Okanagan Market Prediction

Okanagan Real Estate Market

I hope you are having a fantastic summer and staying cool in this heat!

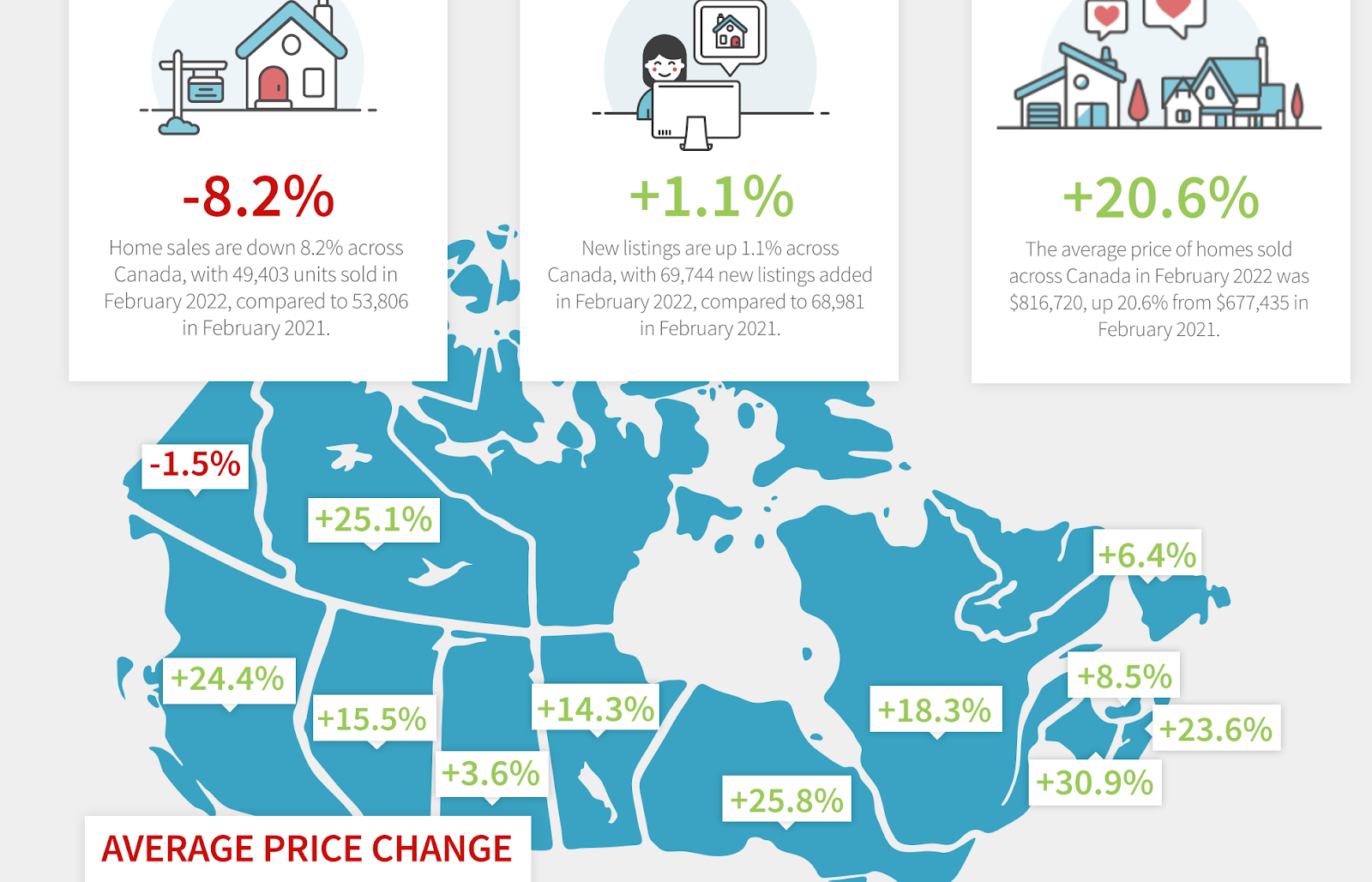

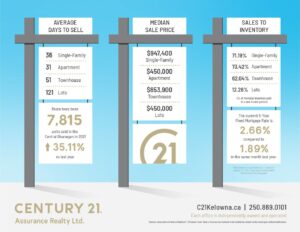

The real estate market in the Kelowna area is remaining strong and steady. Average absorption is rising and in some areas of the Okanagan, has passed the 30% mark.

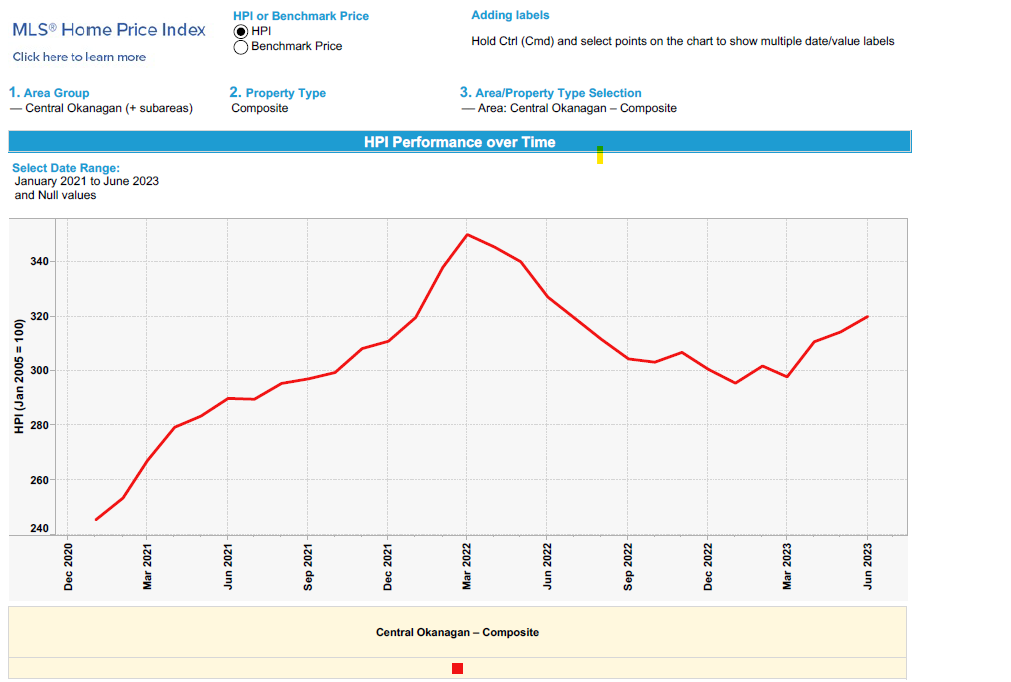

That tells us that the market will remain strong throughout at least the rest of this year unless the government decides to put up interest rates aggressively. Sales have caught up from the downturn starting in the second quarter of 2022 and extending to the first quarter of 2023. We have now surpassed the sales numbers of last year month over month.

Home Price Index

Hot topic: Interest Rates

On July 12, 2023, the Bank of Canada hiked another 0.25%, bringing the rate that sets all rates to 5.0% and bank prime rates to 7.20%. We haven’t seen the policy rate start with the number 5 since 2001.

For variable-rate mortgages, monthly payments will go up by about $15 for every $100K of mortgage balance. Stay tuned for the next rate decision on September 6.

As always, this is just the real estate world according to Rom. I hope you are having an amazing summer!

Please remember, I am NEVER too busy for any of your referrals!

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.

November is following in the tracks that we expected it to. The first quarter of 2022 saw a huge price increase. The second quarter saw a 10 to 15% price drop.