As always, this is just the real estate world according to Rom. I hope you are having an amazing Fall!

Tag: bc immigration

-

Rom’s September 2023 Market Review for the interior of BC

There are three terminologies that I personally use to describe what is going on in the real estate market in the Interior of British Columbia. They are: “a leveling off”, “a recovery”, and “a correction”. In the last two years we’ve gone from a recovering real estate market (Rising) to a leveling off and we are now in a correcting market. The characteristics of a correcting market are; reducing absorption (less properties sold in a said period of time), reducing sales, reducing prices with rising inventory, and rising days on the market to sell. That is exactly what we are experiencing right now. These five activities are happening all over British Columbia and likely throughout the rest of Canada or at least in most locations in Canada to various different degrees. The reason is that the major driving force pushing the market down is rising interest rates. Interest rates are governed federally.My prediction in the market going forward is that we will likely have 9 or 10 months of a correcting market. In the third and fourth quarters of 2024 the correcting market will likely start to level off. This will be spurred by the Bank of Canada starting to inch the interest rates down as inflation gets more under control. The correction will not be a dramatic drop in prices. We will likely see a moderate drop in prices. Perhaps a further 10%. The reasoning behind this assumption is that immigration is maintaining a relatively high demand and low inventory is maintaining a relatively low supply. This is why we have not seen a huge drop in prices so far.There are quite a few assumptions built into my prediction that may or may not come true. For instance, if the Bank of Canada continues to raise interest rates the correction will pick up speed and will last for an extended period of time. I see this ending in the last two quarters of 2024.We have had quite a few years of robust markets. British Columbia has the highest Real Estate prices of any province or State in North America. We recently passed Hawaii.Some of you may disagree with me or even dislike me for saying it but,”We needed a correction”. -

Rom’s June 2023 Real Estate Market Opinion

Okanagan Market Prediction

Okanagan Real Estate Market

I hope you are having a fantastic summer and staying cool in this heat!

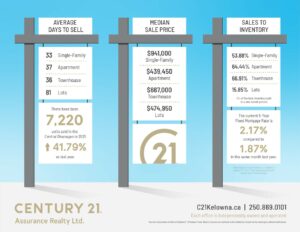

The real estate market in the Kelowna area is remaining strong and steady. Average absorption is rising and in some areas of the Okanagan, has passed the 30% mark.

That tells us that the market will remain strong throughout at least the rest of this year unless the government decides to put up interest rates aggressively. Sales have caught up from the downturn starting in the second quarter of 2022 and extending to the first quarter of 2023. We have now surpassed the sales numbers of last year month over month.

