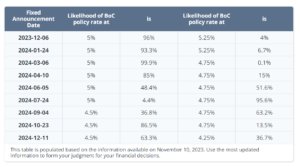

SEASONS GREETINGS!It is a wonderful time to reflect on this year and I am feeling grateful and blessed for the support I receive from you, my clients and friends. I hope to continue being able to support you with all of your real estate needs. In October I mentioned that the Real Estate market in the Interior of BC was showing the beginning signs of levelling off. That levelling has continued into November which gives us one more month towards any kind of certainty that this correction is over. The Bank of Canada has maintained its overnight lending at 5% for the 4th consecutive time. The main reason for this is the inflation rate has come down to 3.12%. That is in contrast to 3.8% last month and 6.9% last year at this time. Therefore, it is getting close to their target rate of 2%. As far as corrections go, this was a pretty mild one. In 2008 the correction lasted 4 years. Here’s an interesting point: people talk of prices going down. Even in a correction, prices rarely go down substantially. When the year ends, prices in 2023 will have been stabilized and we didn’t see much of a decline at the end. I expect in 2024, a rise in house prices around 5-6%. In 2024 I expect the Bank of Canada rate to go down by 1-1.5%. |

| Looking forward to a happy and positive 2024 for all, and as always, this is just the real estate world according to Rom. Wishing you, your family and friends a fun and relaxing Christmas and holiday break! |

Tag: downtown Kelowna

-

Rom’s September 2023 Market Review for the interior of BC

There are three terminologies that I personally use to describe what is going on in the real estate market in the Interior of British Columbia. They are: “a leveling off”, “a recovery”, and “a correction”. In the last two years we’ve gone from a recovering real estate market (Rising) to a leveling off and we are now in a correcting market. The characteristics of a correcting market are; reducing absorption (less properties sold in a said period of time), reducing sales, reducing prices with rising inventory, and rising days on the market to sell. That is exactly what we are experiencing right now. These five activities are happening all over British Columbia and likely throughout the rest of Canada or at least in most locations in Canada to various different degrees. The reason is that the major driving force pushing the market down is rising interest rates. Interest rates are governed federally.My prediction in the market going forward is that we will likely have 9 or 10 months of a correcting market. In the third and fourth quarters of 2024 the correcting market will likely start to level off. This will be spurred by the Bank of Canada starting to inch the interest rates down as inflation gets more under control. The correction will not be a dramatic drop in prices. We will likely see a moderate drop in prices. Perhaps a further 10%. The reasoning behind this assumption is that immigration is maintaining a relatively high demand and low inventory is maintaining a relatively low supply. This is why we have not seen a huge drop in prices so far.There are quite a few assumptions built into my prediction that may or may not come true. For instance, if the Bank of Canada continues to raise interest rates the correction will pick up speed and will last for an extended period of time. I see this ending in the last two quarters of 2024.We have had quite a few years of robust markets. British Columbia has the highest Real Estate prices of any province or State in North America. We recently passed Hawaii.Some of you may disagree with me or even dislike me for saying it but,”We needed a correction”.As always, this is just the real estate world according to Rom. I hope you are having an amazing Fall!

-

Rom’s June 2023 Real Estate Market Opinion

Okanagan Market Prediction

Okanagan Real Estate Market

I hope you are having a fantastic summer and staying cool in this heat!

The real estate market in the Kelowna area is remaining strong and steady. Average absorption is rising and in some areas of the Okanagan, has passed the 30% mark.

That tells us that the market will remain strong throughout at least the rest of this year unless the government decides to put up interest rates aggressively. Sales have caught up from the downturn starting in the second quarter of 2022 and extending to the first quarter of 2023. We have now surpassed the sales numbers of last year month over month.

