Category: Real Estate News

-

Rom’s Real Estate Opinion & Stats August 2020

Kelowna Real Estate Report August 2020

Rom’s Monthly Real Estate Opinion

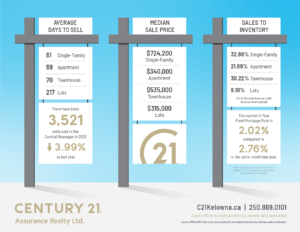

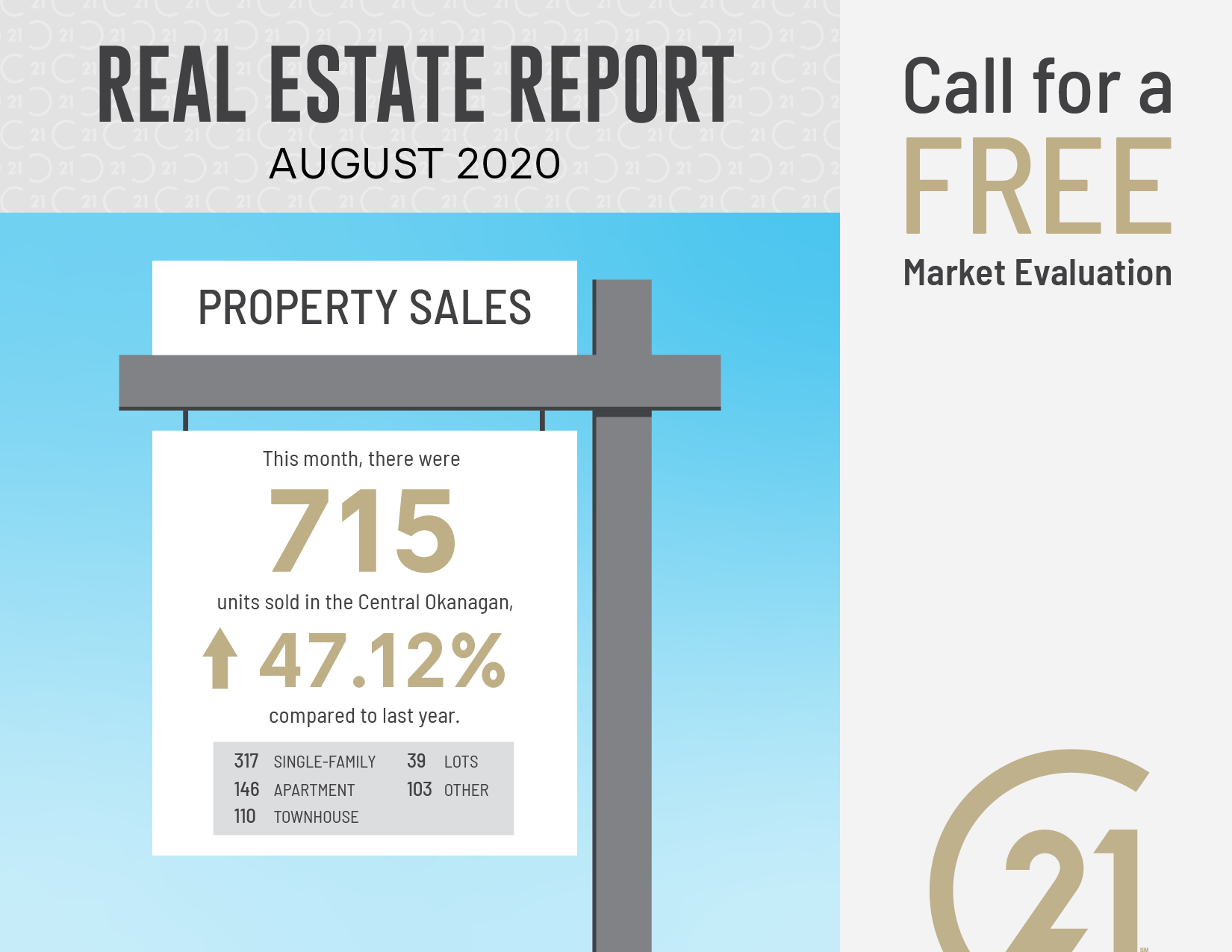

What a whirlwind summer it has been for Okanagan Real Estate! The market continues at a record-breaking pace.

