Okanagan Market Prediction

Cruising along

The market is cruising along as we expected it would once the interest rates levelled off.

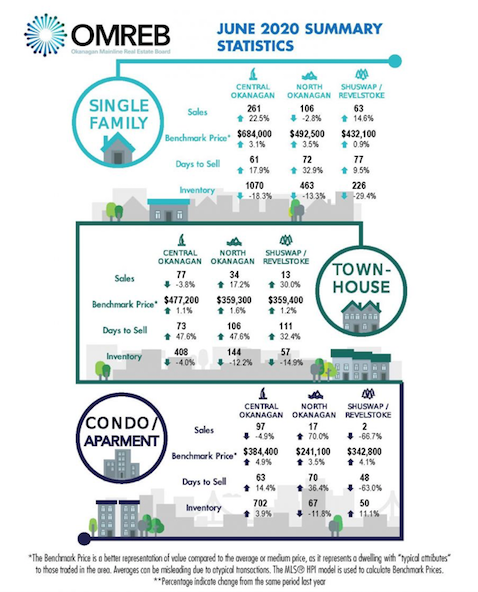

Absorption is rising and is now above 20%. Prices are starting to inch up as well. Sales activity is still lower than normal when you compare April 2023 to April 2022. The reason for this is a lack of inventory.

Fun Fact

Here’s a fun fact… Of the G7 countries (Canada, France, Germany, Italy, Japan, England and the United States), Canada has the lowest housing per 1,000 people. France is in first place.

In order for Canada to catch up to France, we would have to build 3.5 million more homes on top of the 2.3 million homes expected to be built by 2030. On top of that, Canada has now increased its annual immigration goal to 500,000 per year.

What all this tells us is that the inventory problem is not going away any time soon and is going to get worse before it gets better. The result of that is continued upward pressure on prices; the very thing the government is trying to avoid.

Rest of 2023

Prices will rise slightly for the rest of 2023. Interest rates look like they are going to remain steady for a while which will gradually increase buyer demand further.

It’s a great time to buy Real Estate in the Okanagan! However, you always have to remember, that’s just the world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.