Okanagan Real Estate Review

Welcome to the Real Estate Review for the interior of British Columbia for July of 2024.

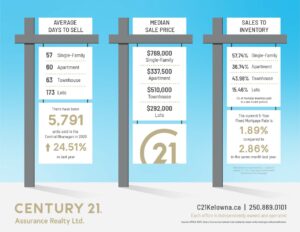

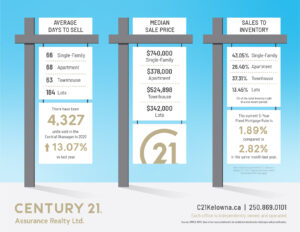

The market in the interior of British Columbia is maintaining a healthy balanced trajectory. The absorption is well within that 12 to 20% range, indicating that we have a level balanced market between supply and demand.

Inventory is rising throughout the province and in fact throughout the country giving buyers more to look at and forcing sellers to be more competitive in their pricing. . This is a result of houses coming on the market because of some of the political changes throughout the province and the country combined with a decrease in demand compared to the last few years.

Interest Rates

The Bank of Canada reduced its rate by 25 basis points to 4.75% in the beginning of June. The bank has also said they will continue to inch the rates down as long as inflation stays in check. At last check inflation was 2.9% which is just .9% above the bank’s target rate of 2%. This brings some uncertainty about further rate decreases in the short term.

A balanced market is a healthy Market. A boom or a bust creates volatility and is not good for either buyers or sellers. We will see this trend continue throughout the rest of 2024 and likely see the beginnings of a rise in 2025.

As always, this is just the real estate world according to Rom. Contact me today for all of your real estate needs!