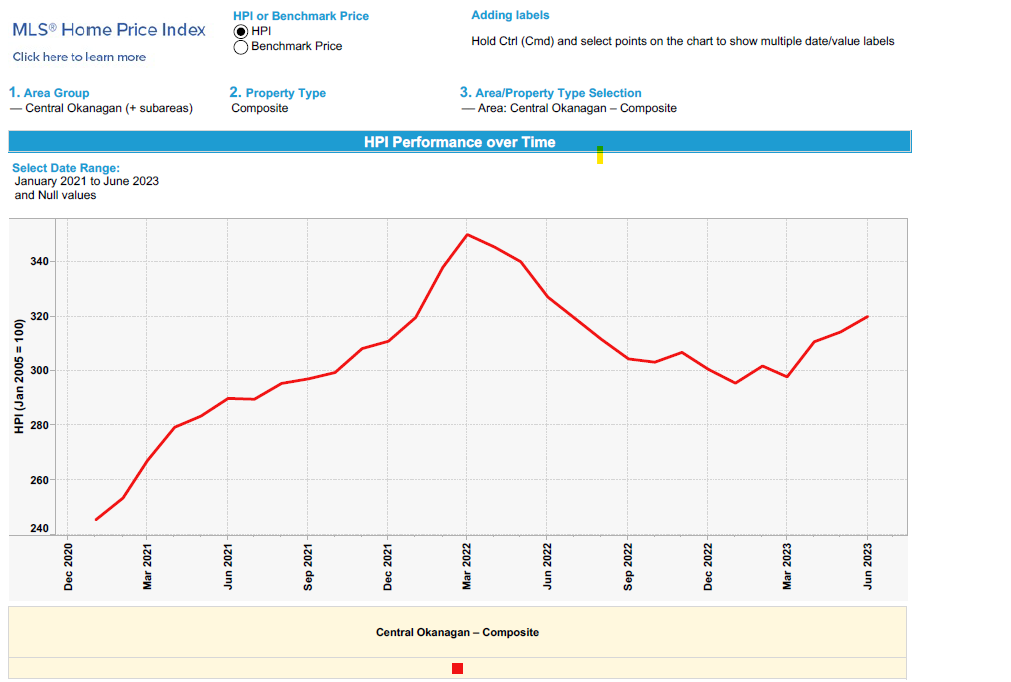

Home Price Index

Hot topic: Interest Rates

On July 12, 2023, the Bank of Canada hiked another 0.25%, bringing the rate that sets all rates to 5.0% and bank prime rates to 7.20%. We haven’t seen the policy rate start with the number 5 since 2001.

For variable-rate mortgages, monthly payments will go up by about $15 for every $100K of mortgage balance. Stay tuned for the next rate decision on September 6.

As always, this is just the real estate world according to Rom. I hope you are having an amazing summer!

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s May 2023 Real Estate Market Opinion

Okanagan Market Prediction

Market on the Rise

When interest rates stopped rising and leveled-off, we changed our predictions to a slow gradual increase over the balance of this year. That was contradictory to a lot of opinions that were more negative. It appears we may have been a bit light in our optimism.

The market is actually heating up at a more robust pace than we anticipated. Absorption is up well over the 20% mark. Prices are continuing to rise. Even though the inventory remains a problem and demand is far exceeding supply, sales are rising compared to last year at this time.

People are figuring out how to cope with and deal with the highest prices in Canada because people want to move to paradise.

Interest Rates

However, the Bank of Canada pushed up the overnight interest rate on June 7 by 1/4 of a point for the first time since the end of last year. In my opinion their reasoning is obvious. Inflation was steadily marching down from a peak of 8.1 % in June of 2022 to 4.3% in April of 2023. Then it jumped to 4.4% in May. The target rate is 2%.

House prices across the country have started to increase and although that is good for homeowners it is not good for home buyers. The bank will continue to raise interest rates until it sees inflation resume its downward direction.

However, you always have to remember, this is just the real estate world according to Rom. Have an awesome month and enjoy the upcoming summer.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s April 2023 Real Estate Opinion

Okanagan Market Prediction

Cruising along

The market is cruising along as we expected it would once the interest rates levelled off.

Absorption is rising and is now above 20%. Prices are starting to inch up as well. Sales activity is still lower than normal when you compare April 2023 to April 2022. The reason for this is a lack of inventory.

Fun Fact

Here’s a fun fact… Of the G7 countries (Canada, France, Germany, Italy, Japan, England and the United States), Canada has the lowest housing per 1,000 people. France is in first place.

In order for Canada to catch up to France, we would have to build 3.5 million more homes on top of the 2.3 million homes expected to be built by 2030. On top of that, Canada has now increased its annual immigration goal to 500,000 per year.

What all this tells us is that the inventory problem is not going away any time soon and is going to get worse before it gets better. The result of that is continued upward pressure on prices; the very thing the government is trying to avoid.

Rest of 2023

Prices will rise slightly for the rest of 2023. Interest rates look like they are going to remain steady for a while which will gradually increase buyer demand further.

It’s a great time to buy Real Estate in the Okanagan! However, you always have to remember, that’s just the world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s Feb 2023 Real Estate Opinion

Okanagan Market Prediction

Light at the end of the tunnel

As we predicted last month, we see some fairly positive light at the end of the tunnel in the real estate market in the interior of British Columbia. This light is coming from 2 directions.

Generally, the spring market in real estate starts when the weather breaks. The weather started to break in the last week of February. Open houses are getting busier with more and more people out looking at houses.

Secondly, the Bank of Canada decided to hold interest rates steady. This is the first time the overnight lending rate has not risen since February of 2022. Most of the consumer interest rates are based on the overnight lending rate.

