Okanagan Market Prediction

Whether the market direction is changing from down to up or up to down, trying to predict the immediate future of the market is like trying to hang glide with a frisbee. There is just not enough new data yet.

Going Up

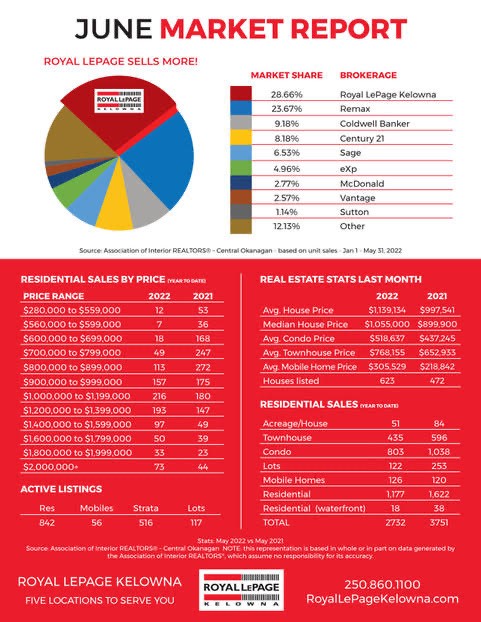

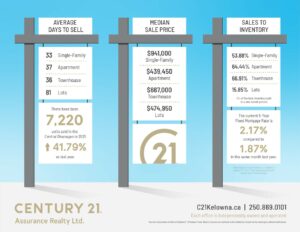

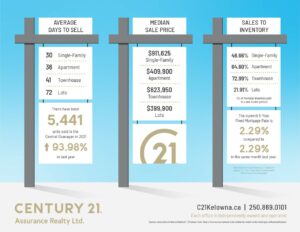

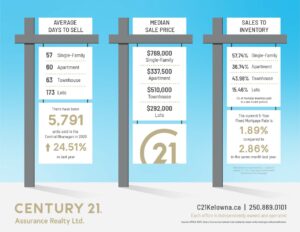

The absorption in the Central Okanagan went from 11% in July to 15 % in August. Sales are up as well. As I mentioned last month the statistics in the market look much worse because of how they compare to the first quarter of 2022.

There are lots of periods in the last 25 years where low double digit absorption or in some cases even single digit absorption was the norm. Prices as well have come down since the first quarter of 2022 and seem to be leveling off a bit.

Interest Rates

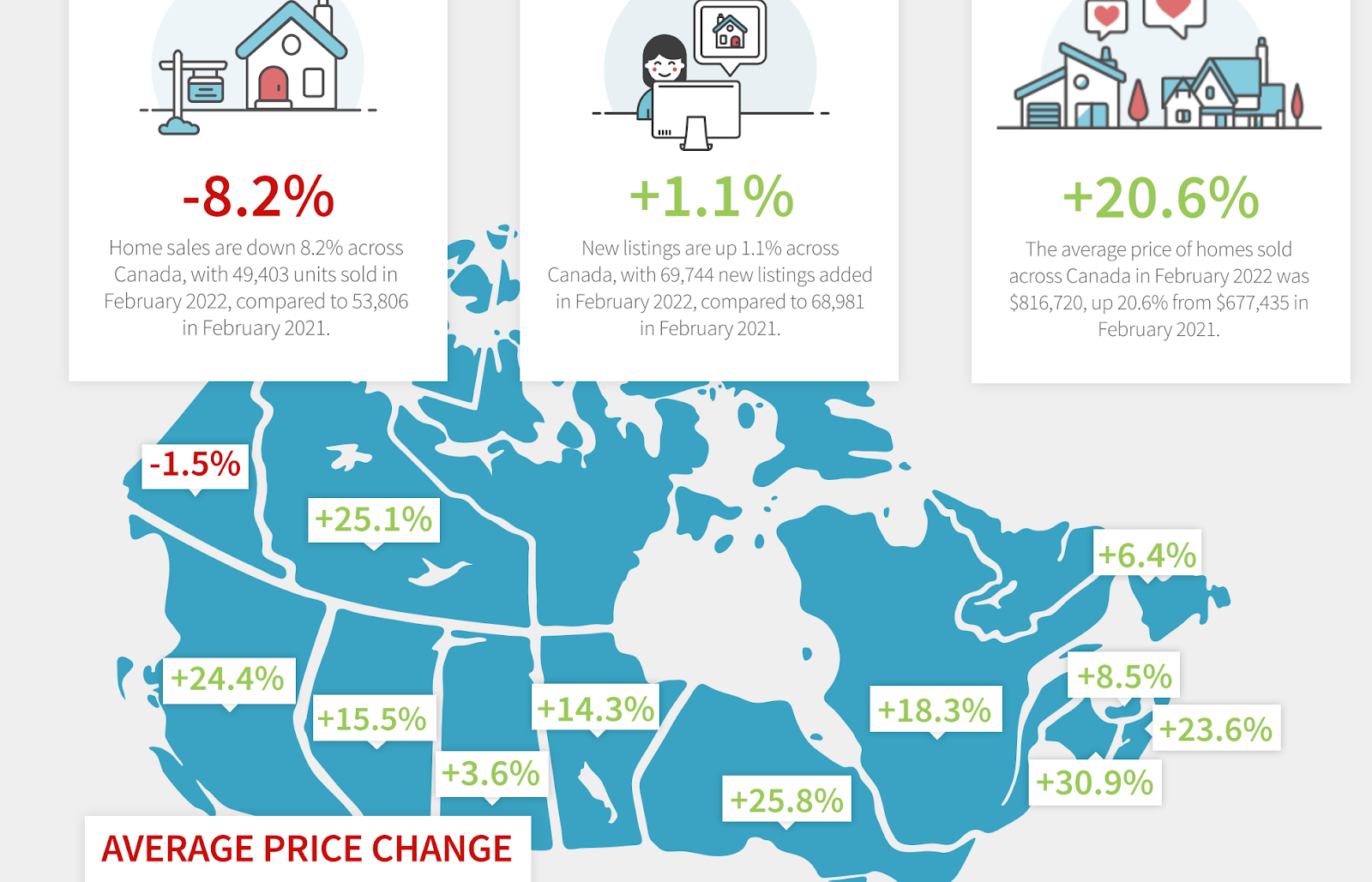

On September 7th the Bank of Canada raised the overnight lending rate by .75%. That sends us a message that they are not finished with their interest rate increases to reduce inflation. The mortgage rates are already following. With each increase a small sliver of the population can no longer buy at all or can no longer buy the type of house they want to buy.

I hate to sound like a broken record but if they continue to push those interest rates up the downward pressure on prices and sales will continue proportionally. I believe that we will actually see a bit of an increase in absorption and sales activity when we do the statistics for September. Kids are back in school, parents have a little more time to house shop and traditionally we see a little bump in early fall.

As always, this is just the real estate world according to Rom. If you have any real estate questions give me a call or send me an email at any time.

Please remember, I am NEVER too busy for any of your referrals!