuts our market down again. However, I don’t think this is going to happen again.

As always. please remember this is just the Real Estate World according to Rom. Get out there and enjoy the beautiful Okanagan Fall season! -

Rom’s Real Estate Opinion & Stats June 2020

Kelowna Real Estate Report June 2020

Rom’s Monthly Real Estate Opinion

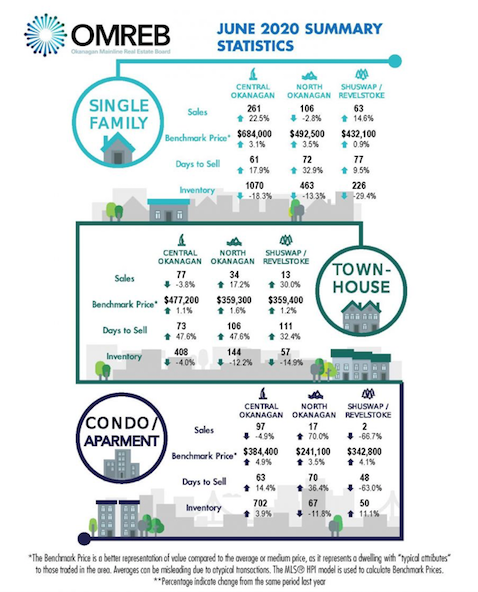

Below you will find the ‘benchmark’ prices for properties. This provides us with a much better idea of the current market rather than using ‘average’ or ‘median’ prices. ALL property prices (Condo’s, Townhomes and Single Family), went UP compared to June 2019.Despite the Pandemic, the real estate market is active and properties are selling. Moreover, the market has bounced back to an astounding level. It is right back to where we thought it would get to before COVID-19 hit. There is no algorithm for the effects of COVID-19 on the Okanagan Real Estate market. World renowned economists really don’t have any idea either.In Kelowna, the absorption rate for June was 24.39%. This means that 24.39% of all residential inventory in the Central Okanagan sold in June! It hasn’t been that high since April 2018. There were 261 residential sales in June in the Central Okanagan. That is the highest number of sales since July 2017.So, what is going on?

How can the market be flourishing when unemployment has shot up and the GDP has shot down? There are 2 factors creating this.First, banks and governments have stepped up hugely. The pandemic did take eligible buyers out of the market. However, every time the interest rates dropped another fraction of a percentage point, multiple new buyers were now able to buy. Remember, the market is driven by the buyers. There was also a backlog of buyers who were ready to purchase but were waiting out the Pandemic. Since we entered phase 3 here in BC, consumer confidence returned and therefore real estate activity spiked.Second, the market and the economy are not doing well in Alberta. Edmonton seems to be doing slightly better than Calgary but they are both hurting because of COVID-19 effects and the bust of the petro-chemical industry. This is driving some to pull that retirement trigger earlier than previously planned and move to the Okanagan.Please remember this is just the world according to Rom. -

Rom’s Real Estate Opinion April 2020 during COVID-19

The Real Estate Market During the COVID-19 Pandemic

There is no doubt that the COVID-19 pandemic has made a big impact in the lives of everyone around the world. The way we live our day to day lives has changed drastically; from how we get our groceries to being able to see our family and friends. The real estate market is no different. However, people still have the need to buy and sell homes, even during these challenging times.

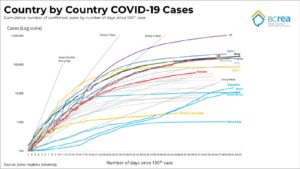

I want to start off by sharing a few visuals. Please click the images to englarge them. The first is Country by Country COVID-19 cases. I want to point out how well BC is doing on flattening the curve, even when comparing to the rest of Canada.

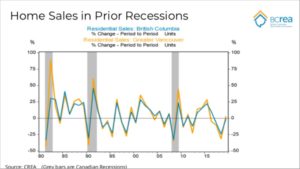

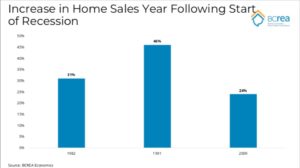

Next I want to share some graphics on home sales and home prices in past recessions. In April, single family homes were actually still up by 4% compared to April 2019. Factor in low rates that we likely wont see again, it is actually a great time to purchase a home.Jean-Francois Perrault, SVP & Chief Economist of Scotiabank stated the following, “We view the housing market to be on a COVID-related pause. Following a dramatic slowing in Canadian housing markets in 2020Q2, we anticipate a quick rebound in home sales and housing starts through 2021 if population growth remains strong, and the economy improves in the second half of the year”.April 2020 Okanagan Real Estate Report

In real estate, we track 5 stats that are the best indicators of what’s going on in the residential market. Those stats are sales, DOM (days on market to sell), inventory, absorption (% of inventory that sells each month), and prices.

Sales and absorption are the first stats to change. They are both down 50-60% compared to April 2019. This is normally the time the market would be ramping up for spring.

The stats also illustrate a significant factor that we discovered years ago about how a market goes through its changes. This is that the prices are always the last stat to change. April’s statistics show exactly this. Prices have essentially not changed.

If we look back to the recession of 2008, sales and absorption began to drop right in the first quarter. However, prices remained stable and/or continued to rise. We are seeing the same right now with house prices actually up 4%, yet condo prices are down 4%. I expect the prices of condos to lower further this year. House prices may lower as well but not as much as condos will.

Conclusion

Although the last stat to be typically affected by a recession/pandemic is the price, it may have a short term effect on lower house prices. Although, we haven’t see this happen yet.

We will soon come to know our new ‘normal’. Businesses will reopen, consumers will regain their confidence and the real estate market will rebound. This could be as early as this Fall.

However, I do believe that condo prices in the Kelowna area will continue to dip due to ample new construction.

As always, this is just the Real Estate World According to Rom.

-

Buying and Selling Real Estate During the Coronavirus Pandemic

Buying and Selling Homes during the Coronavirus Pandemic

Even during this difficult time, I want to let you know that my obligation to help you sell or buy a home is still in force.

The Government of British Columbia has released it’s list of Essential Services. Real Estate services have been listed as essential.

While following the guidelines set out by the government, I will continue to support my clients who are in the need to sell or purchase a home. Homes are still selling, albeit there is less activity.

So, how do you buy and sell real estate in the coronavirus era?

There are many factors to consider while trying to buy or sell while also maintaining social distancing. Open houses are unfortunately not advisable during this time.

Virtual tours offer an in depth look inside a home and its floorplan. Touring a home virtually allows clients to see if a home makes sense to them.

Another option available is if the home for sale is vacant. In fact, I have two vacant properties on the market currently (click the addresses listed below for more information on these listings)!

205-1125 Bernard Ave, Kelowna, BC

While showing vacant properties, I ensure that inside is sanitized, touch nothing and maintain distance from clients as they walk through.

Upon making or accepting an offer, handshakes may not be feasible but teleconferencing and e-signing programs allow things to flow digitally.

Realtors have checklists for buyers and sellers to ensure that properties are able to be viewed safely. If you have any questions, please feel free to contact me to discuss further.

Stay safe and healthy – Rom.