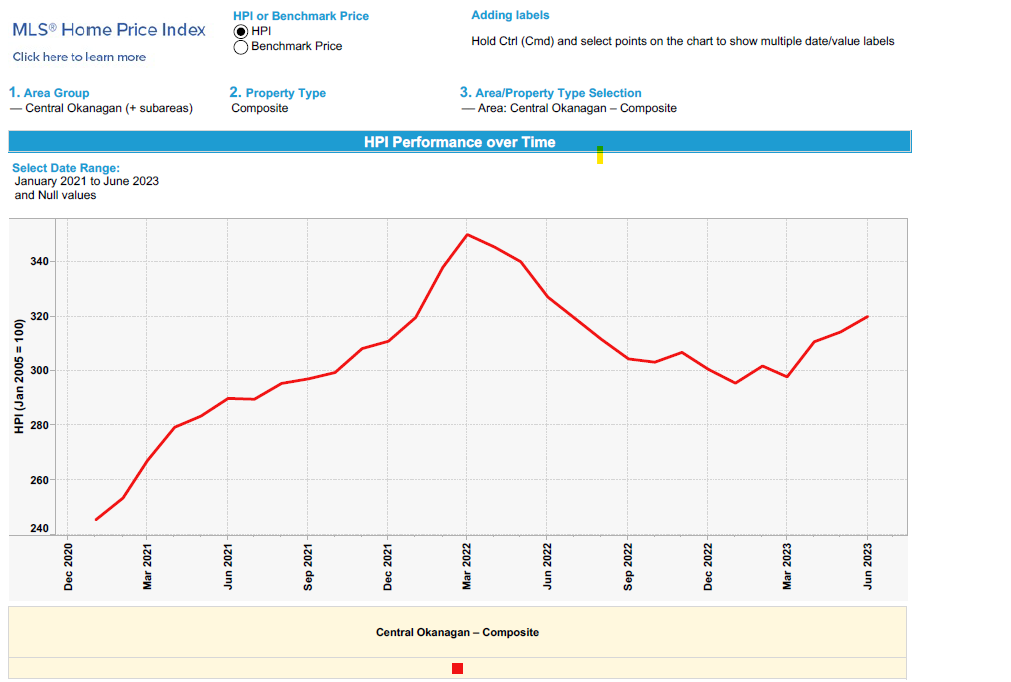

Home Price Index

Hot topic: Interest Rates

On July 12, 2023, the Bank of Canada hiked another 0.25%, bringing the rate that sets all rates to 5.0% and bank prime rates to 7.20%. We haven’t seen the policy rate start with the number 5 since 2001.

For variable-rate mortgages, monthly payments will go up by about $15 for every $100K of mortgage balance. Stay tuned for the next rate decision on September 6.

As always, this is just the real estate world according to Rom. I hope you are having an amazing summer!

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s April 2023 Real Estate Opinion

Okanagan Market Prediction

Cruising along

The market is cruising along as we expected it would once the interest rates levelled off.

Absorption is rising and is now above 20%. Prices are starting to inch up as well. Sales activity is still lower than normal when you compare April 2023 to April 2022. The reason for this is a lack of inventory.

Fun Fact

Here’s a fun fact… Of the G7 countries (Canada, France, Germany, Italy, Japan, England and the United States), Canada has the lowest housing per 1,000 people. France is in first place.

In order for Canada to catch up to France, we would have to build 3.5 million more homes on top of the 2.3 million homes expected to be built by 2030. On top of that, Canada has now increased its annual immigration goal to 500,000 per year.

What all this tells us is that the inventory problem is not going away any time soon and is going to get worse before it gets better. The result of that is continued upward pressure on prices; the very thing the government is trying to avoid.

Rest of 2023

Prices will rise slightly for the rest of 2023. Interest rates look like they are going to remain steady for a while which will gradually increase buyer demand further.

It’s a great time to buy Real Estate in the Okanagan! However, you always have to remember, that’s just the world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s Jan 2023 Real Estate Opinion

Okanagan Market Prediction

It’s a new year!

I hope your 2023 has started off on a positive note! The big real estate stories for January 2023 are the absorption rate and the number of sales.

Absorption Rate

The absorption rate is down for the Central Okanagan zone encompassing Kelowna and surrounding areas. It is down to 9.01%. This is 3% below the important limit of 12%. Traditionally below 12% we will see downward pressure on prices.

Number of Sales

The other important statistic to note is the number of sales. Sales are down approximately 50%. What this says is the demand has decreased dramatically. This decrease in demand for housing is a direct result of the rise in interest rates. As interest rates rise fewer and fewer and people can afford to buy a house.

There is a silver lining in this cloud

For the last few years sellers have been dictating to buyers what their house is going to sell for. Now buyers have a choice. The market has shifted to a more balanced market and in some places a buyer’s market. Sellers have had to get aggressive in their pricing in order to compete with other sellers. Sellers who refuse to accept that the price of their house has come down in the last few months, are sitting on the market with no offers. This trend is a good thing for buyers. They have more inventory to look at and can bargain more aggressively.

Interest Rates

On January 25th the Bank of Canada overnight lending rate was increased by 1/4 of a percentage point (25 Basis Points). This sent a message that the bank is softening its aggressive attack on inflation. The next interest rate announcement is on March 8th. I believe we will see a similar 25 basis point increase. The bank desperately wants to slow the economy and bring down the inflation rate. However, if they keep an aggressive direction, it will increase mortgage defaults and foreclosures and that is not good for anyone.

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s Dec 2022 Real Estate Opinion

Okanagan Market Prediction

The Year 2022

2022 was a whirlwind of a year. In the first quarter of 2022 our prices rose, our absorption was through the roof and sales were record highs.

After that it’s been mostly downhill. By the second quarter of 2022, prices dropped an average of 10 to 15%. Then they levelled off. Prices have remained relatively constant since the end of the second quarter.