Looking at the stats for this month, remember that low inventory is the sign of a robust real estate market, not the opposite! Some of the stats we look at have never been this robust and some we would have to go back years to find a comparable level.

There is a lot of speculation from realtors, investors, buyers and sellers as to what is going to happen in the near future. Most people think that when the government subsidies go away, the real estate market is going to soften or collapse. However, a market never responds to one force.

Multiple positive forces also pushing on the marketplace in the Okanagan! We have dramatically increased migration from Alberta and the Lower Mainland, there are some of the lowest interest rates in history, very low inventory (which pushes up price!), and the back-log demand created from the drop in sales from COVID-19 in April/May.

Stats to consider

Each year the market softens in the fall, so some may anticipate the market turning down. However, when we compare August 2020 to August 2019 stats, it tells a positive, robust story. Residential sales for August decreased slightly to 1,034 compared to July’s 1,094 total units sold across the region yet remained up compared to this time last year by 43%, reports the Okanagan Mainline Real Estate Board (OMREB).

I believe that we are in a fairly robust market for a while to come still. The one change we cannot predict, is if COVID-19 cases were to dramatically increase that shuts our market down again. However, I don’t think this is going to happen again.

As always. please remember this is just the Real Estate World according to Rom. Get out there and enjoy the beautiful Okanagan Fall season! -

What you should know about BC foreclosure procedures

BC FORECLOSURE PROCEDURES

Many buyers are not familiar with the BC foreclosure procedures and therefore feel uncomfortable to put in an offer on a foreclosure listing. I hope the following will provide a better insight in the judicial procedure and why it is important to deal with an experienced realtor who understands foreclosures.

-

The whole process starts with a Demand Letter from the lender accelerating the loan and giving the borrower a short period of time to pay out the mortgage or else facing foreclosure.

-

After, a Petition is filed in the BC Supreme Court Registry where the petitioner is the lender and the borrower and other lower in priority ranked lenders are the respondents.

-

Order Nisi ordered; this is the first order of the Court that fixes the time for redemption. Redemption period is usually 6 months, this is the time period given to the borrower to redeem the mortgage with accrued interest charges.

-

Second order, the Conduct of Sale by the Master (called Judge in foreclosure procedures) will be ordered. Usually after redemption period expires. The lender act now in the role of the Vendor and can list the property for sale with a realtor.

The assigned listing realtor has to provide to the lender’s lawyer: a Comparable Market Analysis report (CMA), suggested list price and what the property likely will sell for. The lender’s lawyer will provide amended listing documents, guidelines for listing and the Schedule A.

The Schedule A is very important and will be part of the contract of purchase and sale and therefore the offer. It amends or null and void certain clauses in the Contract of Purchase and Sale form. For example, it always states that buyer will obtain the property “as is where is”. Make sure you deal with a realtor who understands and review with you this Schedule A. Once an offer has been accepted the listing realtor needs to prepare a marketing report that will be used as affidavit in Court. Once the realtor receives an offer, the listing realtor has to provide guidelines of the offer if available and the Schedule A to the Selling realtor, also called the buyers agent. Important is that the buyers agent provide the full legal name on the contract.

Once the offer is accepted and all subjects are removed there will always be one subject left in contract: “Subject to Court Approval”

This subject removal will trigger a court date, typically within 10-21 days after removal of all conditions. The Buyers agent should always contact the listing agent a day before the court date to see if there is a possibility of competing offers in Court and should write a back up offer.

The accepted purchase price is public, so any potential buyer can either call the realtor and if the realtor doesn’t want to disclose, the buyer can go to court and find out what the purchase price is.

