September 2019 Real Estate Report:

*Click the images to enlarge

Kelowna Real Estate Opinion for Sept 2019

Fall is here and with that brings the falling of leaves, cooler temperatures and a new season of the real estate world. Like I have stated in the last few months, the current market is flat. No exciting rises or bubble bursts and there will be none in the immediate future. Bubbles burst when the market has shot up like a rocket like 2004 to 2007. Markets rise dramatically when the market previously fell off a cliff like in 2009 to 2013. We have nothing like that going on. The market is good; not great, not terrible but good.

A new report shows disparity in home price trajectories across Canada, including some large decreases. The CENTURY 21 analysis of home prices reveals that some communities have seen some steep decreases in price per square foot in the past year, most notably in British Columbia. Brian Rushton, Executive Vice-President of CENTURY 21 Canada said, “It is not surprising to see Vancouver prices drop so much, but the drop is actually more significant in some Metro Vancouver suburbs like West Vancouver and secondary B.C. markets such as Vernon and Kelowna”.

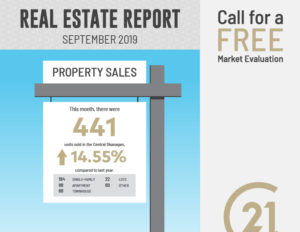

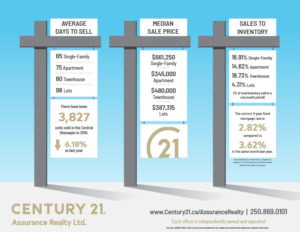

While the report is showing prices drop, sales activity is steady. The townhome market under $500,000 continues to be very active. The single family house market is all over the place. The market for homes over $1 million is very slow right now, with only 3 sold last month. Condo sales are still strong too but I suspect this market to stabilize within the next 2 years.

The only insight we can give you is that so far it looks like 2020 will be very similar. There may be a slight increase in the markets in 2020 caused by some of the positive lending changes; lower interest rates, lower qualifying stress test rates and the new first-time buyer incentive program. These programs and changes will allow a small percentage of the population the ability to buy when they could not before the program. Also, the five year bond yields and mortgage rates (yes, there is a correlation there), are back at or have broken levels compared to five years ago.

As always, this is the Real Estate World according to Rom.