Record high inflation is beginning to come down with Real Estate prices leading the way. Fuel and grocery prices are expected to inch down in 2023 as well.

Sales are up!

Real Estate sales in the Okanagan in February, although down from February of 2022, have increased substantially from January of 2023. The absorption figures, which is the best statistic to use when trying to predict the future of the local markets, has increased moderately in all three zones as well.

Not so fast…

I cannot say at this point that the downward trend is over. The market always rises in the spring. However, I can say that combined with the interest rates, the spring market seems to be opening up fairly early and we should have a fairly active spring market in the Okanagan.

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s Jan 2023 Real Estate Opinion

Okanagan Market Prediction

It’s a new year!

I hope your 2023 has started off on a positive note! The big real estate stories for January 2023 are the absorption rate and the number of sales.

Absorption Rate

The absorption rate is down for the Central Okanagan zone encompassing Kelowna and surrounding areas. It is down to 9.01%. This is 3% below the important limit of 12%. Traditionally below 12% we will see downward pressure on prices.

Number of Sales

The other important statistic to note is the number of sales. Sales are down approximately 50%. What this says is the demand has decreased dramatically. This decrease in demand for housing is a direct result of the rise in interest rates. As interest rates rise fewer and fewer and people can afford to buy a house.

There is a silver lining in this cloud

For the last few years sellers have been dictating to buyers what their house is going to sell for. Now buyers have a choice. The market has shifted to a more balanced market and in some places a buyer’s market. Sellers have had to get aggressive in their pricing in order to compete with other sellers. Sellers who refuse to accept that the price of their house has come down in the last few months, are sitting on the market with no offers. This trend is a good thing for buyers. They have more inventory to look at and can bargain more aggressively.

Interest Rates

On January 25th the Bank of Canada overnight lending rate was increased by 1/4 of a percentage point (25 Basis Points). This sent a message that the bank is softening its aggressive attack on inflation. The next interest rate announcement is on March 8th. I believe we will see a similar 25 basis point increase. The bank desperately wants to slow the economy and bring down the inflation rate. However, if they keep an aggressive direction, it will increase mortgage defaults and foreclosures and that is not good for anyone.

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Should You Buy or Wait?

It is hard to believe January is already over. Is it my age, or is everyone feeling the time is going by faster?

As the market is slower everywhere it is important to reach out to Buyers. Buyers have the impression not to buy or do the wait and see approach… sitting on the fence.

Is this a good time to buy real estate? I often get this asked. The answer is Yes!

Rate-sensitive markets like real estate have fallen over 20% depending on the individual market due interest rates increases and inflation. But this is still an excellent opportunity for investors and new home buyers to take advantage of much lower real estate prices despite the current higher mortgage rates. It’s worth noting that despite much higher rates with lower purchase values, the monthly payments in many cases are very similar. Either you pay top dollars in a high market, 100,000+ more with a lower interest rate, or purchase a property much lower, with higher interest rates.

Example:

Taking the average Canadian sold price, a buyer today would save almost $160,000 on the down payment despite having a higher monthly payment of $257.

With a short-term rate strategy, this buyer can lock in a 1-2 year fixed rate to ride out the current rate cycle and then be in a position to renew/refinance at future lower rates.Whereas waiting until rates come down, we could see real estate values return to growth, which would mean higher down payment requirements and more competition.

-

Rom’s Dec 2022 Real Estate Opinion

Okanagan Market Prediction

The Year 2022

2022 was a whirlwind of a year. In the first quarter of 2022 our prices rose, our absorption was through the roof and sales were record highs.

After that it’s been mostly downhill. By the second quarter of 2022, prices dropped an average of 10 to 15%. Then they levelled off. Prices have remained relatively constant since the end of the second quarter.

December

Absorption dropped dramatically in December. However, if you look back historically December absorption generally has a fairly dramatic drop from November. This is simply because half of the month is spent around vacation, holidays and family.

What’s ahead in 2023?

It will be interesting to see what happens in the first quarter of 2023. I believe there will be some downward pressure on prices in 2023. This will be caused by a continued increase in the interest rate.

The next announcement for the Bank of Canada is on January 25th. My guess is that it will either be raised 1/4 or 1/2 of a percentage point. These two possibilities will have very different results to the buying consumers across Canada.

A quarter of a percentage point will show that the Bank of Canada is softening their approach on interest rates. A half of a percentage point will show the consumers in Canada that they are definitely not finished yet. If interest rates go up another half a point at the end of January we will see continued softening in sales and prices.

“After a very strong first half of 2022, we began to see market activity moderate amid consistently rising interest rates imposed by the Bank of Canada,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “although inventory levels remain tight, the high interest rates will continue to subdue market activity in the coming months.”

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!