Any party can present an offer to the court and they will give the offer in a sealed envelope to the listing agent. Please note, all these competing offers should be subject free other than “subject to Court Approval”.

Procedure In Kelowna Court:

Vendors Lawyer presents the offer to the Master and the Master asks if any party would like to submit an offer.

-

The Master will approve the sale based on considerations such as: appropriate marketing efforts have been taken place by the realtor (aforementioned affidavit from the listing agent), there is a substantial deposit either by draft or certified check, and the purchase is above or at appraised value. If not, it is still at the discretion of the Master to approve the sale.

-

In the event that there are competing offers in Court, the Master asks the Vendors Lawyer if he or she has received all offers in sealed envelope and besides the considerations mentioned above, the Master will accept the highest offer. Sometimes the difference could be as little as $500.00. It is important to work with an experienced realtor to work out an offer strategy.

In some cases the Master order to have all parties leave the Courtroom and resubmit all final offers. At the end, it is at the Master’s discretion what offer he or she will approve.

Important: always deal with a realtor who has experience with foreclosures. Rom would be happy to help you when you are thinking of buying a foreclosure property.

Phone: 250.317.6405 or Email: Rom@RomRealty.com

-

-

What Buyers should know about Kelowna Real Estate

I have experienced a lot of buyers in Alberta, Northern BC, Saskatchewan and Manitoba who still think that Kelowna is so expensive, yet you can find a great WATERFRONT resort style condominium in premium downtown Kelowna with the possibility of a boat slip in the low $400’s! How about renting out these condo’s short term for $1,400-$1,600 per week in the Summer and the same amount per month in the off season? Especially the recreational market in the Okanagan has been hit hard due to the fierce competition of homes in Arizona and Nevada and the almost abundance of new resort style properties that has been built outside the Okanagan region.

The increasing value of the US dollar, bottom low mortgage rates and the improved economy in the Okanagan is turning around this depressing (recreational) market. My opinion is that between now and the end of 2015 the best opportunities will occur to get into the Okanagan real estate market.

Buyers, the time is now to get off the fence, you will be surprised, as many of my Prairie friends, what a great property deals are out here in Kelowna.

Please don’t hesitate to contact me if you would like to know more about the opportunity to buy and live in our beautiful Okanagan Valley.

-

If you bought your very first home in 2014, the Canadian Government wants to give you $750!

This is how the First Time Homebuyer Tax Credit works:

The initial costs associated with purchasing a home can be a particular burden for first-time homebuyers especially when added to the money required for a down payment.

To assist first-time homebuyers with the costs associated with the purchase of a home, the Government of Canada introduced a First Time Homebuyers Tax Credit (FTHB) in 2009.

The HBTC is calculated by multiplying the lowest personal income tax rate for the year (15% in 2009) by $5,000. For 2009 (and still in 2014), the credit will be $750.

For more information on this great plan, please click on the following link:http://www.cra-arc.gc.ca/gncy/bdgt/2009/fqhbtc-eng.html

-

Why Chinese buyers are pouring into the Okanagan’s vineyards

Zhenzhen Fu, 28, stands in the rows of grapes at a winery in Lake Country, British Columbia. Zhenzhen Fu is a young Chinese woman who is touring British Columbia’s Okanagan Valley wine region and is interested in purchasing a B.C. winery.KELOWNA, B.C. — It’s harvest season in British Columbia’s Okanagan wine country. Among the yellowing vineyards, the crushing of grapes, and the tourists flocking to winery shops to sample and stock up on past vintages, Zhenzhen Fu is on a life-changing mission. She wants to buy and run a winery. The 28-year-old, who moved to Canada from Weihai, a seaside city in China’s eastern Shandong province, is on her fourth visit to Canada’s western wine region this year. She says her passion for wine runs deep. She can’t wait to make quality reds of her own — first to serve the local market, then for export to China, where red is considered a lucky colour. “I am a wine lover,” says Ms. Fu, who became a Canadian citizen after moving here in her teens and completed a computer engineering degree from the University of Alberta, before settling in Vancouver. “It’s the reason I want to get into this business. I want to make a wine that is special.”

