Okanagan Market Prediction

It’s a new year!

I hope your 2023 has started off on a positive note! The big real estate stories for January 2023 are the absorption rate and the number of sales.

Absorption Rate

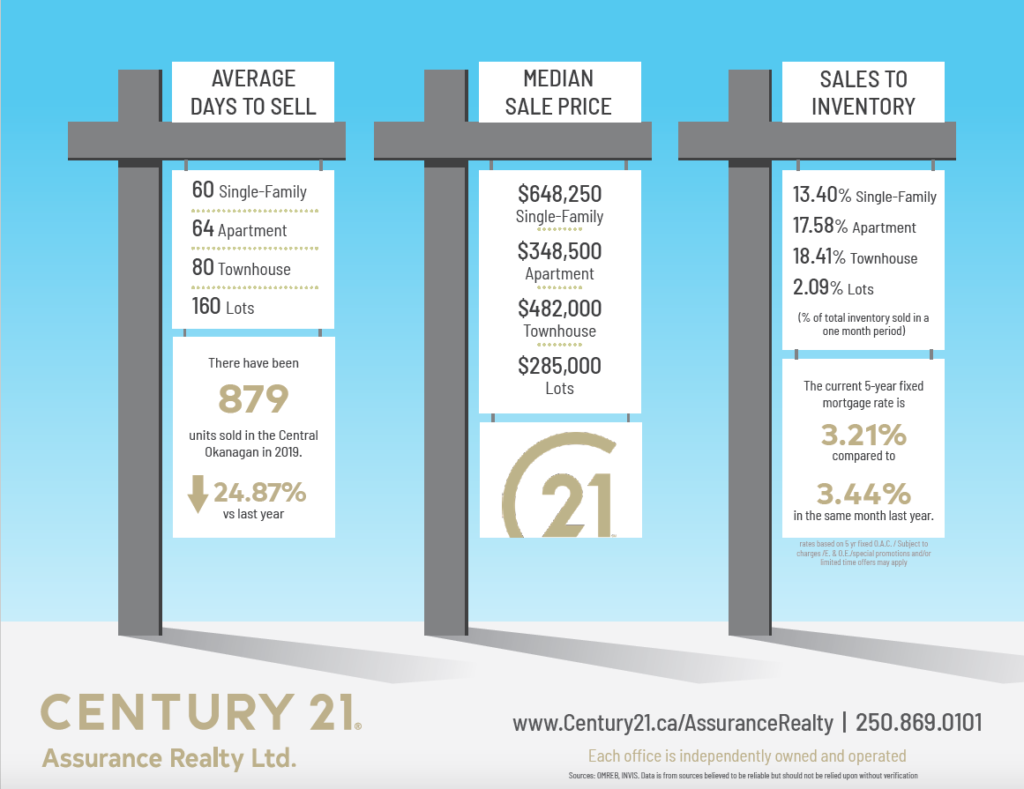

The absorption rate is down for the Central Okanagan zone encompassing Kelowna and surrounding areas. It is down to 9.01%. This is 3% below the important limit of 12%. Traditionally below 12% we will see downward pressure on prices.

Number of Sales

The other important statistic to note is the number of sales. Sales are down approximately 50%. What this says is the demand has decreased dramatically. This decrease in demand for housing is a direct result of the rise in interest rates. As interest rates rise fewer and fewer and people can afford to buy a house.

There is a silver lining in this cloud

For the last few years sellers have been dictating to buyers what their house is going to sell for. Now buyers have a choice. The market has shifted to a more balanced market and in some places a buyer’s market. Sellers have had to get aggressive in their pricing in order to compete with other sellers. Sellers who refuse to accept that the price of their house has come down in the last few months, are sitting on the market with no offers. This trend is a good thing for buyers. They have more inventory to look at and can bargain more aggressively.

Interest Rates

On January 25th the Bank of Canada overnight lending rate was increased by 1/4 of a percentage point (25 Basis Points). This sent a message that the bank is softening its aggressive attack on inflation. The next interest rate announcement is on March 8th. I believe we will see a similar 25 basis point increase. The bank desperately wants to slow the economy and bring down the inflation rate. However, if they keep an aggressive direction, it will increase mortgage defaults and foreclosures and that is not good for anyone.

However, you always have to remember, that is just the real estate world according to Rom.

Please remember, I am NEVER too busy for any of your referrals!