SEASONS GREETINGS!It is a wonderful time to reflect on this year and I am feeling grateful and blessed for the support I receive from you, my clients and friends. I hope to continue being able to support you with all of your real estate needs. In October I mentioned that the Real Estate market in the Interior of BC was showing the beginning signs of levelling off. That levelling has continued into November which gives us one more month towards any kind of certainty that this correction is over. The Bank of Canada has maintained its overnight lending at 5% for the 4th consecutive time. The main reason for this is the inflation rate has come down to 3.12%. That is in contrast to 3.8% last month and 6.9% last year at this time. Therefore, it is getting close to their target rate of 2%. As far as corrections go, this was a pretty mild one. In 2008 the correction lasted 4 years. Here’s an interesting point: people talk of prices going down. Even in a correction, prices rarely go down substantially. When the year ends, prices in 2023 will have been stabilized and we didn’t see much of a decline at the end. I expect in 2024, a rise in house prices around 5-6%. In 2024 I expect the Bank of Canada rate to go down by 1-1.5%. |

| Looking forward to a happy and positive 2024 for all, and as always, this is just the real estate world according to Rom. Wishing you, your family and friends a fun and relaxing Christmas and holiday break! |

Category: Newsletter

-

Rom’s Real Estate Market Opinion – Dec 2023

-

The Real Estate Market According to Rom – November

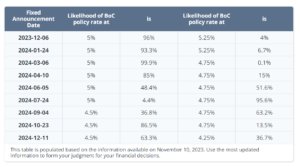

The real estate market in the interior of British Columbia is starting to show signs that things may be leveling off some. Below is a graph of the Bank of Canada overnight lending interest rate announcements since it was .25% in April of 2022. The last two interest rate announcements from the Bank of Canada have been holding steady at 5% for their overnight lending rate. Inflation dropped on October 17 from 4% to 3.8%. This is what the bank wants to see. The Canadian Real Estate, and Mortgage Market are watching this closely. It seems that the rate hikes are starting to level off. Please see the rate predictions below

The Bank of Canada, along with the government need to put pressure on inflation by raising the interest rate to push consumers from purchasing, but if they are aggressive for too long of a period it’s going to create a much bigger problem for us in the future.The next Bank of Canada announcement is December 6th. If they hold steady at 5%,which In my opinion I believe they will, that will bring us a balanced market in 2024.

I am estimating that we can call the market “back to the norm.” What we experienced in the years prior to Covid. A reasonably active Spring 2024, with a slight downturn in the summer months, and then a moderate increase in the fall.

Things are looking up for 2024, and as always, this is just the real estate world according to Rom. I hope you enjoy the rest of your November.