Her father in China is backing her purchase: He’s a red wine lover, and an importer of Canadian goods, including lumber. But here in B.C., he’s looking for an investment to pass on to his only daughter. He plans to mentor her and help her sell the vintages they produce into China. Clad in a delicate-pink Chanel jacket, emerald Valentino bag and black Moussy platform shoes for an eclectic urban look, Ms. Fu hardly cuts the figure of the weathered wine farmer. But she is part of a growing number of Chinese-Canadians, and investors from China, snapping up wineries in this B.C. valley.

Rows of grapes in Lake Country, British Columbia on October 21, 2014.

Rows of grapes in Lake Country, British Columbia on October 21, 2014.Many of them own homes in Vancouver and see the Okanagan wineries, just a quick flight or a half-day’s drive from the city, as an extension of their Canadian presence. They also see an alluring business case: Demand for wine among China’s growing and more sophisticated middle class is booming. The country has quickly become the world’s leading market for red wine, according to London-based International Wine and Spirit Research. Last year, China consumed 1.86 billion bottles of red, an increase of 136% over the previous five years. Younger Chinese consumers see wine as a healthier choice than the high-alcohol grain liquors favoured by their parents; and the B.C. government has been supportive of Asian investment in the province. For those not already Canadian citizens, the purchase of a winery can help win permanent residency in Canada as business immigrants through the provincial nominee program.

“Today the Chinese are drinking about one bottle of wine per capita, adult, a year, where we’re drinking about 36 bottles a year,” says Harry McWatters, founder of B.C.’s Sumac Ridge Estate winery. “If we can get them halfway in between, the world wouldn’t have enough wine.” There are 240 grape wineries in British Columbia today, from just 17 in 1990 and 86 in 2003. The thirst for investment and ownership turnover is high in a business that is extremely capital intensive. The average sale price of a winery in B.C. is $10-million. The listing price of the 40 now available for sale, publicly and privately, ranges from $1.85 million to $55-million. Chinese interest in buying B.C. wineries perked up around 2008–2009, as families from Mainland China built a presence in Western Canada and began scouring for investment opportunities. Once the Chinese families get established, and someone speaks a bit of English, then there is a confidence to get into that business. Then there are families who are in the export business, so it’s natural add on.

The Okanagan’s ripening as a reputable wine region happened just in time to position it as a draw for Chinese capital.

The Okanagan’s ripening as a reputable wine region happened just in time to position it as a draw for Chinese capital.Selling a winery is complex and takes time. The product is specialized and the operations involve many components, from vineyards, inventory, and equipment to, in some cases buildings, restaurants and retail outlets. With buyers from China unfamiliar with the region, the sale process can involve extensive tours around the Okanagan. It has to be the right price point, and then the right location, then you have to have a good team and a good brand, and have decent cash flow. Then you have to match the family with the winery, and make sure that all the components are looked after so that it continues to be successful. And when they do make their move, they pay cash — an important edge. Traditional banks tend to be uneasy about a business that requires such a long-term horizon and deep pockets. Farm Credit Canada, Canada’s largest agricultural term lender, is the main financial institution that supports the wine business.

The Okanagan’s ripening as a reputable wine region happened just in time to position it as a draw for Chinese capital. The rapidly emerging affluent middle class in China was soon followed by a taste for western indulgences. Now one of the world’s top wine markets, there are an estimated 1 million planted acres of vineyards in the country (compared to about 10,000 in British Columbia and 40,000 in California’s Napa region), but production hasn’t kept up with demand, the quality is often poor, and there is a widespread problem with counterfeit wines, made locally but labeled as European.

“In China you cannot control the quality of the red wine, so they import a lot,” says Ms. Fu. “There are too many kinds and there are a lot of fake red wines… And when we came to the wine tour, in the Okanagan, we saw a lot of wineries in the Okanagan. They are so beautiful, and we just fell in love.”