December

Absorption dropped dramatically in December. However, if you look back historically December absorption generally has a fairly dramatic drop from November. This is simply because half of the month is spent around vacation, holidays and family.

What’s ahead in 2023?

It will be interesting to see what happens in the first quarter of 2023. I believe there will be some downward pressure on prices in 2023. This will be caused by a continued increase in the interest rate.

The next announcement for the Bank of Canada is on January 25th. My guess is that it will either be raised 1/4 or 1/2 of a percentage point. These two possibilities will have very different results to the buying consumers across Canada.

A quarter of a percentage point will show that the Bank of Canada is softening their approach on interest rates. A half of a percentage point will show the consumers in Canada that they are definitely not finished yet. If interest rates go up another half a point at the end of January we will see continued softening in sales and prices.

“After a very strong first half of 2022, we began to see market activity moderate amid consistently rising interest rates imposed by the Bank of Canada,” says the Association of Interior REALTORS® President Lyndi Cruickshank, adding that “although inventory levels remain tight, the high interest rates will continue to subdue market activity in the coming months.”

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!

-

Tax Fighter Guide for HomeOwners

Tax Fighter Guide for the Homeowner

Here is your guide to appealing your property assessment notice. Pay your fair share of property taxes and not a penny more! Click the TaxFighter link below:

TaxFighterPDF

-

Rom’s Sept 2022 Real Estate Opinion

Okanagan Market Prediction

The keyword for this month is stabilization. The absorption has stabilized, prices have stabilized and inventory has stabilized. There are some interesting things going on in this correction which is keeping this market stable and putting a fairly abrupt end to our correction, for now.

Unemployment

The most important one being that unemployment is at an all-time low. In most corrections unemployment rises. This country is seeing a new paradigm where businesses cannot get people to work. There are high paying jobs right across this country with no one to fill them.

However, we expect another aggressive interest rate hike, possibly 75 points and at least another 25 points? hike in November or December this year. This will likely put a damper on the stabilization in the upcoming months.

Conclusion

We have been getting so used to record low mortgage rate hikes and therefore it will take a while to get used to these higher rates. However, keep in mind that the average interest rate since 1990 is 5.79%. We are still about a half a point below that average.

As always, this is just the real estate world according to Rom. If you have any real estate questions give me a call or send me an email at any time.

NEW COMPLIMENTARY SERVICES FROM MOVESNAP

Enjoy an exceptional home moving experience with MoveSnap.

The complimentary digital platform and concierge service offers everything you need to conquer your moving tasks. From helping with organizing your to-dos and sourcing vetted pros to money-saving offers from big-name and local brands, MoveSnap lets you streamline and reduce the stress of moving.

Plus, the live concierge team expertly guides you through your move-related questions throughout your moving journey.

Please remember, I am NEVER too busy for any of your referrals!

-

Rom’s June 2022 Real Estate Opinion

What is happening to our house prices?

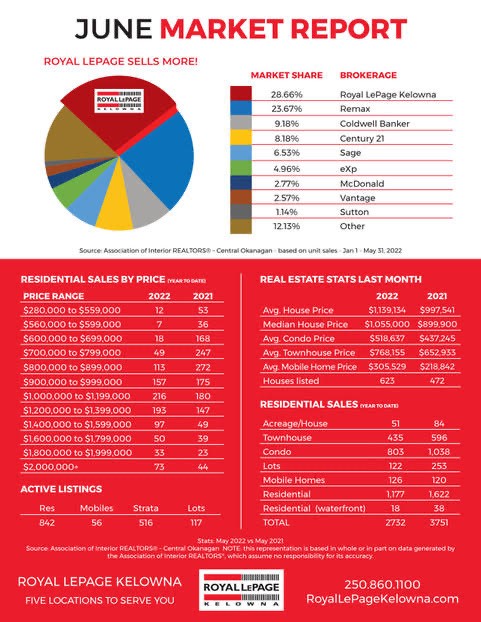

In the Central Okanagan stats show that the average price has dropped slightly in May 2022 compared to April 2022. BUT! A month does not make a market.

What it does mean is that the crazy frenzy of multiple offers (all over list price!) is over. If we see a continued, gradual increase in interest rates that will be a strong indication of things to come. Year to date our house prices are up 21%.

