Kelowna Real Estate Opinion for Jan 2020

We are well into the swing of things for 2020. I hope you are continuing on with any resolutions and visions you set for yourself for 2020! It’s never too late to get back on track. For this months opinion, I will start off with a couple of real estate definitions:

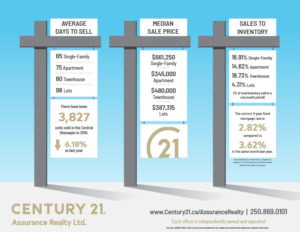

- Market Correction: A downward trend with prices, absorption and sales reducing, and inventory and DOM (days on market to sell) increasing

- Market Recovery: An upward trend with prices, absorption and sales increasing, and inventory and DOM (days on market to sell) decreasing

One of the important differences when comparing the Real Estate Market to the Stock Market is that the Stock Market is global and the Real Estate Market is local. The old phrase, “location, location, location” is not only important in real estate. It causes a lot of misunderstandings with ‘experts’ who try to predict the Real Estate Market (including a lot of realtors). The press will grab onto anything that looks radical in the market. Then they report without a lot of reference to the relevance of the information or the differences in the various locations. The problem is that the public gobbles up whatever the press feeds them. This problem is relevant in the Real Estate statistics in the Okanagan right now.

Current Okanagan Situation

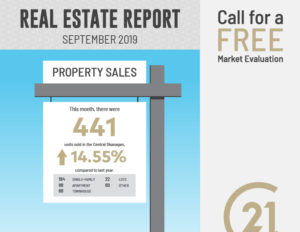

Currently, when we look at the statistics, the Okanagan is in recovery mode. Around the third quarter of 2019, it started to shift from a slight correction to a slight recovery. Here in the Central Okanagan, there was a bit of a lag for the last couple of years. We have a larger economy than some surrounding markets. Therefore, it was building up rebound pressure. We are now seeing a positive market bounce back! It will be interesting to watch as we proceed through 2020 if this trend continues. I expect big markets like Vancouver and Toronto will continue to recover. This means for the Okanagan that we will be in a very gradual recovery trend for the next couple years.

As always, this is just the Real Estate World according to Rom.