Canadian wine exports to China have been increasing from a modest base, says Mr. McWatters, a pioneer and leader in the province’s wine industry, with 47 vintages under his belt. Because B.C. has limited capacity to expand, its wine makers have been focusing on quality, and the Chinese are catching on. “[The Chinese are] looking for wines of distinction, wines that have breeding and a unique characteristic,” says Mr. McWatters, who is starting a new winery after launching well-known establishments like Sumac Ridge Estate in 1980 and See Ya Later Ranch Estate Winery in 1995. As they discover B.C.’s wide range of varietals, from Pinot noirs and Merlots to Rieslings and Gewurztraminers, they become interested in owning the production, he says. “There have certainly been lots of Asians looking at the investment here over the last five to 10 years, but it’s really only in the last three to four years that we have seen real traction take place,” Mr. McWatters says. “It’s a direct reflection of the way wine is growing with such tremendous interest in China.”

Tait says she’s only seen positive things from the new owner of her former winery, Bench 1775 — a businessman from Beijing who paid more than $8-million for the operation in February. As is often the case with change, there have been hints of nervousness in the region that Chinese ownership could bring unwelcome consequences — job losses for locals, slipping quality, loss of local control. One winery spokesman says there has been negative reaction recently from wine consumers “when they hear a local winery is not locally owned. ”But Val Tait says she’s only seen positive things from the new owner of her former winery, Bench 1775 — a businessman from Beijing who paid more than $8-million for the operation in February.

Tait says she’s only seen positive things from the new owner of her former winery, Bench 1775 — a businessman from Beijing who paid more than $8-million for the operation in February. As is often the case with change, there have been hints of nervousness in the region that Chinese ownership could bring unwelcome consequences — job losses for locals, slipping quality, loss of local control. One winery spokesman says there has been negative reaction recently from wine consumers “when they hear a local winery is not locally owned. ”But Val Tait says she’s only seen positive things from the new owner of her former winery, Bench 1775 — a businessman from Beijing who paid more than $8-million for the operation in February. There are 240 grape wineries in British Columbia today, from just 17 in 1990 and 86 in 2003. The thirst for investment and ownership turnover is high in a business that is extremely capital intensive. One of the Naramata, B.C.’s iconic wineries because of its sweeping vistas, Bench 1775 is located on a 31-acre property with a tasting room overlooking Lake Okanagan. Already, it exports 8,000 cases a year to China, its biggest export market — as much as it sells domestically. The owner (who prefers to stay anonymous) offers expertise in the retail end of the Chinese market, where he has been exporting B.C. wines for a decade, she says. And as is often the case with Chinese purchases, Ms. Tait, a viticulture expert with an extensive history of producing red table wines, was asked to continue as general manager and told to keep up the high-quality product. With Canadian brands competing with many better-known wines in China, “we have to produce a premium product,” she says. “It’s a very discerning market. Brand and quality are very important.” Chinese investors “are bringing in capital that we need to be able to operate in the global stage,” Ms. Tait says. “It ups everybody’s game.

There are 240 grape wineries in British Columbia today, from just 17 in 1990 and 86 in 2003. The thirst for investment and ownership turnover is high in a business that is extremely capital intensive. One of the Naramata, B.C.’s iconic wineries because of its sweeping vistas, Bench 1775 is located on a 31-acre property with a tasting room overlooking Lake Okanagan. Already, it exports 8,000 cases a year to China, its biggest export market — as much as it sells domestically. The owner (who prefers to stay anonymous) offers expertise in the retail end of the Chinese market, where he has been exporting B.C. wines for a decade, she says. And as is often the case with Chinese purchases, Ms. Tait, a viticulture expert with an extensive history of producing red table wines, was asked to continue as general manager and told to keep up the high-quality product. With Canadian brands competing with many better-known wines in China, “we have to produce a premium product,” she says. “It’s a very discerning market. Brand and quality are very important.” Chinese investors “are bringing in capital that we need to be able to operate in the global stage,” Ms. Tait says. “It ups everybody’s game. Zhenzhen Fu, chats with General Manager Mike Lang at Lang Vineyards wine cellar Naramata , British Columbia.