Interest Rates

On June 1st the government raised the overnight lending rate .5 percent (50 Basis points). That is the third rise since the new year. The talk is that they’re going to do the same thing on July 13th with the next overnight lending rate announcement.

Personally, I think they should wait to see what the true effect is on the rises they have done so far on our housing market and our economy.

My opinion is that the market will shift to a forecast of further declining prices (starting late May). We will likely see a gradual drop in the high end market but a more significant drop in the median market.

It’s still a Sellers Market

The absorption rate (the percentage of properties sold versus inventory at any time) for May 2022 in the Central Okanagan was 28.86%. It is still a seller’s market. The absorption rate will have to go below 20% to show a true shift to reducing prices and a balanced market between sellers and buyers.

I believe we will see a continued softening of the market as we go forward and as the government continues to raise interest rates.

As always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s April 2022 Real Estate Opinion

What’s happening in the Okanagan Real Estate Market?

The Federal Government has announced 2 ways they are considering to slow down the upward pressure on house prices.

Firstly, a proposed ban on foreign buyers purchasing houses across Canada for the next 2 years. However, the percentage of foreign buyers in Canada has dropped from 9% in 2015 to only 1 % in 2020. I therefore don’t think this will have any real effect on house prices.

The second proposal is to invest billions into new construction. That is really the only way to slow down the house price increases. The market is driven by supply and demand. We either have to increase the inventory or decrease the demand. The demand for housing in April is still strong in the Okanagan. The absorption rate for March 2022 in the North and Central Okanagan is still above 60%. That means in March 60% of all the houses on the market on the first of the month sold in March. Therefore increasing the inventory should work to slow down the market.

We haven’t yet seen the effect on the market of the rising interest rates and in turn the increasing mortgage rates. Although it is still a great time to sell your home (especially if you own a secondary home!!), the increasing mortgage rates will price more buyers out of the market. Increased mortgage rates and increasing inventory should help shift to a more balanced marketplace.