-

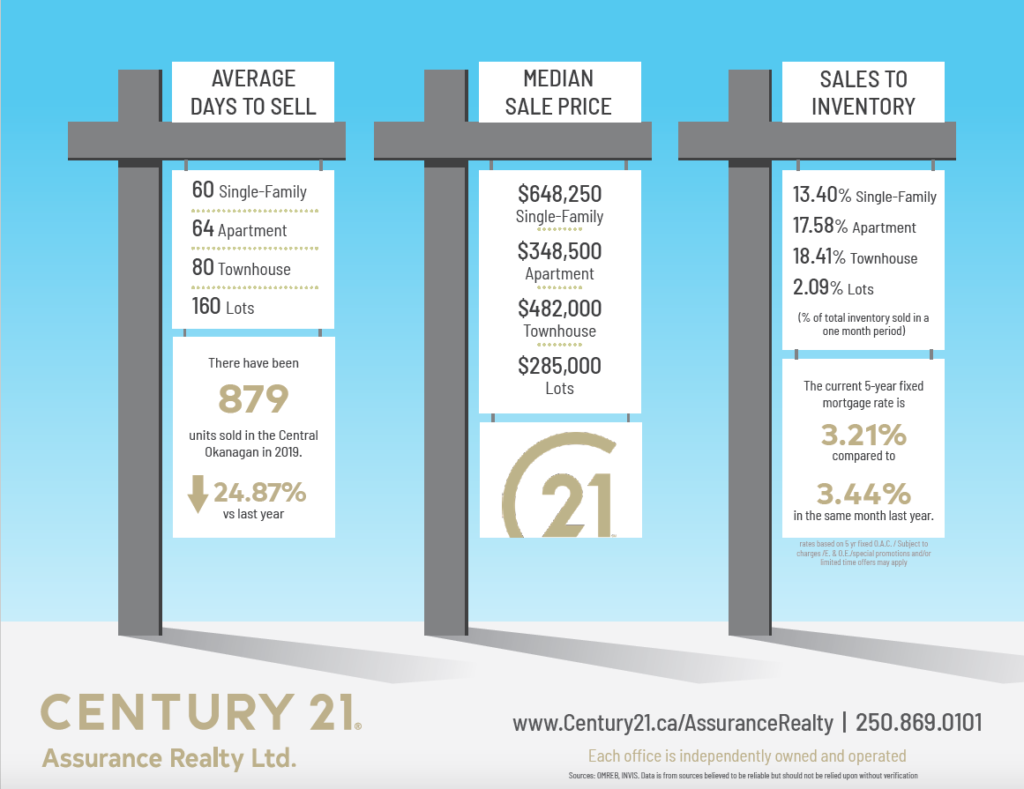

Kelowna Real Estate Market Stats March 2019

House Prices and Sales Activity in Kelowna in the Rebound

We are seeing that sales and house prices have started to rebound. In March, 2019 the median house price was $648,250 up from $619,000 in February, 2019. Sales and absorption for the Central Okanagan have normalized and I suspect this will continue to do so for the rest of the year. If you are unsure what this means, the absorption rate is the amount of sales at a given time and with a given listing inventory. However, make no mistake, the Okanagan real estate market is definitely softening and sales activity is still lower than March of last year. Buyers have more inventory to look at and sellers are going to have to get more aggressive with their pricing to reach a sale.

We are now at a balanced market with prices creeping down, however, I expect house prices to stabilize and maybe slightly go up again by mid year. Keep in mind that we experienced a huge price increase from March 2018 to July 2018, when Okanagan house prices were at its highest ever! A price correction was inevitable. Unfortunately all tax assessed values of properties are currently based on that record July month. As a result, some sellers may think that their house is worth more than true market value. Often sellers in a market like this do what we call, “chasing the market down”. They resist price reductions until it’s too late. When they finally do drop their price (out of frustration), they are actually still above market value.

A cardinal rule in the Real Estate business is that if a property has been marketed “reasonably well” and “priced well” for 30 days or more, without any serious activity or sale, it is overpriced for that market… but that is just the Real Estate World according to Rom.

*Click on the images for larger view

-

More Millennials From Vancouver Buying Property in Kelowna

If you’ve even remotely followed the real estate trends of BC in the last decade (and we’re betting more than a few of our readers have) you know Vancouver has become completely unaffordable to most young people.

The Millennial Generation, which encompasses most younger people between 15 and 35, is finding it hard to purchase property in Vancouver. This is significant because this is the generation that fuels the tech sector – a tech sector which Kelowna has laid the foundation to thrive in.

Bloomberg breaks down the shrinkage of Millennials in Vancouver.

Bloomberg recently dug through the stats to find that most of these young tech savvy individuals are finding work, and a home, in Victoria and Kelowna.

“Kelowna is another city seeing a recent flow of millennial housing refugees from British Columbia’s biggest city. The town of 123,000 is in the midst of building a six-story innovation center for startups and Accelerate Okanagan, an organization that supports local tech companies.”

It’s great to see the efforts of Kelowna’s leaders in providing a safe haven for tech companies paying off. The Kelowna lifestyle is very appealing the Millennials – the difficult part has always been finding work. Tech companies are wising up to value Kelowna has to offer and as the Bloomberg article points out, the real estate game has made it easier to attract these individuals:

“Karen Olsson, chief operating officer for Kelowna-based software company Community Sift, says it’s getting easier to recruit people from bigger cities because they’re drawn to the lifestyle that includes farm-to-table dining, hand-roasted organic coffee and local beer.”

It’s true that Kelowna’s median age has grown from 41 to 43 from the 2006 census to the 2011 census. However, population in all age groups has grown. Young people are flocking to Kelowna – just not as fast as retirees. It’s just one more reason Kelowna’s housing market remains strong and at record levels.

Courtesy of Realestaterookie