Zhenzhen Fu, chats with General Manager Mike Lang at Lang Vineyards wine cellar Naramata , British Columbia.She credits the new owner with having a remarkably long-term vision, and unusual patience. While spending most of his time in China, he participates in all aspects of the business when he is at the winery — from bottling wines to picking grapes. “Now I am thinking: ‘Where will this winery be in 100 years?’ whereas before it was, ‘Where will be in 10 years?’ It changes everything in your approach when you start thinking 100 years down the road,” Ms. Tait says. “In China there are more millionaires than the Canadian population,” says industry pioneer, Guenther Lang, whose Lang Vineyards was the province’s first to sell its products directly to the public, setting off a trend that has led to a booming wine-tourism market. “Business people want to get investments outside of China, and one of the preferred locations is B.C.; Canada is investment friendly and the last big banking crisis confirmed that — our big banks … performed best in the world.”

After Mr. Lang sold his winery to a Canadian investor in 2005, the buyer ran into trouble during the recession. Enter Yong Wang, a Chinese businessman, who bought it out of receivership from the Bank of Montreal in 2009. Mr. Wang bought new equipment, invited Mr. Lang to return as a consultant and installed his nephew, Mike Lang, as general manager. Mr. Wang kept the winery’s 10 employees, and is consulted on major decisions, but for the most part, Mike Lang says, the owner allows the staff to do what it takes to be successful. “We started from scratch and worked our way back,” he says. “Our wine sales have been up again. We are getting the market we used to have. We are bringing some new varietals to the table, so that is drawing in a lot of customers.” He exports about 500 cases a year to China, where Mr. Wang’s daughter opened a store that sells the B.C.-produced wine. The plan is for her eventually to move to B.C.

As for Zhenzhen Fu, she is continuing to look for a winery with a great view, land to expand and to build guest rooms, and a solid balance sheet. She is also taking sommelier courses to refine her knowledge of wine. She’s fallen in love with winemaking far more than she ever had with computer engineering. At the very least, she says, when she buys her winery, “maybe I can fix my own computer.”

Source: Claudia Cattaneo of Financial Post

-

Four Reasons Why Negotiations Go Quickly Sideways in Real Estate

A good realtor acknowledge the importance of negotiating and that without certain skills negotiating a good real estate deal can go sour very quickly. When I see a negotiation go sideways it’s usually because someone didn’t take into consideration the person sitting across the desk from them.

1. Lack of Respect

Respect of both parties in negotiations is so important. If you want to kill any deal quickly, throw respect out the window. It’s a lot about understanding the differences in personalities and how the person you are negotiating with is different from you. Recognize that it’s a human being sitting across the desk from you with different needs and wants. Not everybody is the same.

I’ve seen people call the other person down in a negotiation and although it’s obvious that you shouldn’t do that, it still happens. Recognize the quality of the person that sits across the desk from you and don’t shut them out. That’s what I mean by respect. If you shut somebody out, you might as well stop negotiating. If you keep pushing back on everything, all you’ll end up with is a lose-lose situation or maybe a lose-win situation.

A successful negotiation reaches that win-win situation.

2. Lack of Trust

To an extent, trust is part of respect. Of course you can’t go in blind and trust that they will be totally open and honest about everything but that’s not what I’m suggesting.

You need to trust with skepticism.

Coming in with a bit of trust with skepticism allows you to negotiate. If you go in with zero trust, your gut is automatically going to go against everything you hear from the other party because you’re assuming that they are being dishonest.. If you constantly think that they are lying to you, how can you trust them enough to get to a conclusion that you can solve together? That’s why I like to trust with skepticism because you aren’t going in with blind trust.

3. Not Considering Desired Outcomes For Both Parties

Get a feel for what their desired outcome is and also know what your own desired outcome is before entering into negotiations. A negotiation doesn’t usually start and finish in the same session so there’s usually some time to gather additional information and do some homework to help you validate what you have been told. Hopefully that extra research will build your trust and confidence in whomever you are negotiating with.