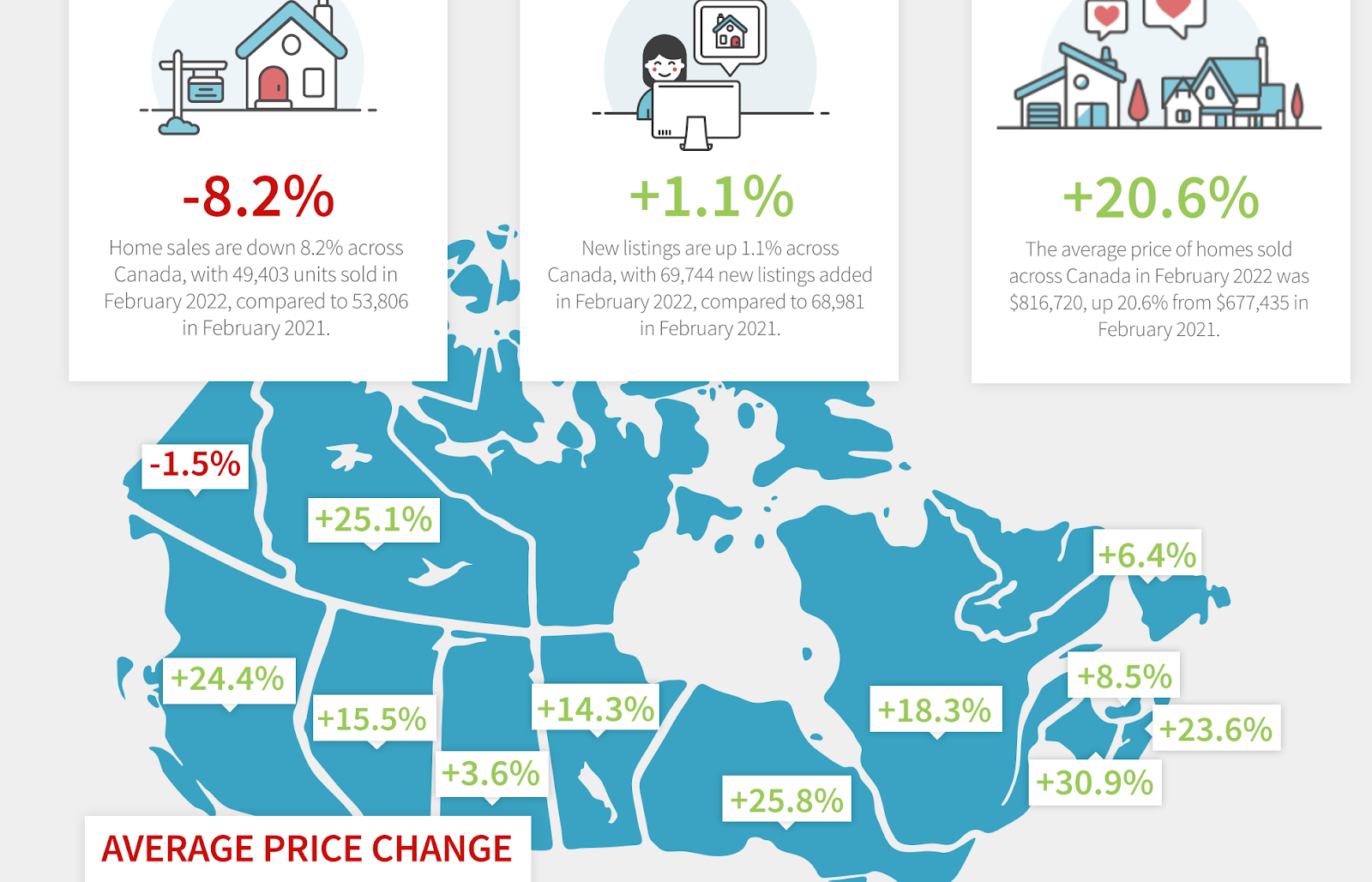

The graphic below shows that the market is similar across Canada. The only place in the entire country where prices dropped was the Yukon and it was only by 1.5%. BC is in the top 3 for price increases.

However, you always have to remember that this is just the Real Estate World according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.

-

Rom’s October Real Estate Stats & Opinion

Okanagan Real Estate Report October 2021

*click images to enlarge

Rom’s Real Estate Opinion

This month the overall message for our real estate market is positive, (with a little bit of caution). The market is cruising along just as we predicted. Perhaps a little better than we predicted.

Let’s talk Absorption

The absorption (percentage of total residential inventory that sells on a monthly basis) in the Central Okanagan is staying strong at slightly above 50%. Usually there is downward pressure on absorption this time of year as the market slows for the winter. If you look back on previous years the absorption tends to start dropping in September and continues until spring. That has not happened yet.

Again, to be redundant, the absorption has to get below 20% before the upward pressure on prices levels off. Statistically, absorption has to get below 12% before you see prices trending downward. Year to date prices for residential properties are up 20+% in the Central Okanagan compared to the same time frame last year. Keep in mind this is residential properties only.

The Commercial Side

The commercial/industrial market, although not as robust as the residential market, is also showing strong gains. Most of the excess inventory we saw 3 to 5 years ago has been eaten up and prices per acre of industrial land are rising. Commercial lease rates are also rising and demand for development land is increasing. We are seeing more and more developers coming to the interior as they realize the lack of inventory is like a carrot in front of the donkey they are riding on.

Interest Rates

Now, here is the caution I spoke of. The Bank of Canada has decided to ease off a program called “Quantitative Ease” (QE). I am not an economist nor would I propose to understand the intricacies of this but here is what I know so far. The QE program is designed to push inflation and avoid deflation. The Federal Government buys billions in bonds weekly; which somehow keeps interest rates down, pushing people to buy more “stuff”: cars, houses, etc.

As of October 27, the Feds have decided to diminish these purchases to slow down inflation. This will put upward pressure on interest rates. We have already seen borrowing rates rise slightly in the last few weeks. At this stage I am not sure what will happen to interest rates or the effect on our demand for Real Estate in the Okanagan. I don’t think you will see huge jumps in interest rates. It would shut down the economy. Rather they will “creep” them up.

It does not take a rocket scientist to figure out that as interest rates went down, more people qualified and were able to buy. So guess what? As interest rates go up, less and less people will qualify to buy.

In Conclusion

I doubt we are going to see anything but a continued minor slow down as we end the year and walk into 2022. However, as always, this is just the real estate world according to Rom.

If you would like to find out what your home is really worth in a market like this give me a call or text me at 250-317-6405 and I would be happy to evaluate your home. It can be done completely remotely if you prefer. It is totally free.