4. Poor Due Diligence

In the case of negotiating real estate, let’s say you are negotiating a commercial building or a project and the seller says the utilities are $1,000 per month. You’ve got to trust him that utilities are $1,000 a month while going through the negotiation process. If you accuse them of being incorrect, you can’t negotiate.

When you are finished negotiating, it’s time for due diligence. This is when you check to ensure the utilities are in fact $1,000 a month. If you don’t check, then shame on you because I can tell you that the numbers you receive in real estate negotiations for commercial buildings are often incorrect. I’m not saying people are fraudulently give wrong numbers, what I am saying is it’s not unusual to see the numbers skewed for the situation.

For example, the seller show you a utilities bill for the month of September that says $1,000 but leaves out the fact that September is always the least expensive month of the year. He’s not technically lying but if the rest of the year it was $3,000 a month, you are going to need to know that before finalizing the deal.

Cover All Your Bases

These are the types of things you need to watch out for in negotiations or else they might go sour on you. Maintain a balance of trust and healthy skepticism, always have respect for the person across the desk and consider their needs. Most importantly, always do your due diligence.

I’ve been in negotiations where you sit and negotiate based on the numbers and then you finish the negotiation and do the due diligence only to find out all the numbers are all wrong. Does that re-open the negotiations? Maybe, maybe not. That will be up to you at that point in time but the important thing is that you stay vigilant through the entire process. After all, it’s the client who will pay for it in the end.

-

Great News for First Time Home Buyers!

In case you have missed it, the BC Provincial government recently announced changes to the exemption limits for the First Time Home Buyer exemption, commencing February 19, 2014.

Prior to the change, the First Time Home Buyer Exemption was capped at $425,000.00 and there was a sliding scale between $425,000.00 and $450,000.00. The new cap effective Feb. 19, 2014 is $475,000.00 and there is a sliding scale between $475,000.00 and $500,000.00.

This means that any purchase up to $475,000, the First Time Home Buyer doesn’t pay any Property Transfer Taxes, a savings of thousands of dollars! -

Buying Foreclosure Properties in Kelowna, British Columbia

Irrespective of economic conditions, foreclosure properties are often viewed as a “deal” for the savvy real estate investor. However, courts in British Columbia have a duty to ensure that foreclosure properties are being sold as close to their fair market value as possible. Usually this means ensuring that a property is marketed with a REALTOR on the MLS system. Here are some key points for Home Buyers to remember when they are buying foreclosure properties in Kelowna and other parts of British Columbia:

1. Offer is Subject to Court Approval.

Buying a foreclosure starts much like any other real estate deal, except that often you are negotiating with the Bank, the Bank’s Realtors, and the Bank’s Lawyers. This means that offers must be open for acceptance for longer periods of time to allow the institution’s foreclosure committee time to consider your offer. Unlike a regular real estate deal, just because your offer has been accepted does not mean that “You Have a Deal”.

All deals are subject to court approval. This means that a judge (or master) must approve the terms and conditions which have been agreed to by the bank. The judge will be ensuring that the current home owner has been given proper notice of the proceeding and that they have not “paid out” or redeemed their mortgage prior to the Court Date.

A Buyer should keep in mind that a judge has absolute discretion in her courtroom and success in court can never be guaranteed. The outcome will vary depending on whether the application by the lender for sale of the property is uncontested, contested by the home owner, or if there is multiple offers presented in court.

2. No Other Subject Conditions

The offer which is presented to the Court (and the Lender) must not contain any subject conditions for the benefit of the Buyer. In most real estate transactions, subject conditions allow time for a Buyer to perform due diligence on the property they are purchasing while binding the Seller to the deal (for example: obtain a home inspection). In a traditional real estate deal, if an issue is discovered (ie; a leaking roof) after the deal signed but prior to subject removal, the Buyer will have an opportunity to re-negotiate with the Seller and will not be legally obligated to complete in the face of the new information.

In foreclosure transactions, the Buyer must do all due diligence prior to knowing if their offer will be acceptable to the bank or the court. This means that a Buyer is faced with a dilemma: a) potentially spend thousands of dollars on home inspection costs, appraisal fees, and other consultants only to have the property purchased by another party on court day; or b) buy an “as-is” property without proper due diligence which may have many costly unforeseen complications.

Financing is one area in foreclosure transactions that cannot be overlooked. Once the court approves the offer, the Buyer is legally obligated to complete the transaction and pay the Purchase Price. Buyers must ensure that their mortgage brokers have received an unconditional approval from their lender prior to proceeding to Court.

3. Property Purchased “As-Is”

In a standard residential real estate transaction, the Seller provides a Property Disclosure Statement which provides the Buyer with a modest amount of disclosure on the condition of the premises.

One of the key differences between a foreclosure purchase and most residential real estate transactions is that the Buyer is purchasing the property “As-Is”. In a foreclosure, the seller (Lender) explicitly is making no representations or warranties about the Property and there is no Property Disclosure Statement which is provided (or it is simply blank).

When a Buyer is purchasing a property in “As-Is” condition, the onus is on the Buyer (caveat emptor) to ensure that the property meets the Buyer’s needs. Commonly foreclosure properties have issues including: non-compliance with bylaws, illegal activity, squatters, no occupancy certificates, unhealthy conditions (mold), and very poor maintenance.

The Buyer needs to understand that the condition of the premises may change dramatically between the date of viewing to the date of possession. The Buyer is inheriting all these potential issues, “warts and all”.

4. Be prepared for Court

Once a Buyer’s initial offer is accepted, the Lender’s lawyers will set down a date in Court for approval of the offer. This initial offer becomes part of the public court filing and other parties may show up in court to present better offers. The Lender’s sole responsibility is to set the date for the chambers hearing, if the initial Buyer wishes to have the option of revising their offer in Court (usually in the face of competing offers) they (together with their agent) should attend in chambers on the date. Buyers are well advised to have their “BEST OFFER” ready on the court date (with an appropriate deposit in the form of a Bank Draft) if there are competing offers.

It is important that any offer presented to the court should contain the correct information as the court will rely on the offer to draft the Order Approving Sale which will be filed in the Land Title Office by the lawyers for the successful Buyer. Care should be taken to ensure: Correct Legal Names of Purchasers; Correct Legal Description of All Property; and Correct Description of Property Interest Acquired (i.e.; Leasehold v. Freehold)

5. Closing and Possession Issues

Once you are successful in Court and the Court has granted you, as Buyer, an Order Approving Sale, there are still a number of potential complications. At this stage it is important that you are using the services of a Real Estate Lawyer familiar with closing of distressed and foreclosure properties. Obtaining title to your new home is much different in the case of foreclosure property as there is no transfer filed in the Land Title Office and instead the actual Order Approving Sale is reviewed and approved by a Land Title Examiner. If there have been any mistakes in drafting of the order by the Lender’s counsel, the order may be defected by the Land Title Office and the Lender’s counsel only obligation will be to correct the order.

Possession of a foreclosed property is not guaranteed on the Closing Date. A tenant, squatters, or the former owner may be present on the property. In this case the bank is only required to use reasonable efforts to obtain another court order (writ of possession) ordering the property be vacated. This process can take additional time. A Buyer should not rely on timely possession of foreclosure property.

6. Liability Issues

In summary, Buyers assume a number of additional liabilities when foreclosure property is purchased, including:

a) Property Damage

b) Property Non-compliance with law and by-laws

c) Illegal Activity

d) Adverse Possession of Premises

e) Potential Tax Liability (GST and Non-Resident Withholdings)

f) Potential Strata Assessment Liabilities

Foreclosure property purchases can represent a good deal for many savy and experienced property investors however, Buyers should carefully enter into these arrangements fully educated on the risks of purchasing foreclosure property.

Compliments of Peter Borszcz, Real Estate Lawyer, Pihl Law Corporation